As tax season approaches, it’s important for individuals and businesses to be aware of the various forms they may need to file with the IRS. One such form is the 1099, which is used to report income other than wages, salaries, and tips. For the year 2025, the IRS has made available the printable version of the 1099 form, making it easier for taxpayers to report their income accurately.

Whether you’re a freelancer, independent contractor, or business owner, you may receive a 1099 form from clients or companies you’ve worked with throughout the year. It’s crucial to report this income on your tax return to avoid penalties and ensure compliance with IRS regulations. By utilizing the IRS 1099 Form 2025 printable, you can easily fill out the necessary information and submit it to the IRS on time.

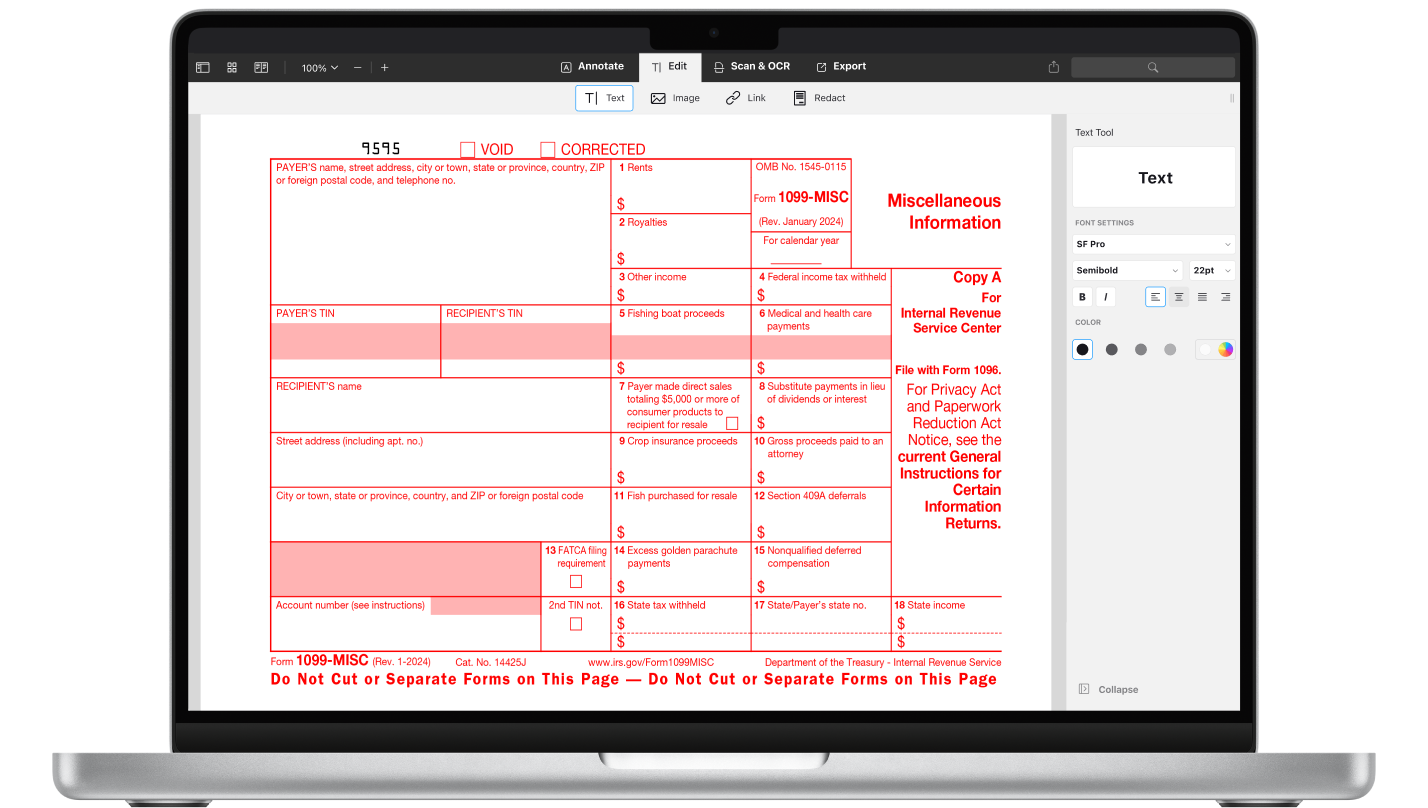

Save and Print Irs 1099 Form 2025 Printable

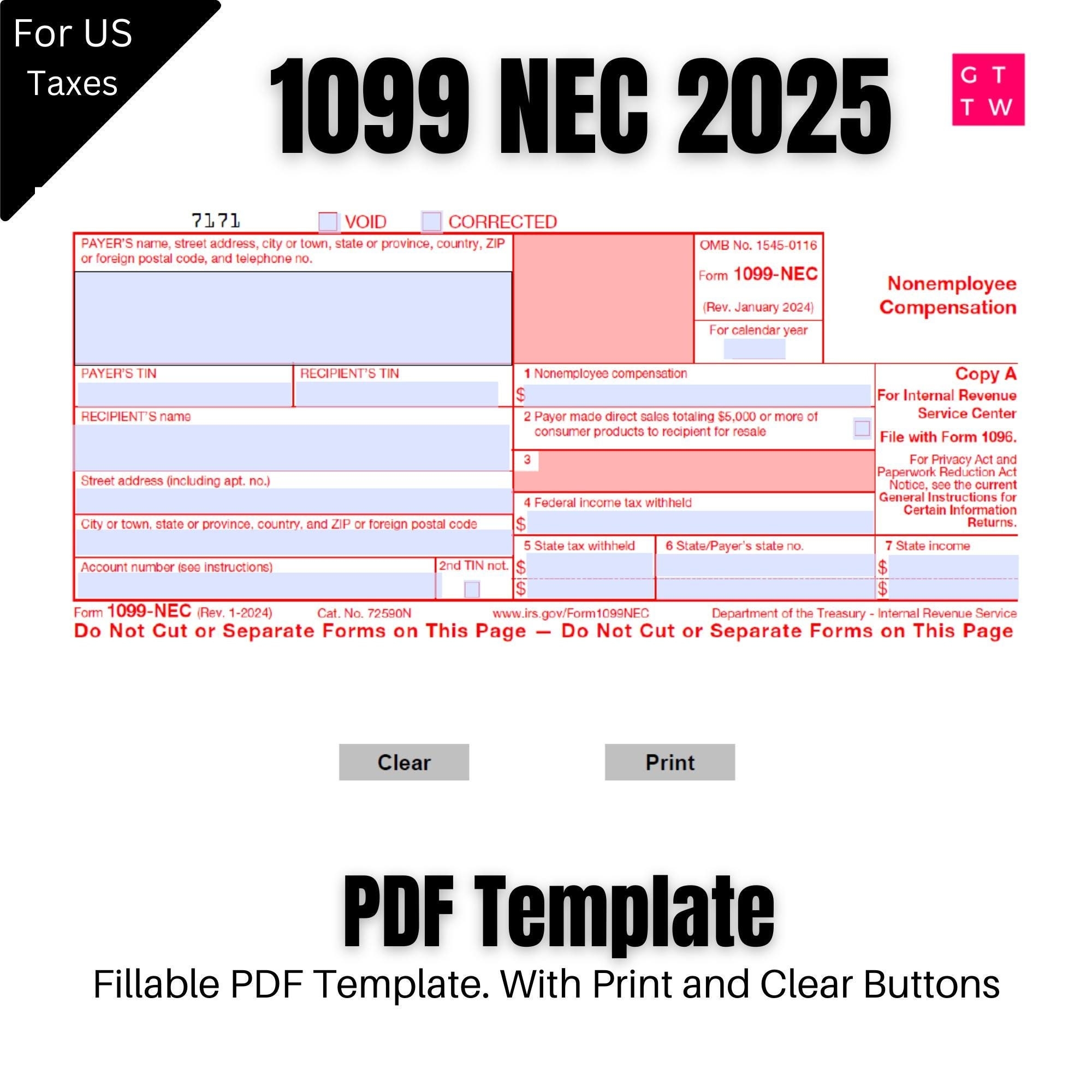

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

1099 NEC Editable PDF Fillable Template 2025 With Print And Clear Buttons Courier Font Etsy

IRS 1099 Form 2025 Printable

The IRS 1099 Form 2025 printable is designed to be user-friendly and straightforward. It includes sections for your personal information, the payer’s information, and details about the income you received. By following the instructions provided on the form, you can accurately report your income and avoid any discrepancies that could trigger an audit.

When filling out the IRS 1099 Form 2025 printable, be sure to double-check all the information you provide. Any errors or omissions could delay the processing of your tax return and potentially result in fines or penalties. If you’re unsure about how to fill out the form correctly, consider seeking assistance from a tax professional or using online resources provided by the IRS.

Once you’ve completed the IRS 1099 Form 2025 printable, make sure to submit it to the IRS by the deadline specified for your tax return. Failure to report all income accurately could result in consequences that may impact your financial standing. By taking the time to fill out the form correctly and submit it on time, you can ensure a smooth tax filing process and avoid any unnecessary stress.

In conclusion, the IRS 1099 Form 2025 printable is a valuable tool for individuals and businesses to report their income accurately and comply with tax regulations. By utilizing this form and submitting it on time, you can avoid penalties and ensure a hassle-free tax season. Take the time to familiarize yourself with the form and seek assistance if needed to ensure a successful tax filing experience.