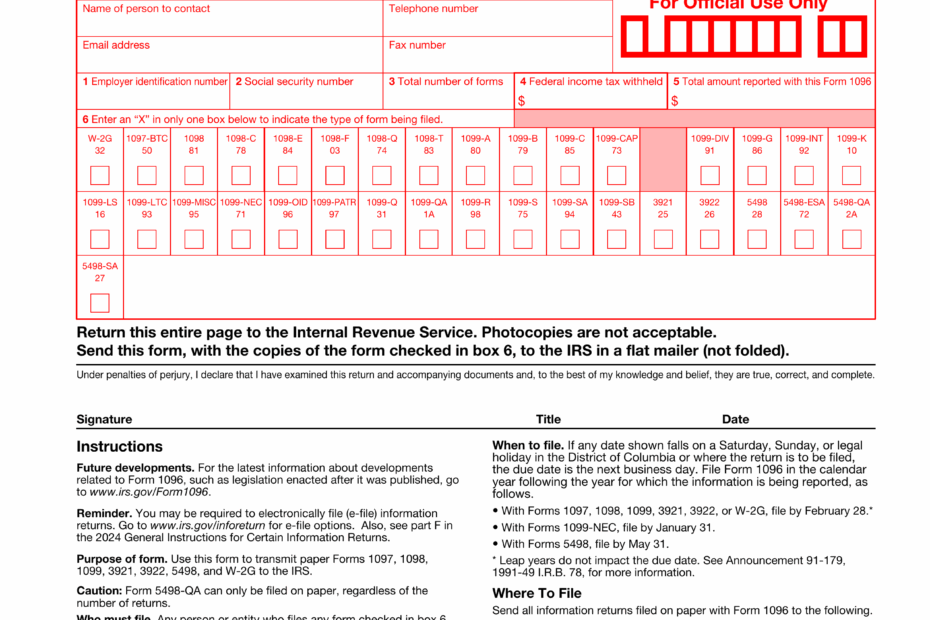

Filing tax forms can be a daunting task, but with the IRS 1096 Form Printable, the process becomes much easier. This form is used to summarize and transmit information returns such as 1099, 1098, and W-2G forms to the IRS. It is important for businesses and organizations to accurately complete and submit this form to ensure compliance with tax regulations.

Downloading the IRS 1096 Form Printable allows you to fill out the necessary information electronically or print it out and complete it by hand. This form is essential for reporting various types of income, payments, and other financial transactions to the IRS. By using this form, you can streamline the reporting process and avoid potential penalties for non-compliance.

Download and Print Irs 1096 Form Printable

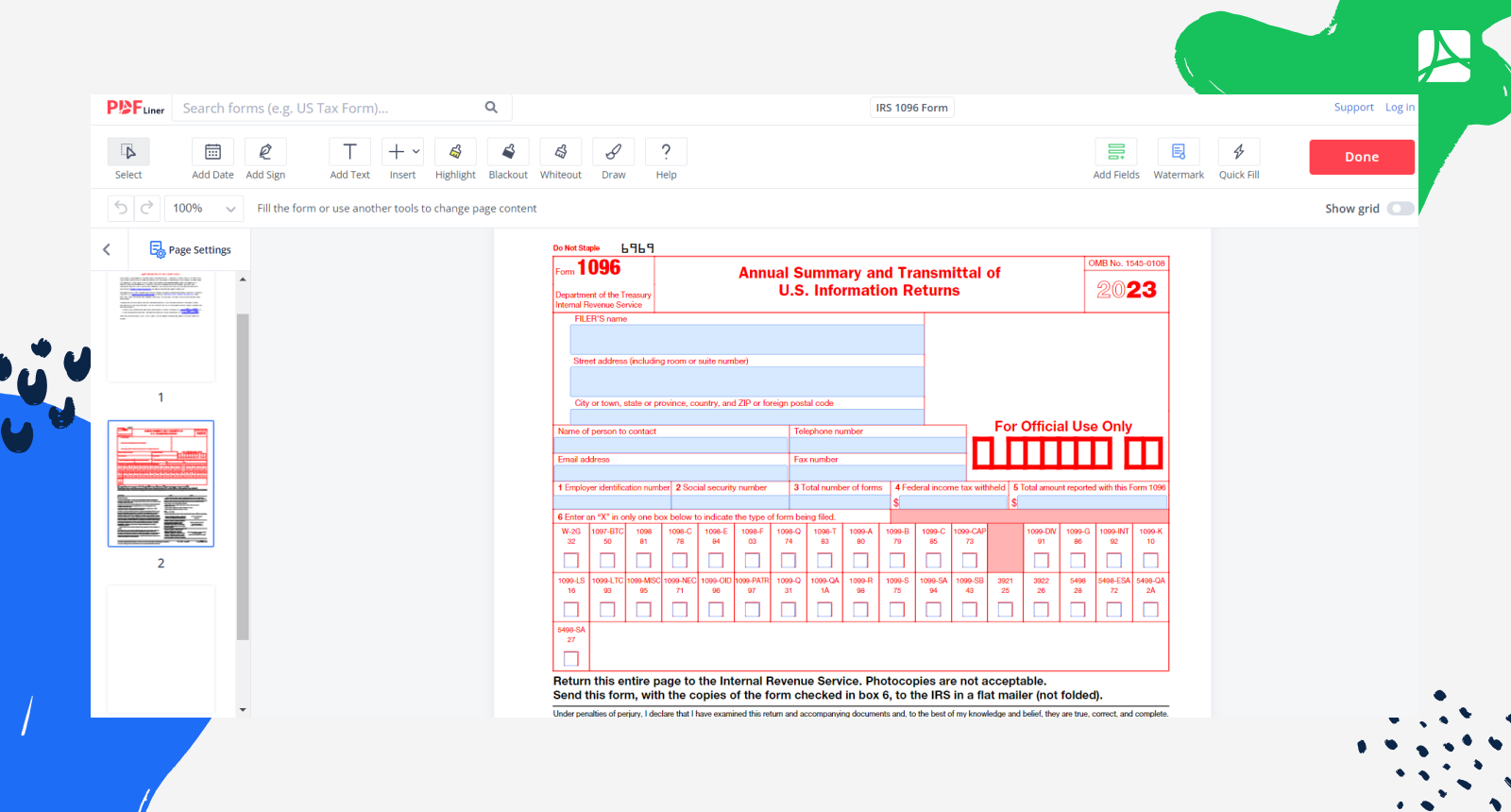

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

When filling out the IRS 1096 Form Printable, make sure to provide accurate information such as your name, address, taxpayer identification number, and total number of forms being submitted. It is crucial to double-check all the details before sending the form to the IRS to avoid any discrepancies or errors.

Once you have completed the IRS 1096 Form Printable, you can either mail it to the IRS along with the corresponding information returns or submit it electronically through the IRS’s online filing system. Whichever method you choose, it is important to meet the deadline for filing to avoid any late penalties or fees.

Overall, the IRS 1096 Form Printable is a valuable tool for businesses and organizations to report information returns accurately and efficiently. By utilizing this form, you can ensure compliance with tax regulations and avoid any potential issues with the IRS. Make sure to download and fill out the form correctly to submit your information returns in a timely manner.

In conclusion, the IRS 1096 Form Printable is an essential document for businesses and organizations to report information returns to the IRS. By using this form, you can simplify the reporting process and ensure compliance with tax regulations. Download the form today and start filing your information returns with ease.