Completing tax forms can be a daunting task for many individuals and businesses. However, the IRS 1096 Form 2025 Printable can make the process a lot easier. This form is used to summarize and transmit information returns such as 1099s, W-2s, and more to the IRS. By utilizing the printable version of this form, filers can efficiently submit their required information without the need for specialized software.

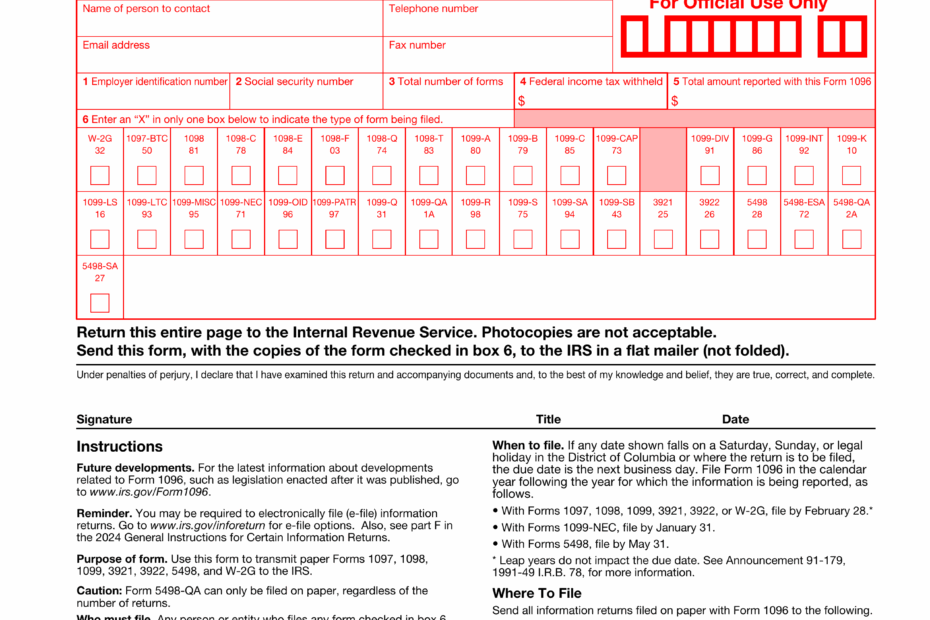

IRS 1096 Form 2025 Printable is essential for businesses and individuals who need to report certain types of income to the IRS. This form serves as a cover sheet that summarizes the information returns being submitted. It includes details such as the total number of forms being filed, total amounts reported, and the filer’s contact information. By accurately completing this form, filers can ensure that their information returns are properly processed by the IRS.

Quickly Access and Print Irs 1096 Form 2025 Printable

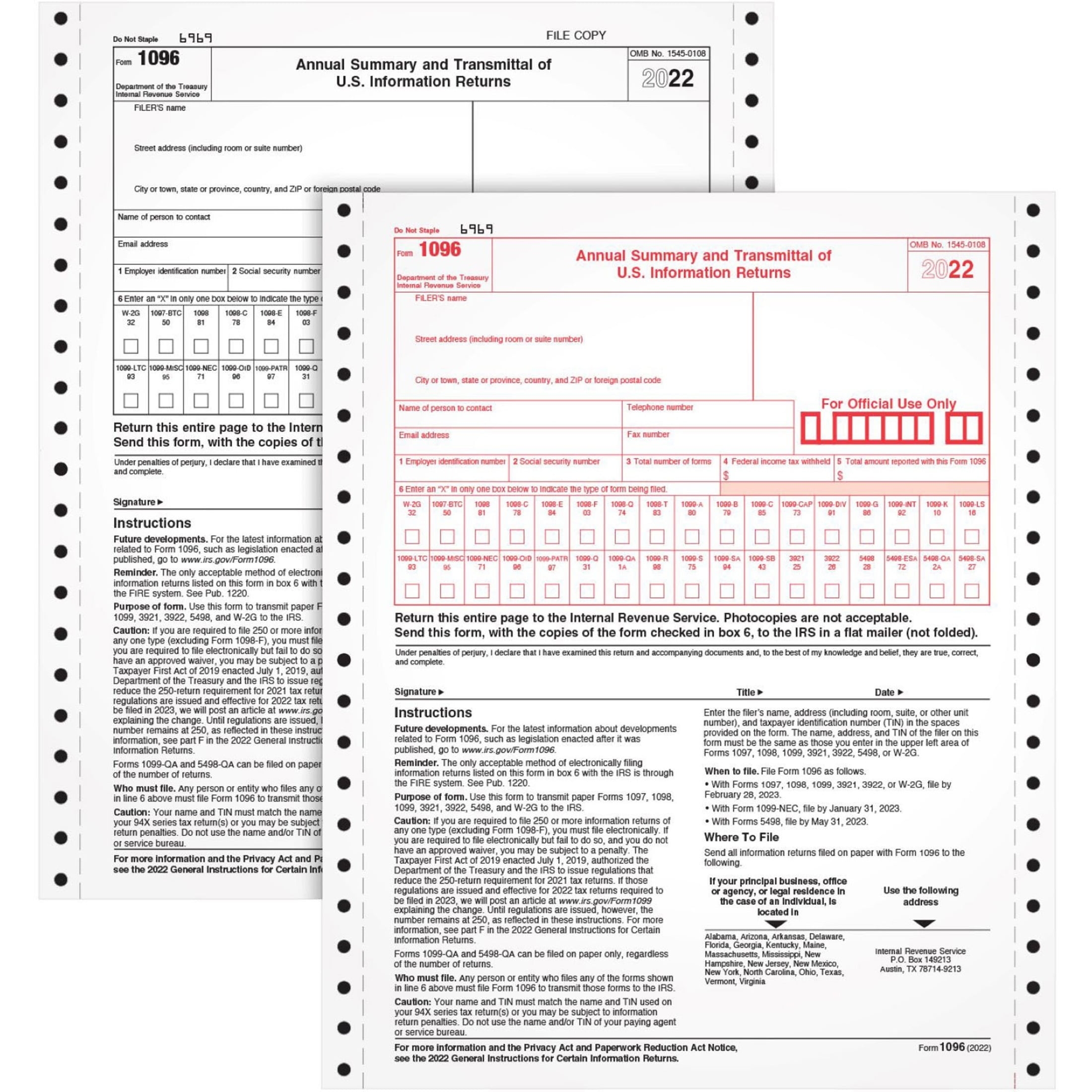

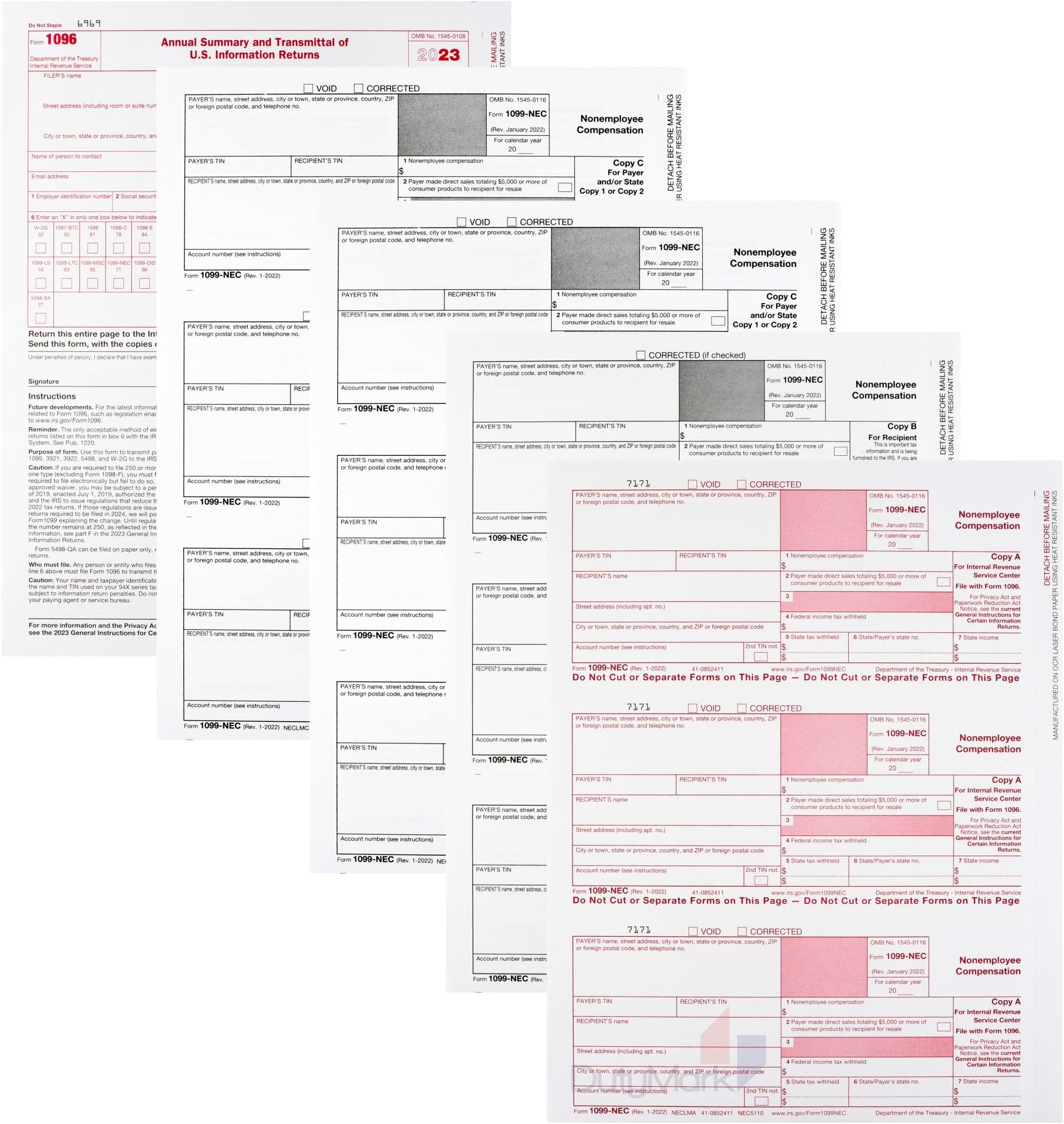

1099 Nec Envelopes 2024 2024 IRS 1096 Transmittal Forms 25 Pack Laser Printable 2023 1099 Nec Tax Forms Quickbooks

1099 Nec Envelopes 2024 2024 IRS 1096 Transmittal Forms 25 Pack Laser Printable 2023 1099 Nec Tax Forms Quickbooks

When using IRS 1096 Form 2025 Printable, it is important to carefully review the instructions provided by the IRS. These instructions outline how to fill out the form correctly, including where to enter specific information and how to calculate totals. By following these guidelines, filers can avoid errors that may result in processing delays or penalties. Additionally, the printable format allows for easy completion and submission of the form without the need for specialized software.

For businesses that need to submit multiple information returns, IRS 1096 Form 2025 Printable can streamline the filing process. This form allows filers to consolidate their information returns into a single document, making it easier to submit to the IRS. By accurately completing the form and attaching the required information returns, businesses can ensure that their tax reporting obligations are met in a timely manner.

In conclusion, IRS 1096 Form 2025 Printable is a valuable tool for individuals and businesses that need to report certain types of income to the IRS. By utilizing this form, filers can efficiently summarize and transmit their information returns without the need for specialized software. Whether filing electronically or by mail, IRS 1096 Form 2025 Printable simplifies the tax reporting process and helps ensure compliance with IRS regulations.