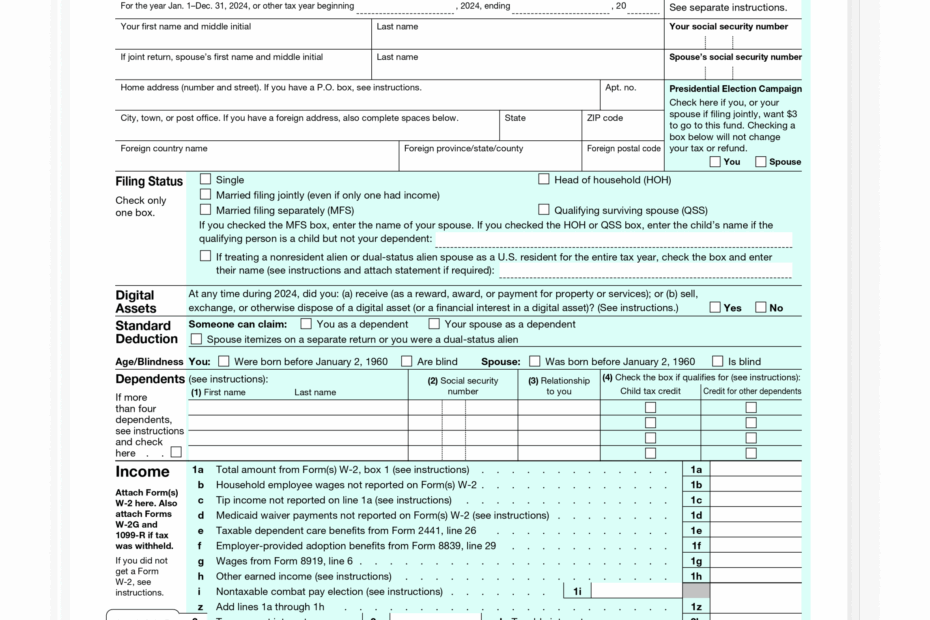

When it comes to filing your taxes, the IRS 1040EZ form is a simple and straightforward option for those with a basic tax situation. This form is designed for taxpayers who have no dependents, earn less than $100,000, and do not itemize deductions. It is a great option for those looking to file quickly and easily without the hassle of a more complicated form.

With the IRS 1040EZ form, you can easily report your income, claim any deductions or credits you may be eligible for, and calculate your tax liability. This form is designed to streamline the tax filing process for those with a simple financial situation, making it a popular choice for many taxpayers.

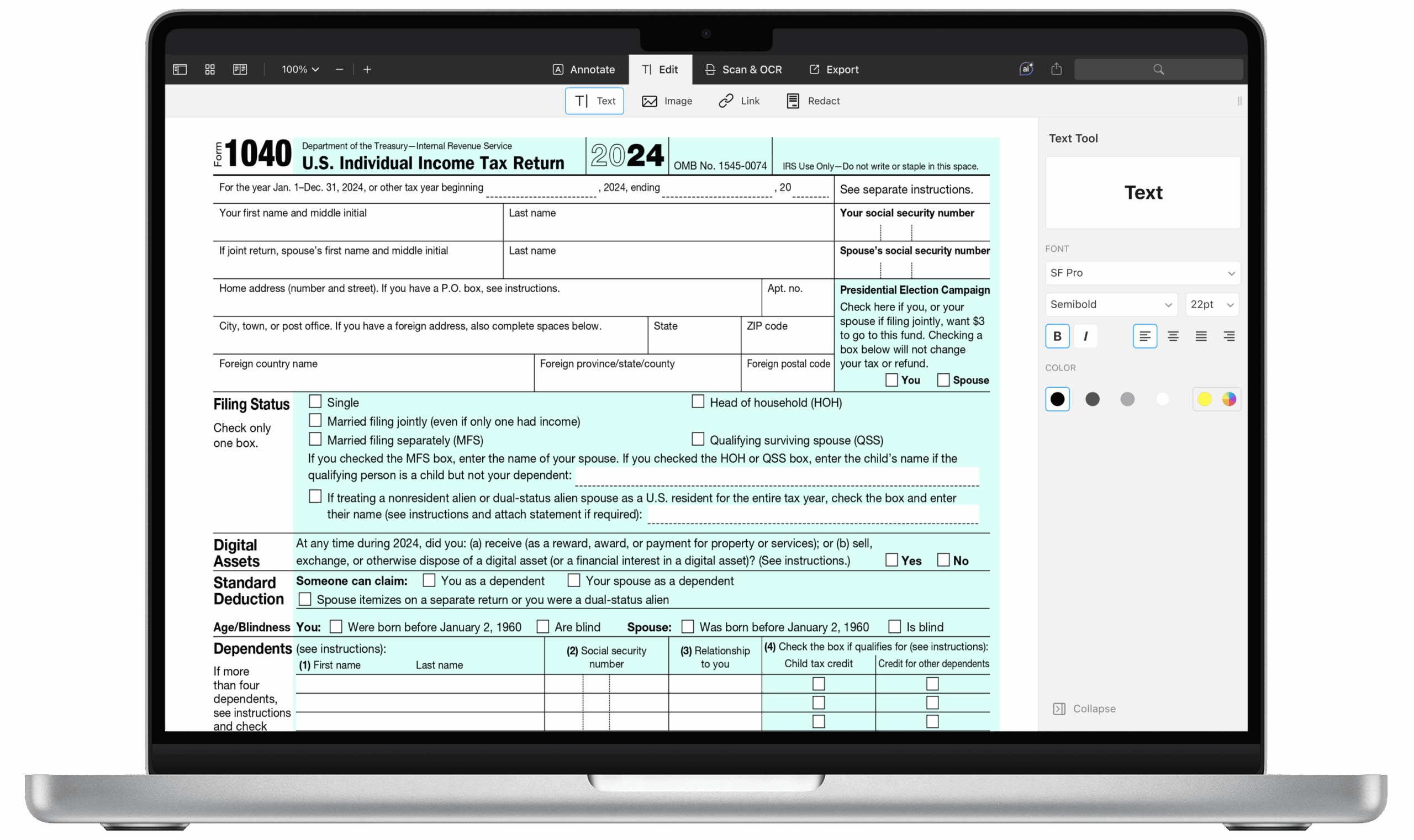

Save and Print Irs 1040ez Printable Form

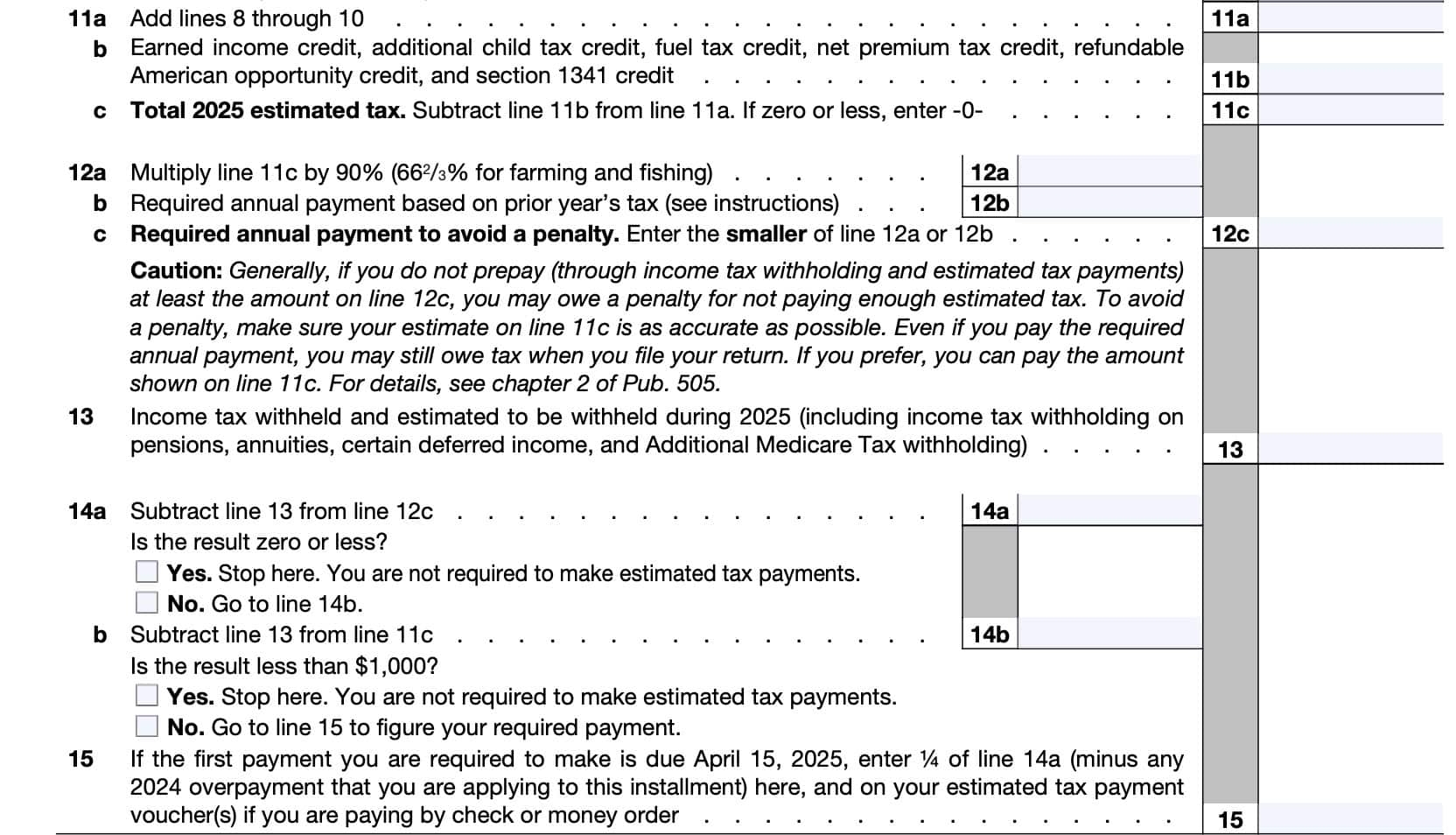

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

IRS 1040EZ Printable Form

When it comes time to file your taxes, you can easily find the IRS 1040EZ form online. Simply visit the IRS website and search for the form by its number. You can then download and print the form to fill out by hand, or use tax software to fill it out electronically.

When filling out the form, be sure to double-check all of your information to ensure accuracy. Any mistakes or omissions could result in delays in processing your return or even a potential audit. Take your time to review your form before submitting it to the IRS to avoid any issues.

Once you have completed the form, you can then either mail it in to the IRS or file electronically. If you are expecting a refund, filing electronically is the fastest way to receive it. If you owe taxes, be sure to submit your payment along with your form to avoid any penalties or interest.

Overall, the IRS 1040EZ form is a simple and convenient option for those with a basic tax situation. By taking the time to fill out the form accurately and submit it on time, you can ensure a smooth tax filing process and potentially receive any refunds owed to you in a timely manner.

So, if you meet the criteria for filing with the IRS 1040EZ form, be sure to take advantage of this easy and efficient option for filing your taxes. With the right information and attention to detail, you can successfully navigate the tax filing process and be on your way to financial peace of mind.