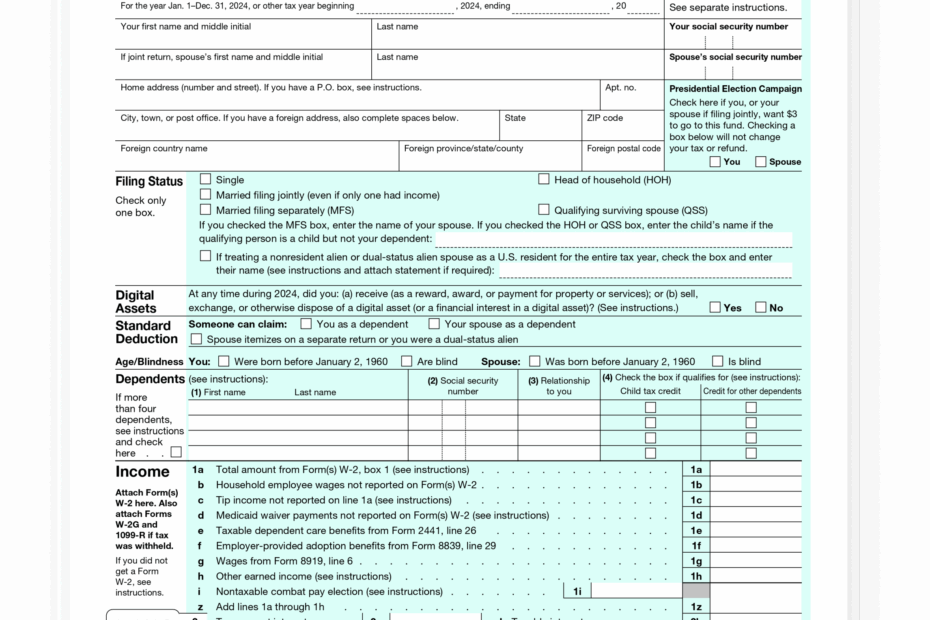

Filing taxes can be a daunting task for many individuals, but the IRS 1040EZ form is designed to simplify the process for those with straightforward tax situations. This form is specifically for individuals who do not have dependents and do not plan to itemize their deductions.

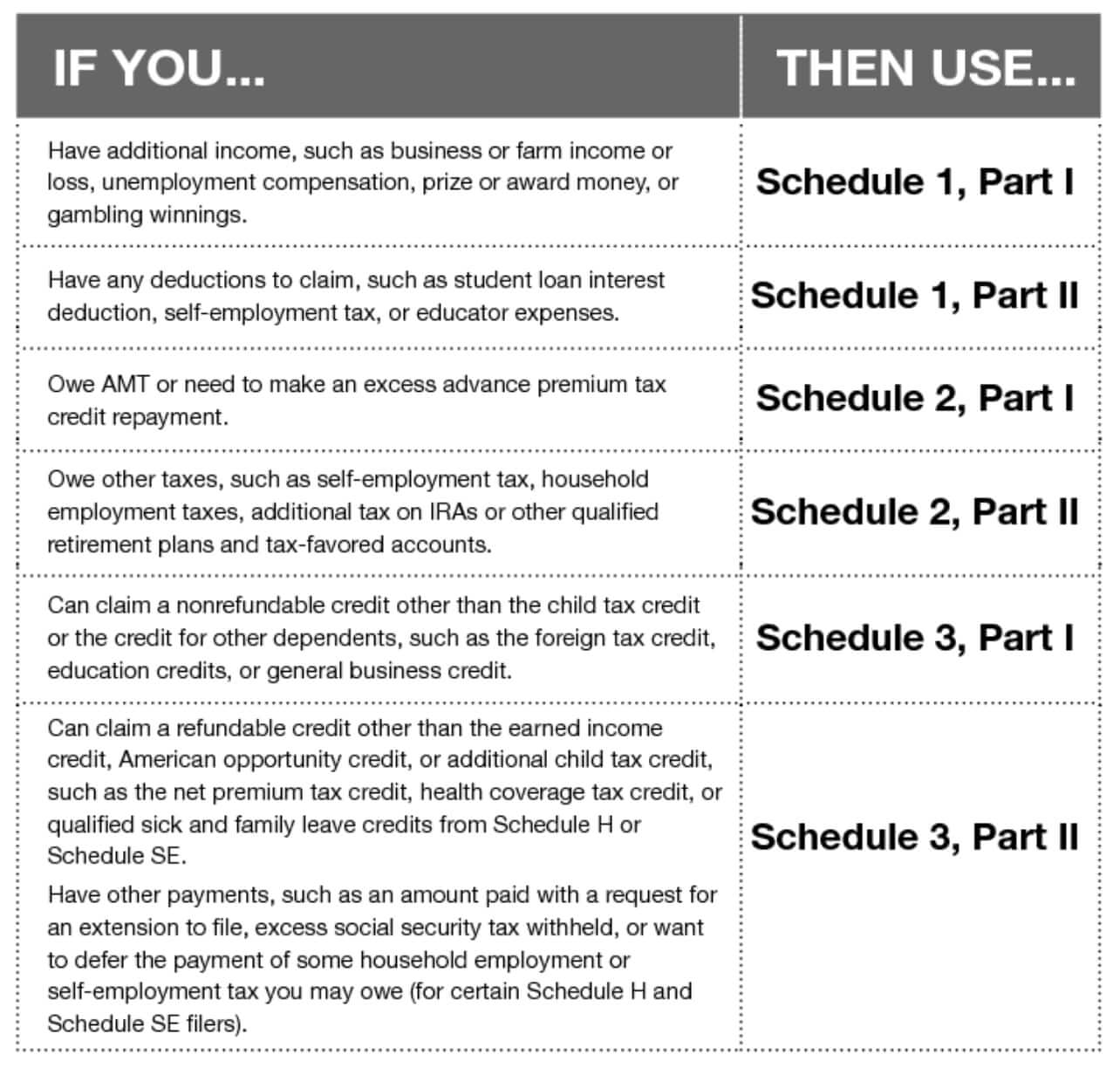

With the IRS 1040EZ form, taxpayers can easily report their income, claim the standard deduction, and calculate their tax liability. This form is a shorter and simpler version of the traditional 1040 form, making it ideal for those who want to file their taxes quickly and efficiently.

Get and Print Irs 1040ez Form Printable

How To Fill Out IRS Form 1040 With Pictures WikiHow

How To Fill Out IRS Form 1040 With Pictures WikiHow

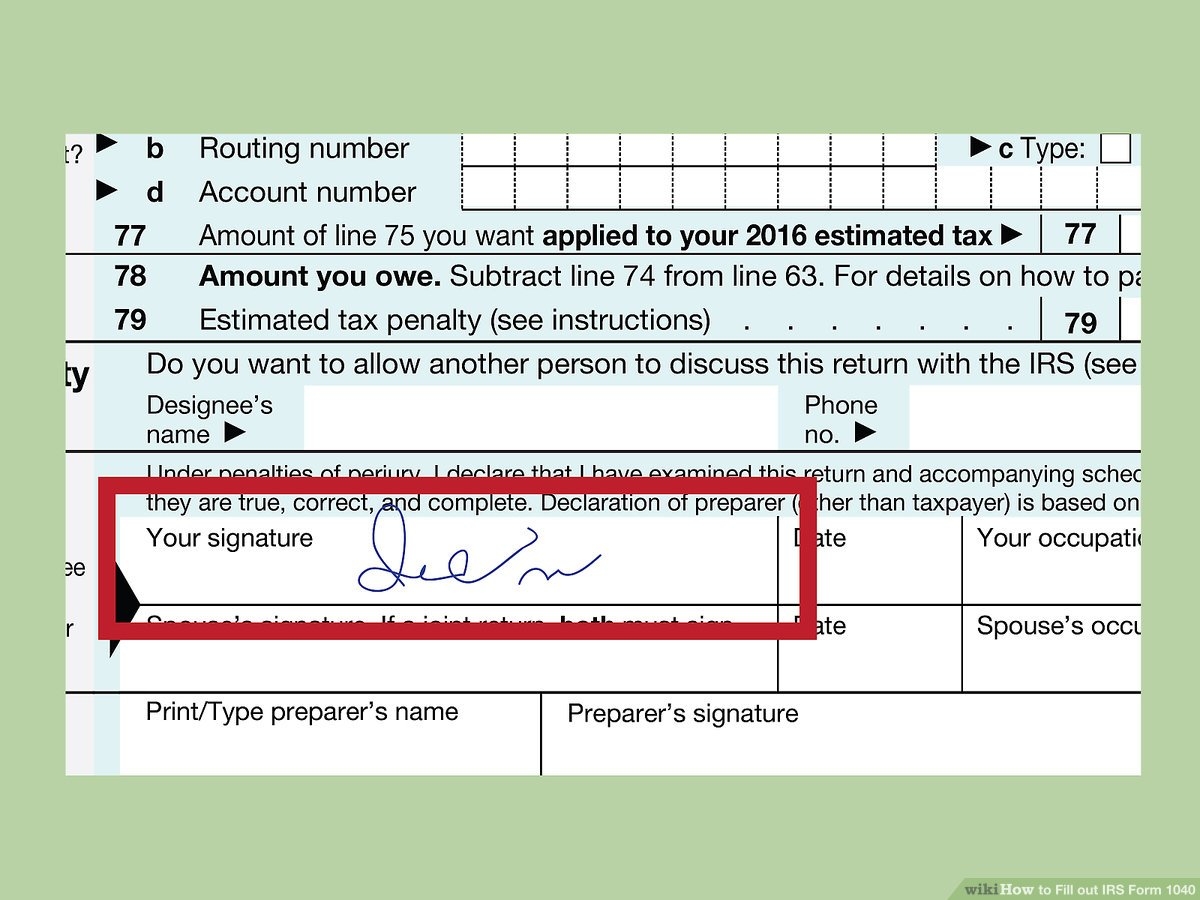

When filling out the IRS 1040EZ form, taxpayers will need to provide information such as their income, filing status, and any taxes that have already been withheld. Once the form is completed, it can be submitted to the IRS either electronically or by mail.

One of the key benefits of the IRS 1040EZ form is that it can be easily found and printed online. Taxpayers can visit the IRS website to download a printable version of the form, making it convenient for those who prefer to file their taxes on paper.

Overall, the IRS 1040EZ form is a useful tool for individuals with simple tax situations who want to streamline the tax filing process. By providing a straightforward way to report income and claim deductions, this form helps taxpayers meet their obligations to the IRS without unnecessary hassle.

In conclusion, the IRS 1040EZ form is a valuable resource for individuals looking to file their taxes quickly and efficiently. By offering a simplified way to report income and claim deductions, this form makes the tax filing process more manageable for those with straightforward tax situations.