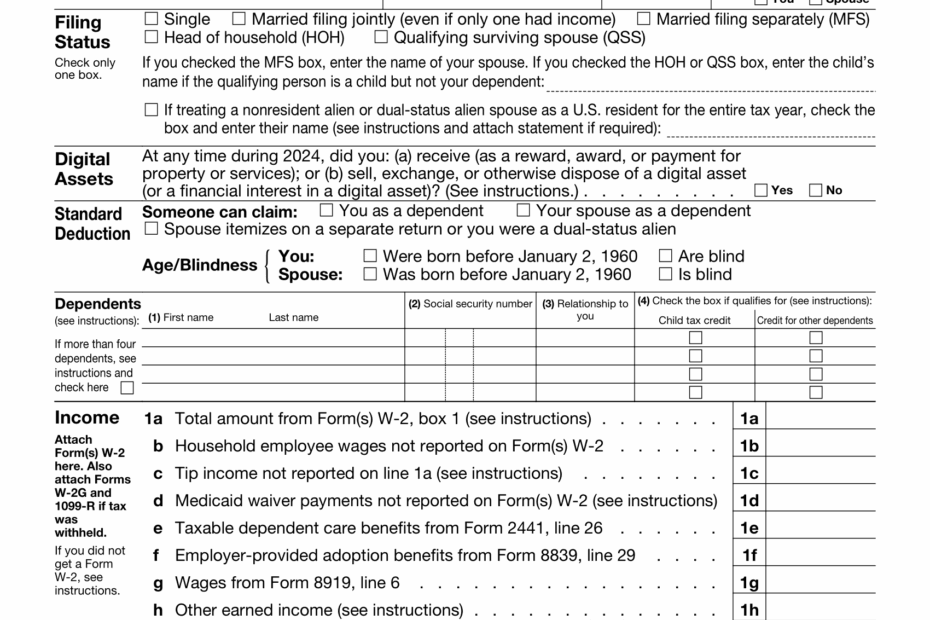

As taxpayers grow older, they may find that their tax situations become more complex. In response to this, the IRS introduced the 1040-SR form in 2019 to cater specifically to seniors aged 65 and older. This form is designed to make it easier for older taxpayers to file their taxes and claim any applicable deductions or credits.

The 1040-SR form is essentially a simplified version of the standard 1040 form, with larger fonts and spaces for easier reading and filling out. It also includes a chart for calculating the standard deduction for seniors, which can be especially helpful for those who are retired and living on a fixed income.

Irs 1040-Sr Form 2025 Printable

Irs 1040-Sr Form 2025 Printable

Get and Print Irs 1040-Sr Form 2025 Printable

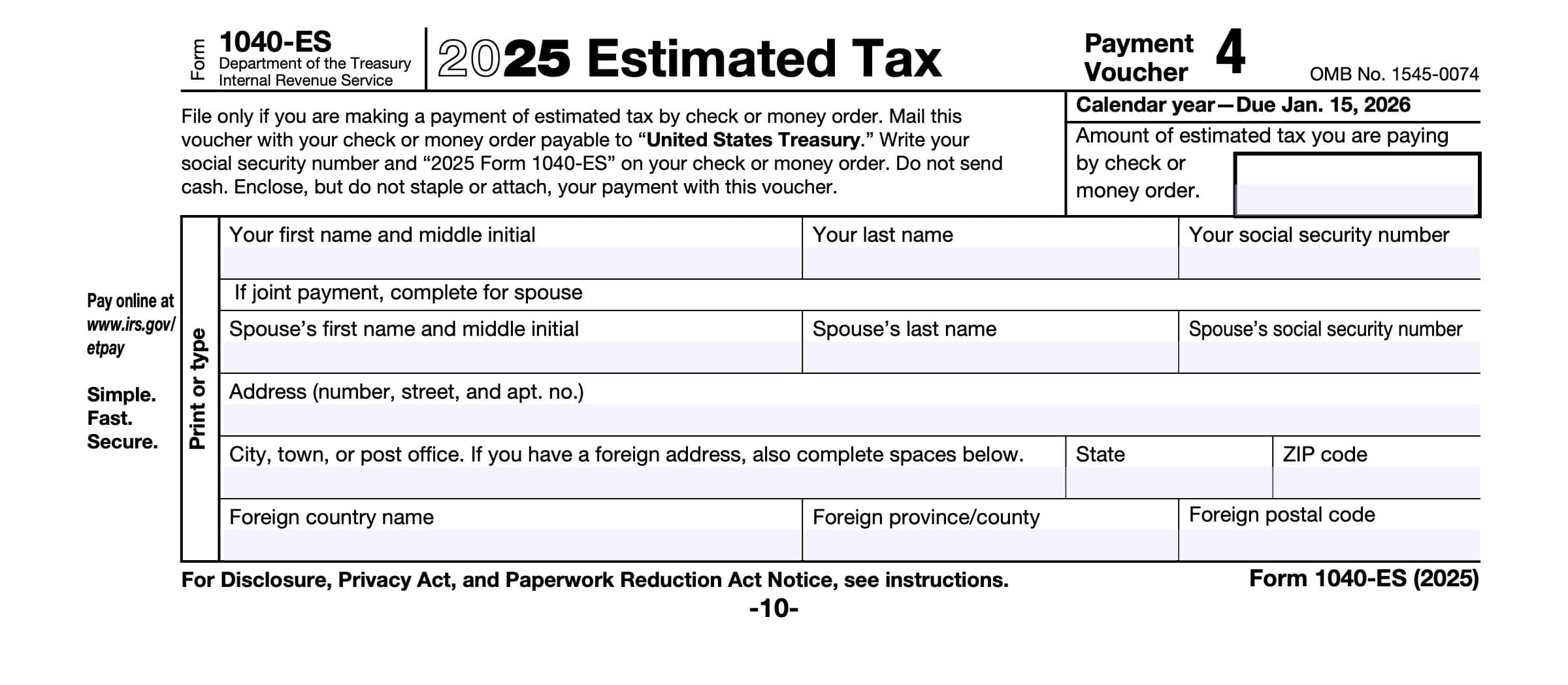

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

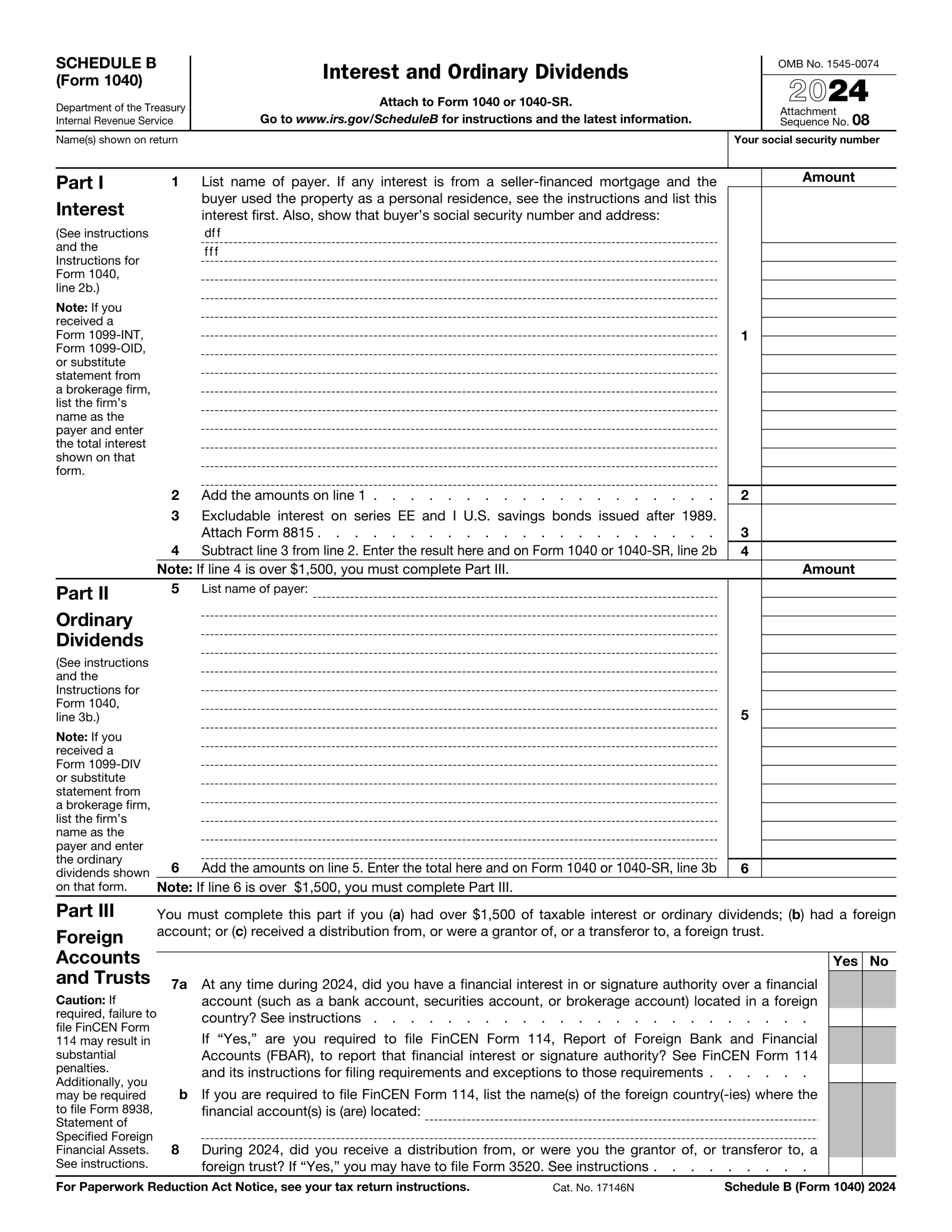

One of the key features of the 1040-SR form is that it allows seniors to report certain types of income that may not be included on the standard 1040 form, such as Social Security benefits, IRA distributions, and pension payments. This can help older taxpayers ensure that they are accurately reporting all of their income and avoiding any potential tax penalties.

In addition to income reporting, the 1040-SR form also includes sections for claiming various tax credits and deductions that are available to seniors, such as the Elderly and Disabled Credit, the Child and Dependent Care Credit, and the Earned Income Credit. By using this form, seniors can maximize their tax savings and potentially reduce their tax liability.

Overall, the IRS 1040-SR form is a valuable tool for seniors who are looking to simplify their tax filing process and ensure that they are taking advantage of all available tax benefits. By providing a user-friendly format and specific provisions for senior taxpayers, this form helps older individuals navigate the complexities of the tax code with ease.

As tax laws continue to evolve, it’s important for seniors to stay informed about any changes that may affect their tax situation. By utilizing the IRS 1040-SR form, older taxpayers can ensure that they are filing their taxes accurately and efficiently, ultimately saving time and money in the process.