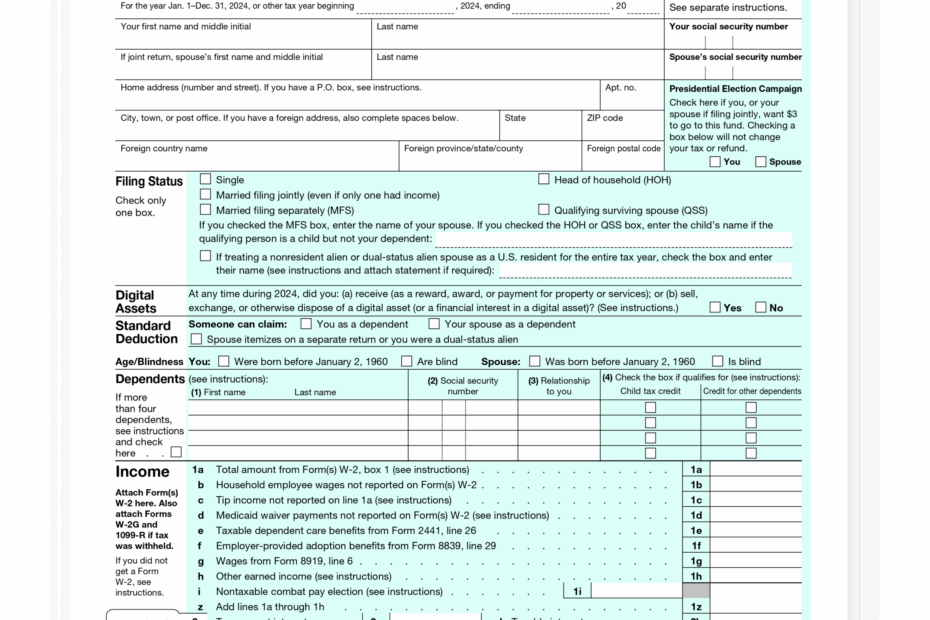

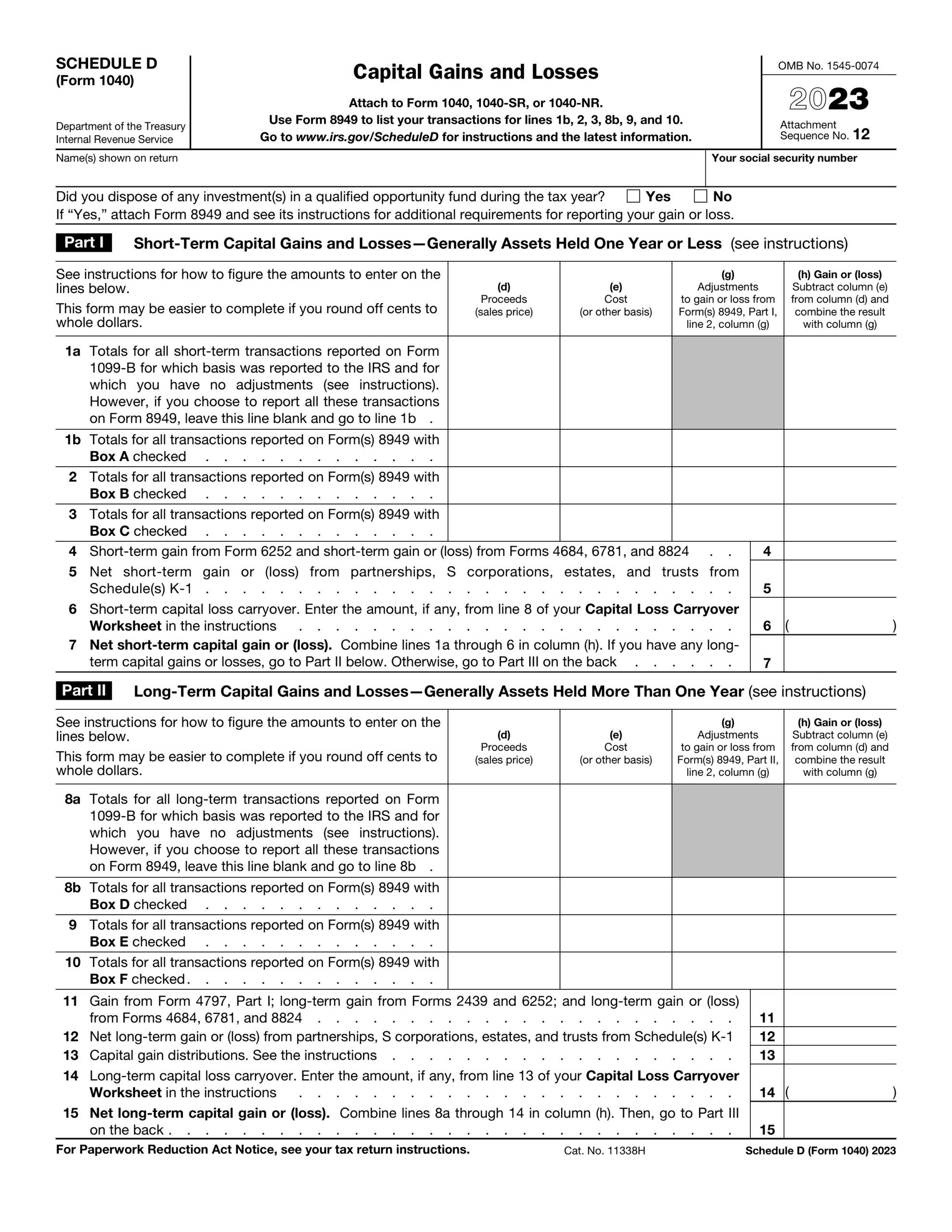

Filing taxes can be a daunting task, but with the right resources, it can be made easier. The IRS 1040 Form 2025 is a crucial document for individuals to report their annual income and calculate their tax liability. Understanding the instructions for this form is essential to ensure accuracy and compliance with tax laws.

With the IRS 1040 Form 2025 Instructions Printable, taxpayers can easily access the guidelines for filling out their tax return. This document provides detailed information on each section of the form, including how to report income, claim deductions, and calculate tax credits. By following these instructions carefully, individuals can avoid errors and potential penalties.

Irs 1040 Form 2025 Instructions Printable

Irs 1040 Form 2025 Instructions Printable

Download and Print Irs 1040 Form 2025 Instructions Printable

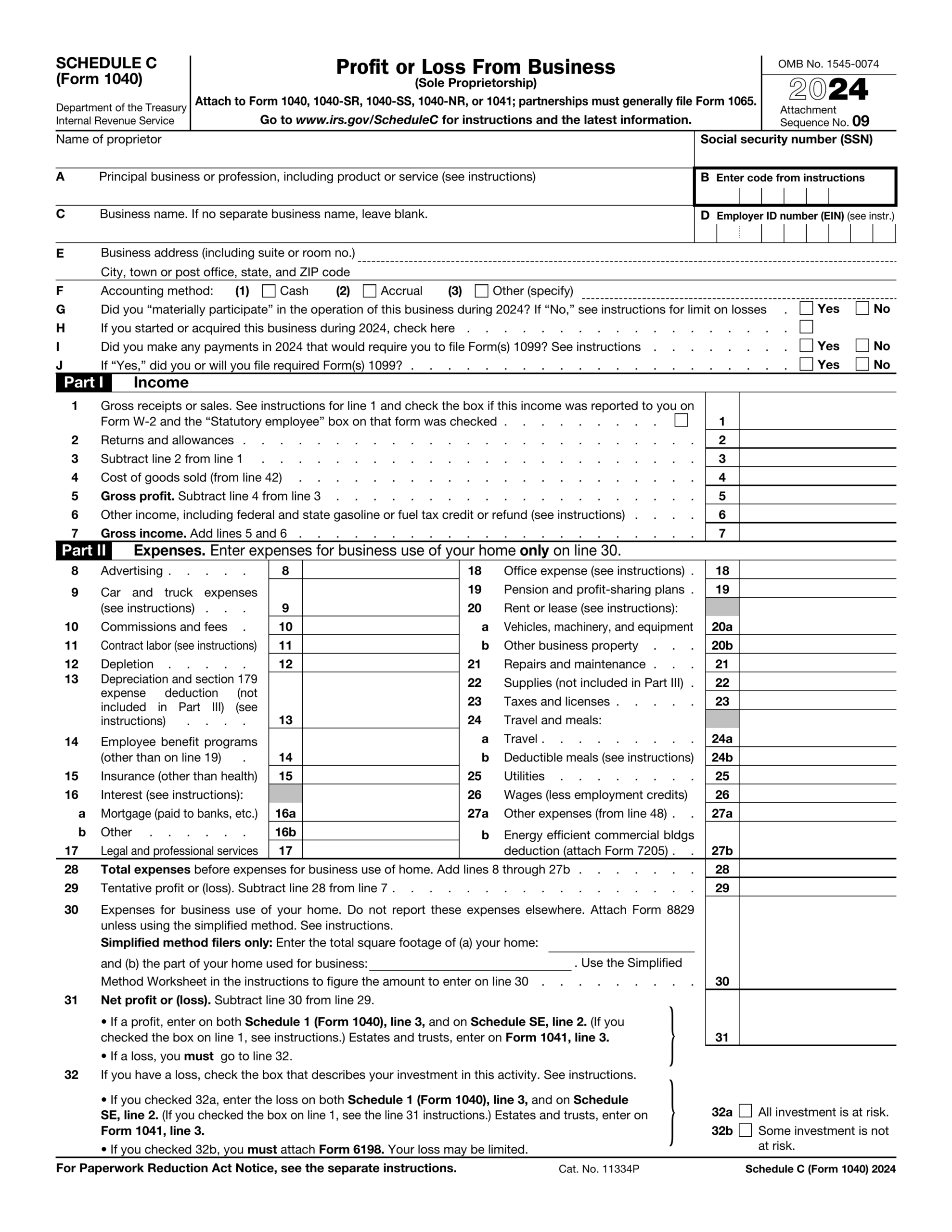

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru

1040 Schedule C 2024 2025 Fill And Edit Online PDF Guru

IRS 1040 Form 2025 Instructions Printable

The IRS 1040 Form 2025 Instructions Printable breaks down the tax filing process into simple steps, making it easier for taxpayers to navigate. It provides explanations for common tax terms, examples for reference, and tips for maximizing deductions. Additionally, it includes information on filing deadlines, payment options, and where to send the completed form.

One important section of the instructions is the eligibility criteria for various tax credits and deductions. Taxpayers must meet specific requirements to claim these benefits, and the instructions outline the necessary documentation and calculations. By following these guidelines, individuals can maximize their tax savings and avoid potential audits.

Another key aspect of the IRS 1040 Form 2025 Instructions Printable is the explanation of any changes to tax laws or regulations. The IRS regularly updates its guidelines, and it is essential for taxpayers to stay informed of these updates. The instructions provide a summary of any recent changes and how they may impact the filing process.

In conclusion, the IRS 1040 Form 2025 Instructions Printable is a valuable resource for individuals navigating the tax filing process. By carefully reviewing and following these guidelines, taxpayers can ensure accuracy, maximize savings, and avoid potential penalties. Utilizing this document can make the tax filing process more manageable and less stressful for individuals.