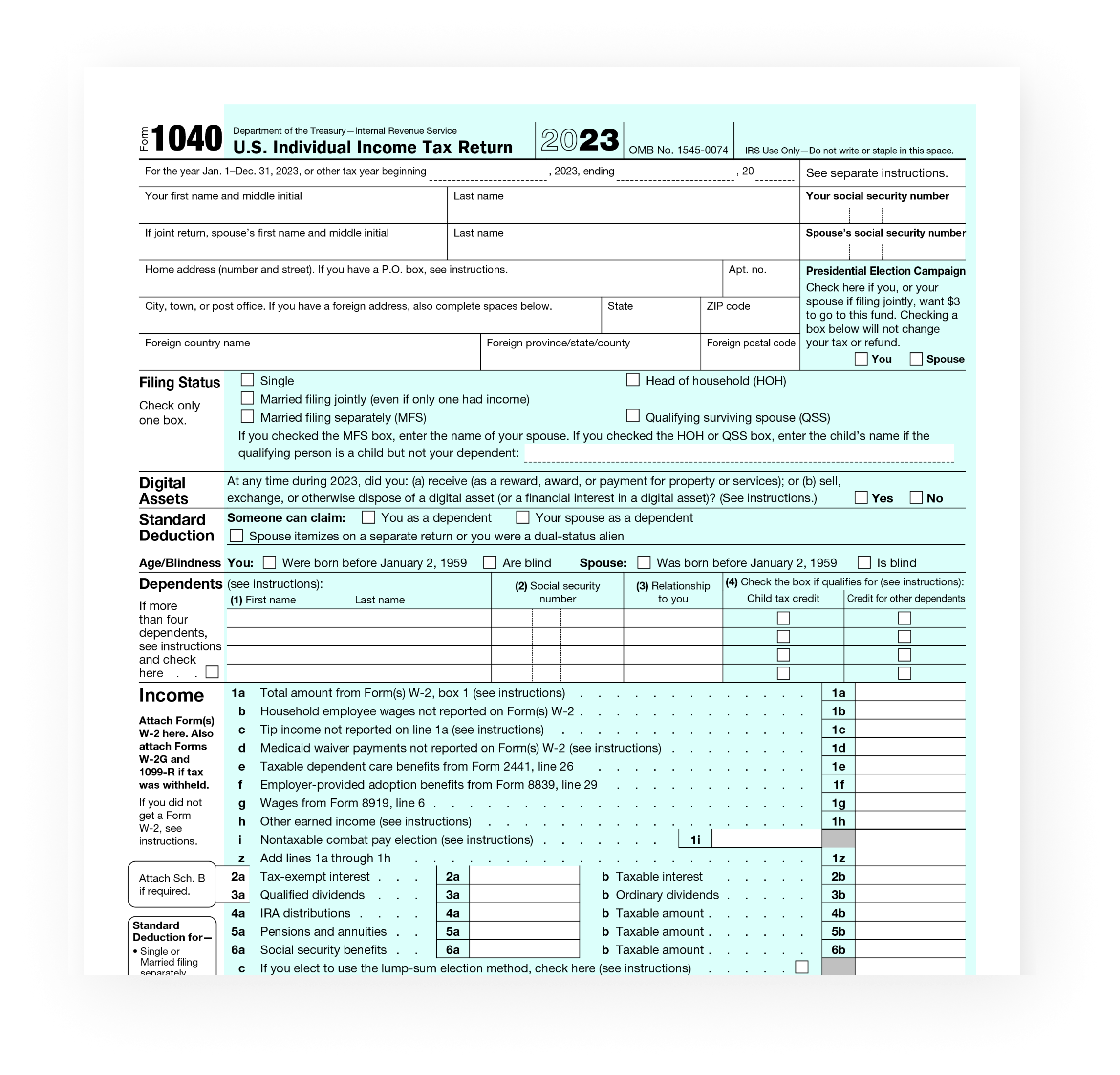

As tax season approaches, many individuals are beginning to gather their necessary documents and prepare to file their taxes. One crucial form that taxpayers will need is the IRS 1040 Form. This form is used to report an individual’s income and determine their tax liability for the year. It is important to have the most up-to-date version of the form to ensure accurate reporting.

For the year 2024, the IRS has released the latest version of the 1040 Form, which is available for download on their website. This printable form can be easily accessed and filled out by taxpayers, making the filing process more convenient and efficient.

Irs 1040 Form 2024 Printable Download

Irs 1040 Form 2024 Printable Download

Download and Print Irs 1040 Form 2024 Printable Download

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

1040 Tax Form 2024 2025 Fill Edit And Download PDF Guru

When downloading the IRS 1040 Form for 2024, taxpayers should ensure that they have all the necessary information and documents ready to accurately complete the form. This includes income statements, deductions, and any other relevant financial information. Filing an accurate tax return is essential to avoid penalties and ensure compliance with tax laws.

Once the form is downloaded and filled out, taxpayers can either file their taxes electronically or mail in the completed form to the IRS. It is important to file taxes on time and pay any taxes owed to avoid penalties and interest charges. The IRS 1040 Form for 2024 provides clear instructions on how to complete the form and where to send it once it is filled out.

Overall, the IRS 1040 Form for 2024 is an essential document for individuals to report their income and file their taxes accurately. By downloading the form from the IRS website, taxpayers can ensure they have the most up-to-date version and can easily fill it out to meet their tax obligations.

In conclusion, taxpayers should take advantage of the IRS 1040 Form 2024 Printable Download to streamline the tax filing process and ensure compliance with tax laws. By being proactive and organized in gathering the necessary information, individuals can file their taxes accurately and on time, avoiding any potential penalties or issues with the IRS.