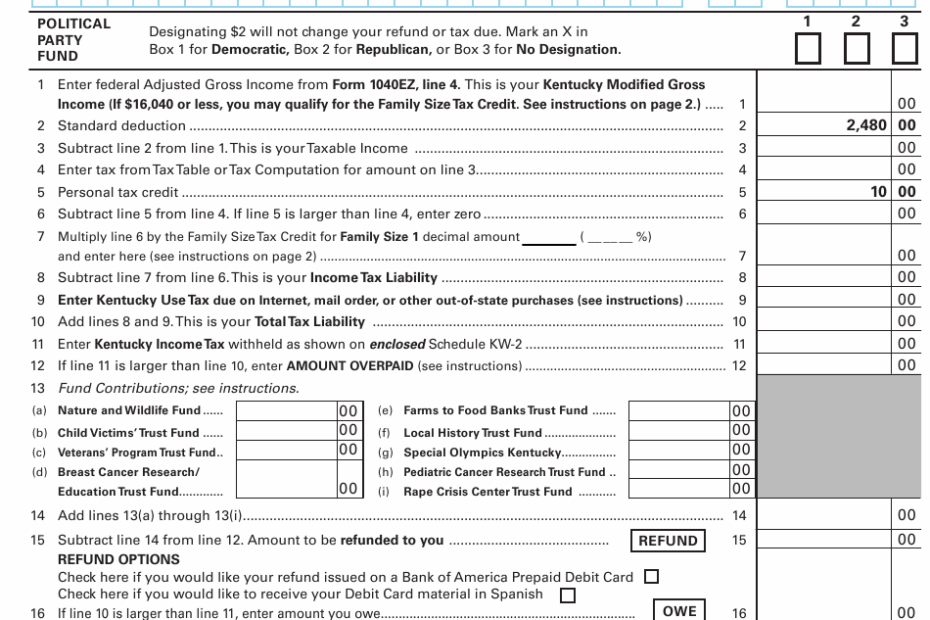

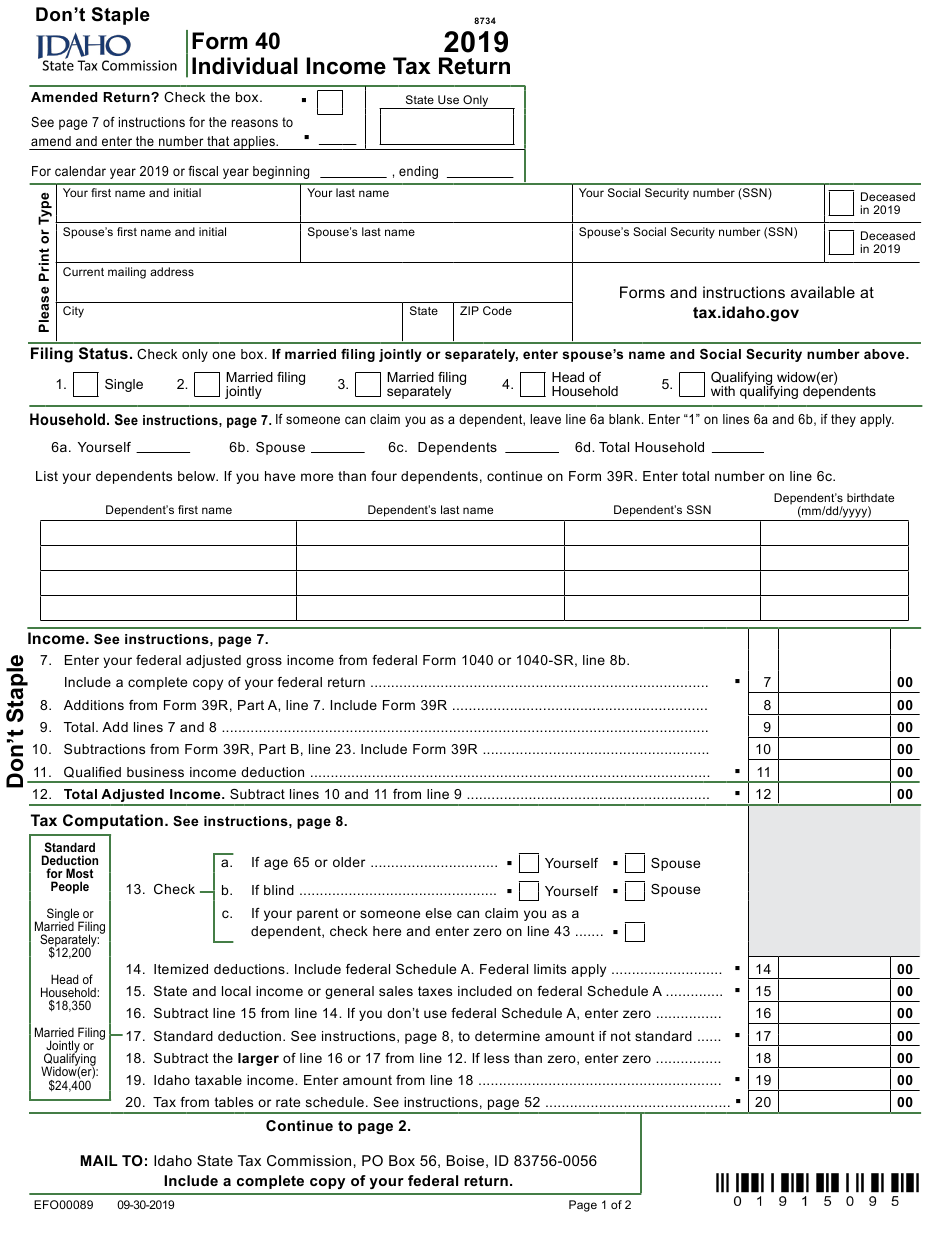

Income tax is a crucial part of every working individual’s life. It is the amount of money that individuals and businesses are required to pay to the government based on their income. Filing income tax returns can be a daunting task, but with the help of printable forms, the process becomes much simpler.

Income tax printable forms are readily available online and can be easily accessed and downloaded. These forms provide a structured format for individuals to report their income, deductions, and credits to the Internal Revenue Service (IRS) or other tax authorities. By using these forms, taxpayers can ensure that they are accurately reporting their income and claiming all eligible deductions.

Save and Print Income Tax Printable Forms

There are various types of income tax printable forms, each designed for specific purposes. Some common forms include Form 1040, which is used by individuals to report their annual income and calculate the amount of tax owed. There is also Form 1099, which is used by employers to report income paid to independent contractors and other non-employees.

When filling out income tax printable forms, it is important to gather all necessary documents, such as W-2 forms, 1099 forms, and receipts for deductions. Taxpayers should carefully review the instructions provided with the forms to ensure that they are completing them accurately. Any errors or omissions could result in penalties or delays in processing the tax return.

Once the income tax printable forms are completed, taxpayers can either file them electronically or mail them to the appropriate tax authority. Electronic filing is generally faster and more efficient, but some individuals prefer to file by mail for security reasons. Regardless of the method chosen, it is important to retain a copy of the forms for your records.

In conclusion, income tax printable forms are a valuable tool for individuals and businesses to report their income and pay their taxes. By using these forms, taxpayers can simplify the tax filing process and ensure that they are complying with tax laws. It is essential to be thorough and accurate when completing these forms to avoid any potential issues with the tax authorities.