When it comes to filing your income tax return, having the right forms is essential. Printable forms make the process easier and more convenient for taxpayers. With the availability of online resources, you can easily access and download the necessary forms to file your taxes accurately.

Whether you are an individual taxpayer or a business owner, having printable forms at your disposal can save you time and hassle. You can fill out the forms at your own pace and double-check the information before submitting them to the IRS. This ensures that you are providing accurate information and minimizing the risk of errors on your tax return.

Income Tax Filing With Printable Forms

Income Tax Filing With Printable Forms

Quickly Access and Print Income Tax Filing With Printable Forms

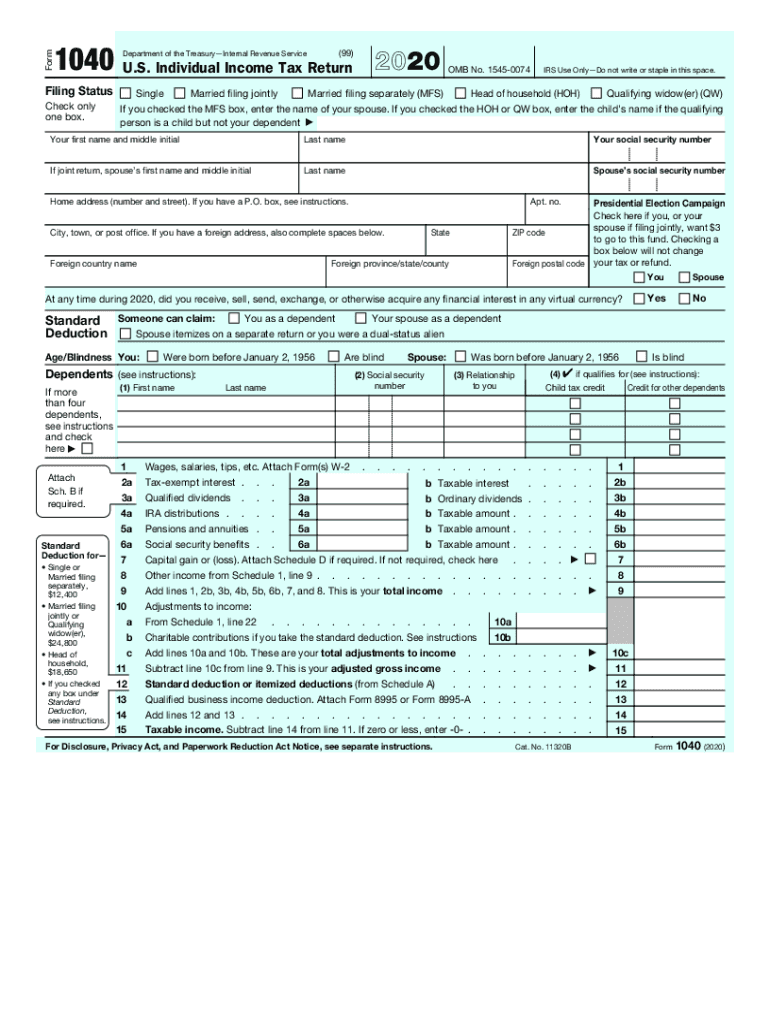

One of the most commonly used forms for individual taxpayers is the Form 1040. This form is used to report your annual income, deductions, and credits. By using printable forms, you can easily input all the necessary information and calculate your tax liability. Additionally, printable forms also include instructions on how to fill out each section correctly, making the process less daunting for taxpayers.

For business owners, printable forms such as the Form 1120 for corporations or the Form 1065 for partnerships are essential for reporting income and expenses. These forms allow businesses to accurately report their financial information to the IRS and ensure compliance with tax laws. With printable forms, business owners can easily keep track of their tax obligations and meet filing deadlines.

Overall, utilizing printable forms for income tax filing is a convenient and efficient way to ensure accurate reporting to the IRS. By having access to the necessary forms online, taxpayers can streamline the filing process and avoid potential errors on their tax return. Whether you are an individual taxpayer or a business owner, printable forms can simplify the tax filing process and help you meet your tax obligations.

Make sure to download and use the appropriate printable forms for your tax situation to ensure a smooth and accurate filing process. By taking advantage of online resources, you can access the forms you need and file your taxes with confidence.