As the tax season approaches, it’s important to start preparing all the necessary documents and information to file your income tax return. Having an income tax checklist for 2024 can help ensure that you don’t miss any important details and maximize your tax deductions.

Whether you’re a salaried employee, self-employed individual, or business owner, keeping track of your income and expenses throughout the year is crucial for a smooth tax filing process. By using a printable income tax checklist for 2024, you can stay organized and avoid any last-minute scrambling to gather required documents.

Income Tax Checklist 2024 Printable

Income Tax Checklist 2024 Printable

Save and Print Income Tax Checklist 2024 Printable

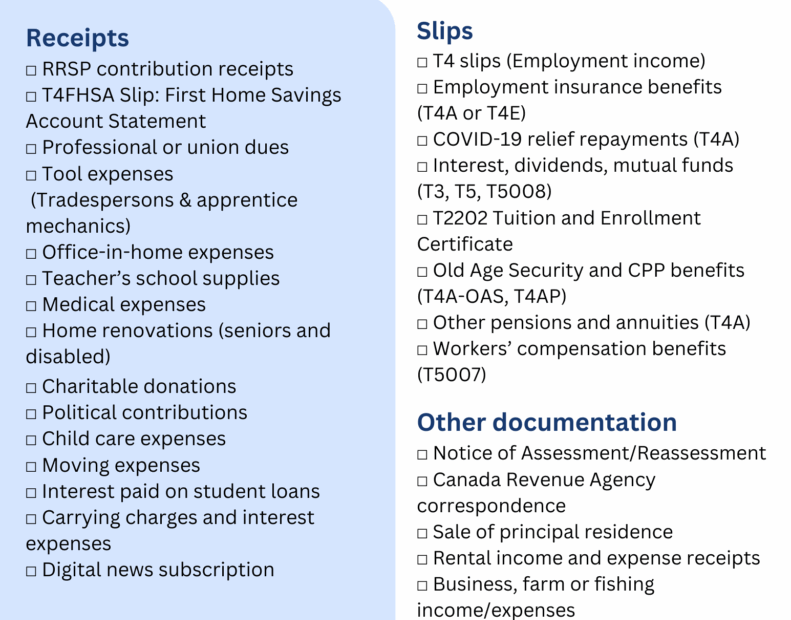

Here are some essential items to include in your income tax checklist for 2024:

- Income documents such as W-2s, 1099s, and investment income statements

- Expense receipts for business-related deductions, charitable contributions, and medical expenses

- Proof of health insurance coverage or exemptions

- Records of any estimated tax payments made throughout the year

- Social Security numbers for yourself, spouse, and dependents

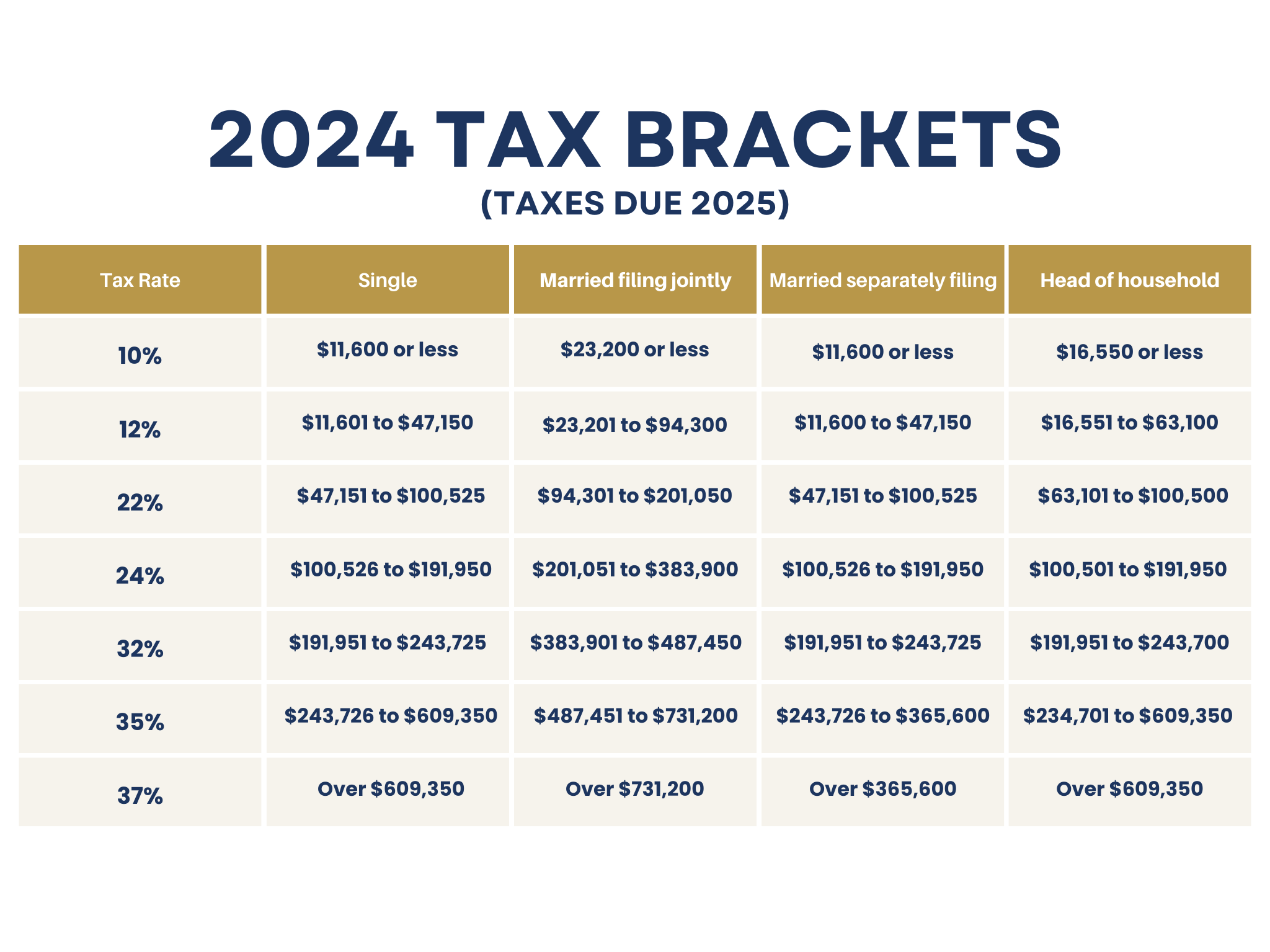

It’s also important to review any changes in tax laws or regulations for the 2024 tax year to ensure compliance and maximize your tax savings. Consulting with a tax professional or using tax preparation software can help navigate any complexities in the tax code and optimize your tax return.

By following a comprehensive income tax checklist for 2024, you can streamline the tax filing process and potentially reduce your tax liability. Start gathering all the necessary documents and information early to avoid any delays in filing your tax return and receiving any refunds owed to you.

Take advantage of printable income tax checklists for 2024 available online or create your own customized checklist based on your specific tax situation. Being proactive and organized can make a significant difference in your overall tax filing experience and financial well-being.

Make sure to review your completed tax return for accuracy before submitting it to the IRS. Double-check all calculations, deductions, and personal information to avoid any potential errors or audits. With careful preparation and attention to detail, you can file your income tax return confidently and efficiently using a printable checklist for 2024.