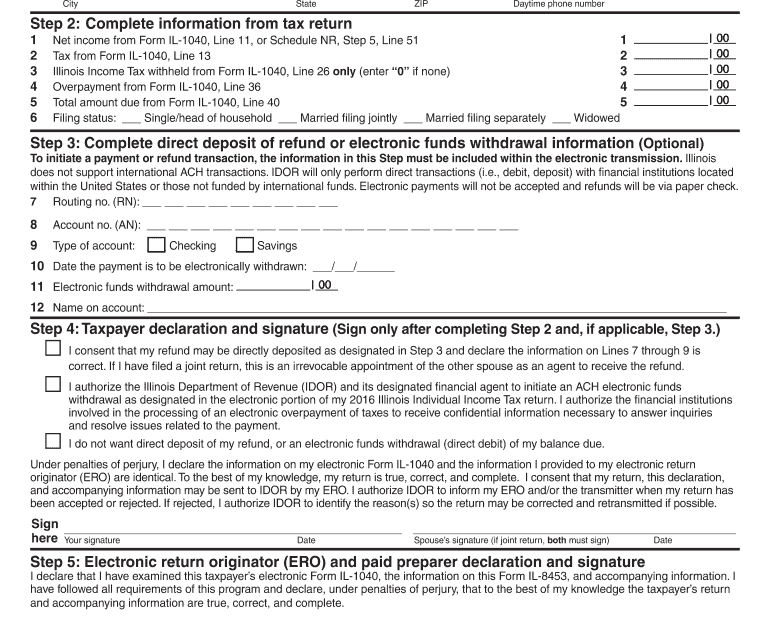

When it comes to filing taxes for trusts in Illinois, it is important to have the necessary forms ready. The Illinois State Income Tax Form for Trusts Printable 2016 is a crucial document that trustees need to fill out accurately to ensure compliance with state tax laws.

Trusts are legal entities that can hold assets and distribute income to beneficiaries. Like individuals, trusts are required to file tax returns and pay taxes on any income earned. The Illinois State Income Tax Form for Trusts Printable 2016 provides trustees with a clear outline of what information needs to be reported and how to calculate the tax liability.

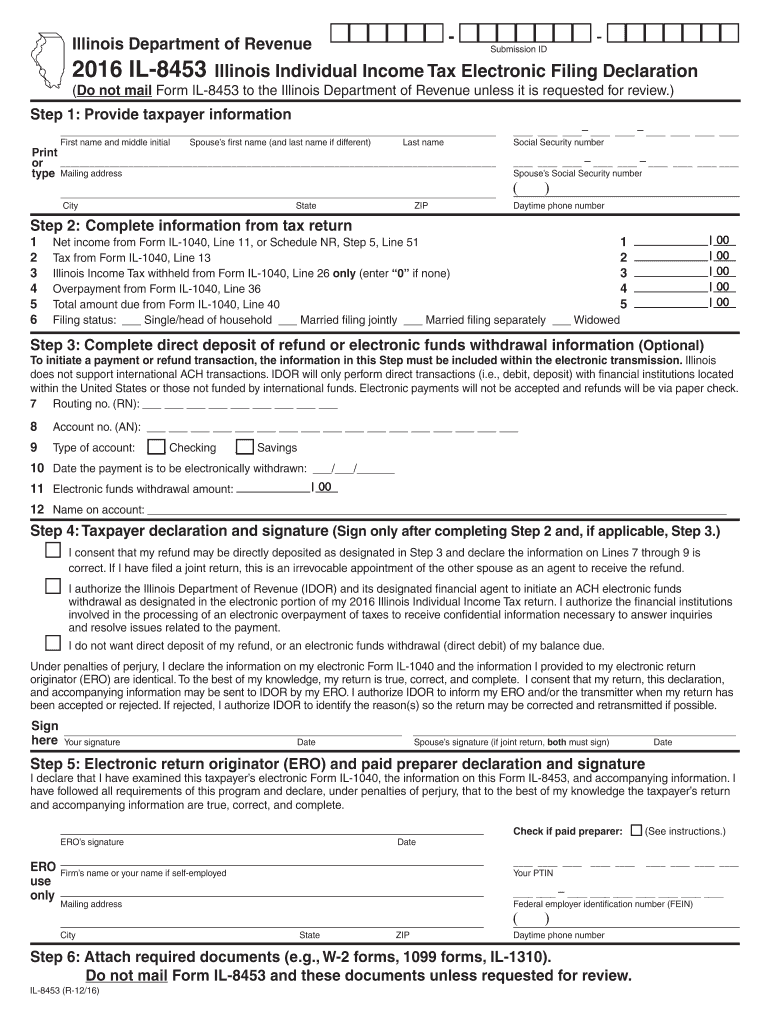

Illinois State Income Tax Form For Trusts Printable 2016

Illinois State Income Tax Form For Trusts Printable 2016

Quickly Access and Print Illinois State Income Tax Form For Trusts Printable 2016

When filling out the Illinois State Income Tax Form for Trusts Printable 2016, trustees will need to provide details about the trust’s income, deductions, and credits. This includes information such as interest, dividends, capital gains, and any other sources of income received by the trust during the tax year. Trustees will also need to report any expenses or deductions that can be claimed to reduce the trust’s taxable income.

It is important for trustees to accurately complete the Illinois State Income Tax Form for Trusts Printable 2016 to avoid any penalties or fines for incorrect information. Trusts that fail to file their tax returns or pay the required taxes on time may face consequences from the Illinois Department of Revenue. By carefully reviewing the form and seeking assistance if needed, trustees can ensure that they are in compliance with state tax laws.

In conclusion, the Illinois State Income Tax Form for Trusts Printable 2016 is a vital document that trustees must fill out accurately to meet their tax obligations. By providing detailed information about the trust’s income, deductions, and credits, trustees can ensure that they are in compliance with state tax laws and avoid any potential penalties. It is important for trustees to take the time to review the form carefully and seek assistance if needed to ensure that they are filing their taxes correctly.

Fillable Form 8960 Net Investment Income Tax Individuals Estates

Fillable Form 8960 Net Investment Income Tax Individuals Estates

Illinois State Income Tax Form 2023 Printable Forms Free Online

Illinois State Income Tax Form 2023 Printable Forms Free Online

Illinois State Income Tax Form Printable Printable Forms Free Online

Illinois State Income Tax Form Printable Printable Forms Free Online

Illinois State Income Tax Form For Trusts Printable Printable Forms

Illinois State Income Tax Form For Trusts Printable Printable Forms

Illinois State Income Tax Form For Trusts Printable Printable Forms

Illinois State Income Tax Form For Trusts Printable Printable Forms

Searching for a simple method to take care of your money matters? The Illinois State Income Tax Form For Trusts Printable 2016 provide a straightforward, secure, and personalizable option right from home. Perfect for your own needs, home businesses, or budgeting, printable checks help you save both time and cash without sacrificing security. Works well with most accounting software and easy to print, they’re a smart choice to store-bought checks. Start printing today and fully manage your financial transactions—instant access, no fees. Explore our ready-to-use templates and pick the one that suits your style. With our easy-to-use interface, financial management has never been this convenient. Download your free printable checks and optimize your check-writing process with security!.