Heavy weight truck owners in California are required to file Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, with the Internal Revenue Service (IRS) every year. This form is used to report and pay the federal excise tax on heavy vehicles with a gross weight of 55,000 pounds or more. Owners must also provide proof of payment of this tax when registering their vehicles with the California Department of Motor Vehicles (DMV).

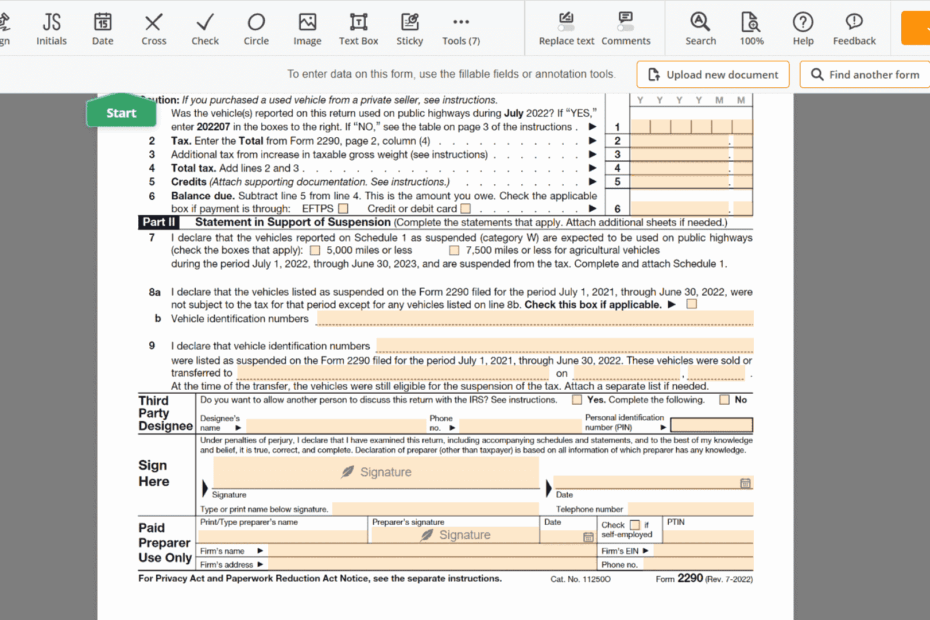

Form 2290 can be filed electronically or by mail, but some truck owners prefer to file a printable version of the form for their records. The printable version of Form 2290 is available on the IRS website and can be easily downloaded and filled out by truck owners.

Heavy Weight Truck Income Tax Ca Form 2290 Printable

Heavy Weight Truck Income Tax Ca Form 2290 Printable

Easily Download and Print Heavy Weight Truck Income Tax Ca Form 2290 Printable

When filling out Form 2290, truck owners must provide information about their vehicles, including the Vehicle Identification Number (VIN) and gross weight. They must also calculate the amount of tax owed based on the weight of the vehicle and the number of months it was in use during the tax year.

Once the form is completed, truck owners can either mail it to the IRS along with a check or money order for the tax owed, or they can pay the tax electronically using the IRS’s Electronic Federal Tax Payment System (EFTPS). After the IRS processes the form and payment, truck owners will receive a stamped Schedule 1, which serves as proof of payment of the tax.

It is important for heavy weight truck owners in California to file Form 2290 and pay the federal excise tax on time to avoid penalties and interest charges. Failure to file the form or pay the tax can result in fines and other consequences. By staying on top of their tax obligations, truck owners can ensure that their vehicles remain in compliance with state and federal regulations.

In conclusion, heavy weight truck owners in California must file Form 2290 and pay the federal excise tax on their vehicles every year. By using the printable version of the form, truck owners can easily keep track of their tax obligations and ensure that they are in compliance with state and federal laws. Filing Form 2290 is an important responsibility for truck owners, and it is essential that they do so accurately and on time to avoid any potential penalties or consequences.