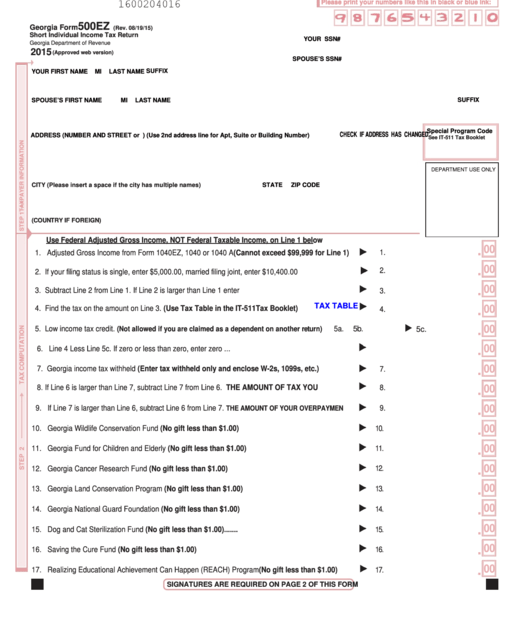

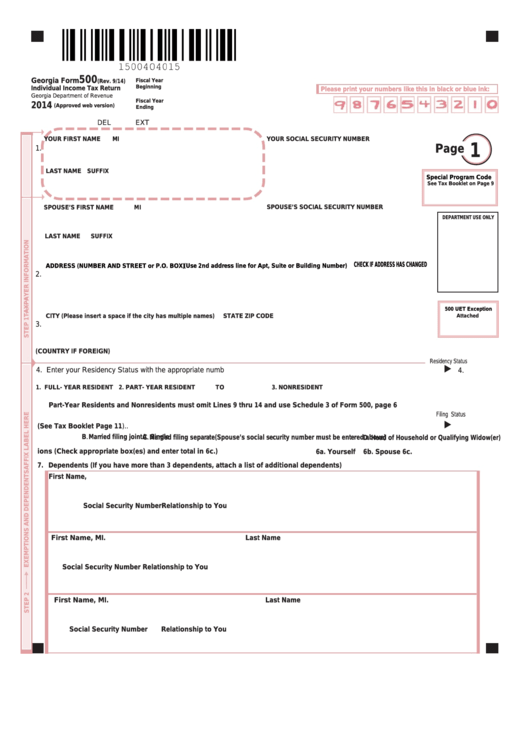

Georgia Income Tax Form 500 is a crucial document for residents of Georgia who need to report their income and calculate their state taxes. It is essential to fill out this form accurately and submit it on time to avoid any penalties or issues with the Georgia Department of Revenue.

Fortunately, the Georgia Income Tax Form 500 is available in a printable format, making it easier for taxpayers to access and complete. This printable form can be downloaded from the Georgia Department of Revenue website or obtained from various tax preparation services.

Georgia Income Tax Form 500 Printable

Georgia Income Tax Form 500 Printable

Quickly Access and Print Georgia Income Tax Form 500 Printable

Georgia Income Tax Form 500 Printable

The Georgia Income Tax Form 500 is divided into sections that require taxpayers to provide information about their income, deductions, credits, and tax liability. By using the printable form, taxpayers can carefully review each section and ensure that they have included all relevant information before submitting it.

When filling out the Georgia Income Tax Form 500, taxpayers must accurately report their income from various sources, such as wages, self-employment, investments, and rental properties. They must also calculate any deductions and credits they are eligible for to reduce their tax liability.

After completing the form, taxpayers must sign and date it before submitting it to the Georgia Department of Revenue. It is important to keep a copy of the completed form for their records and to have proof of filing in case of any discrepancies or audits.

Overall, the Georgia Income Tax Form 500 Printable provides taxpayers with a convenient way to report their income and calculate their state taxes. By carefully completing this form and submitting it on time, taxpayers can ensure that they are in compliance with Georgia state tax laws and avoid any potential issues with the tax authorities.

So, if you are a resident of Georgia and need to file your state taxes, be sure to download the Georgia Income Tax Form 500 Printable and start the process of reporting your income and calculating your tax liability today.