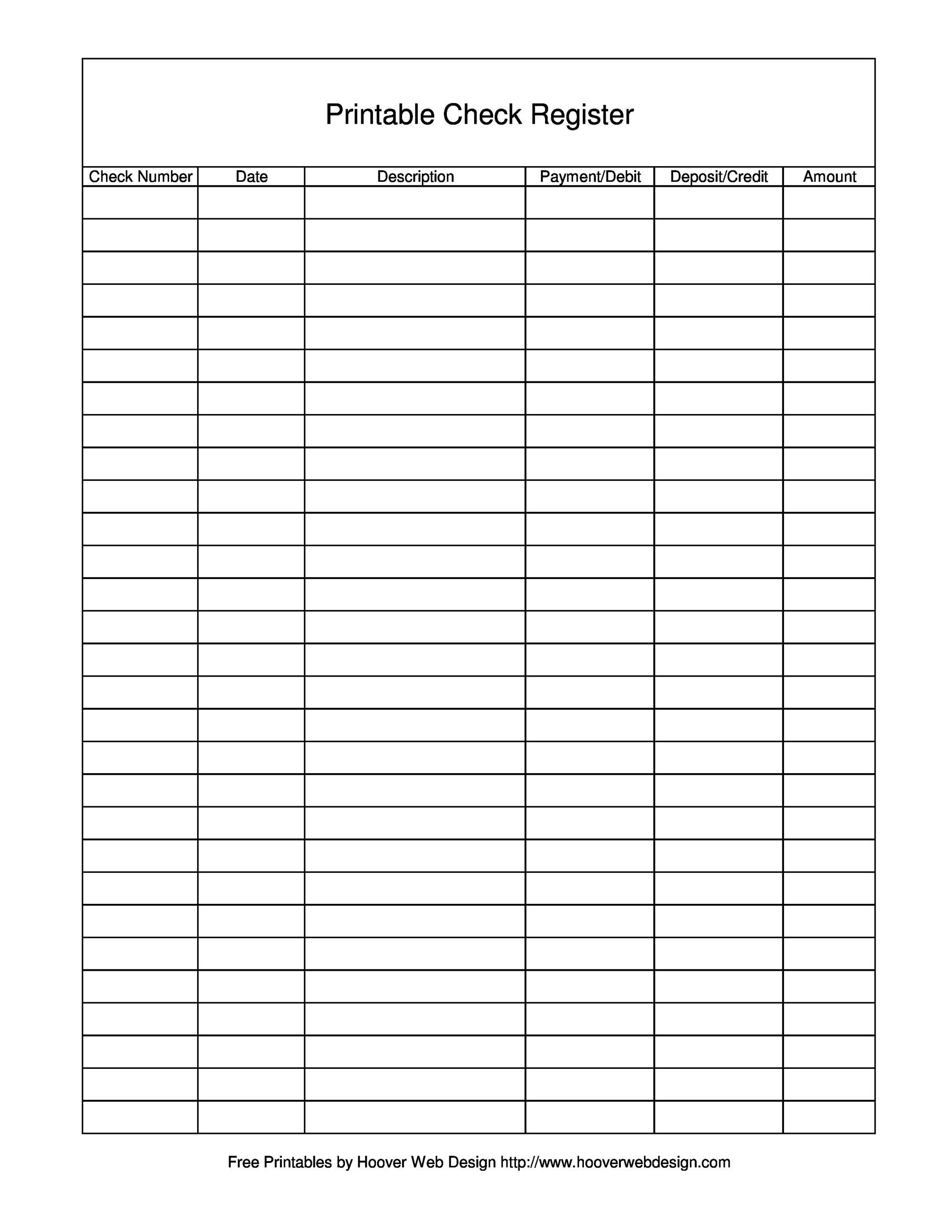

Managing your finances can be a daunting task, but having a personal check register can help you stay organized and keep track of your spending. With a free printable personal check register, you can easily record all of your transactions and monitor your account balance.

Keeping track of your expenses is crucial for maintaining a healthy financial life. By using a check register, you can ensure that all of your transactions are accounted for and avoid any overdraft fees or missed payments. With the convenience of a printable template, you can easily update your register whenever you write a check or make a deposit.

Free Printable Personal Check Register

Free Printable Personal Check Register

Quickly Access and Print Free Printable Personal Check Register

Free Printable Personal Check Register

There are many websites and online resources that offer free printable personal check registers that you can download and print at home. These templates typically include spaces for the date, check number, description of the transaction, and the amount. Some templates also have columns for deposits and withdrawals, as well as a running balance to help you keep track of your account balance.

Using a personal check register is a simple and effective way to manage your finances. By recording all of your transactions in one place, you can easily track your spending and identify any discrepancies. This can help you identify areas where you may be overspending and make adjustments to your budget accordingly.

Having a personal check register can also provide you with peace of mind knowing that you have a clear record of your financial transactions. In the event of any discrepancies or disputes, you can refer back to your register to verify the details of the transaction. This can help you resolve any issues quickly and efficiently.

In conclusion, a free printable personal check register is a valuable tool for managing your finances and staying organized. By using a template to record all of your transactions, you can easily track your spending, monitor your account balance, and avoid any financial pitfalls. Take advantage of these resources to help you achieve your financial goals and maintain a healthy financial life.