Managing finances can be a challenging task, especially for those with a low income. Keeping track of expenses and creating a budget can help individuals stay on top of their finances and ensure they are living within their means. One useful tool to help with budgeting is a printable budget worksheet, which can help individuals outline their income and expenses in a clear and organized manner.

For beginners who are new to budgeting, having a printable budget worksheet can provide a simple and structured way to track their finances. It can serve as a visual representation of where their money is going each month and help them make informed decisions about their spending habits.

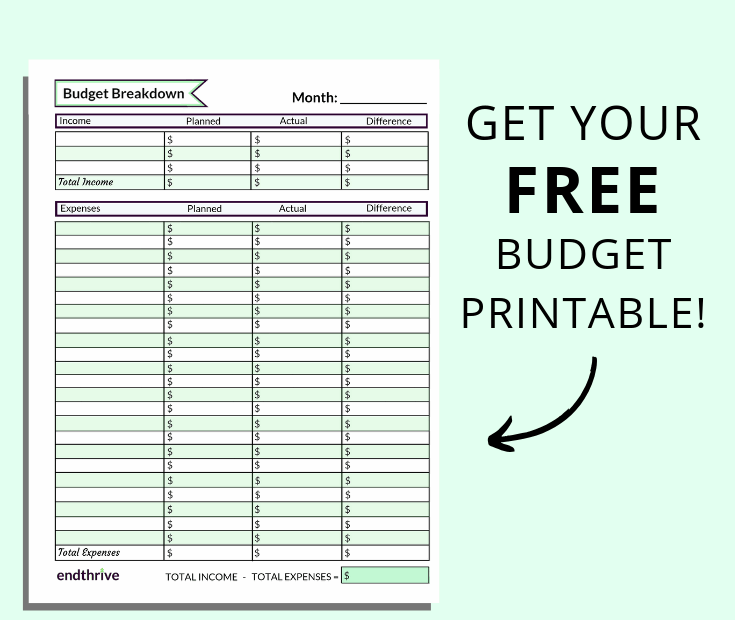

Free Printable Low Income Budget Beginner Printable Budget Worksheet

Free Printable Low Income Budget Beginner Printable Budget Worksheet

Easily Download and Print Free Printable Low Income Budget Beginner Printable Budget Worksheet

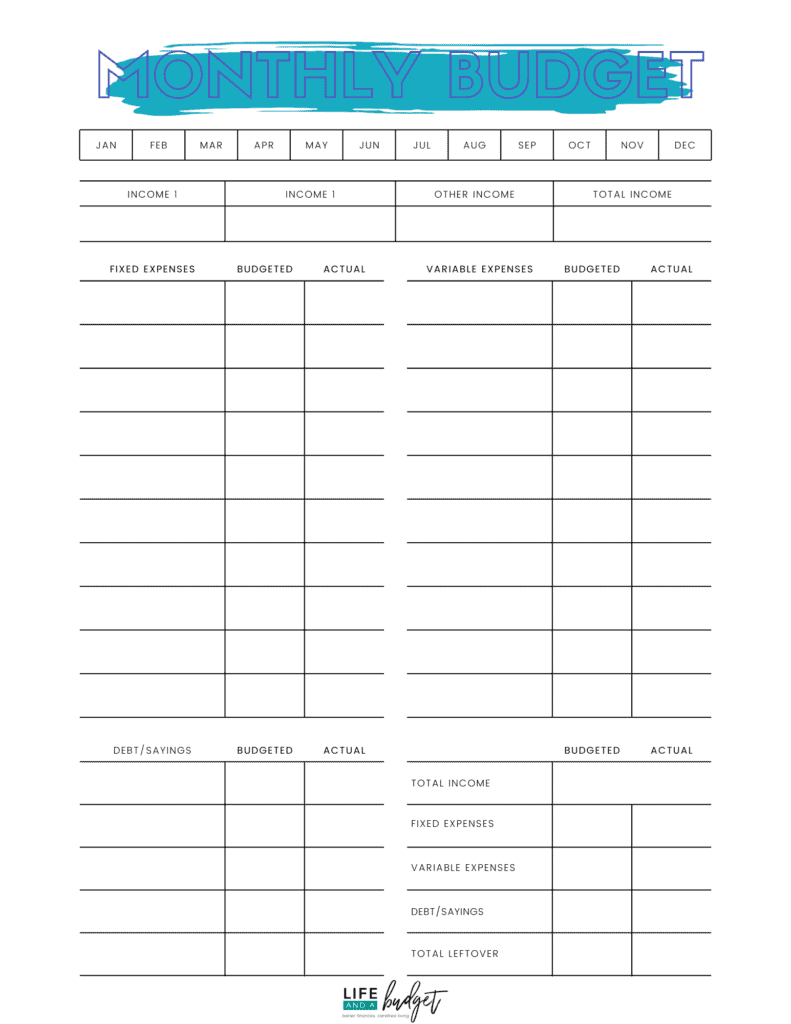

Creating a budget worksheet can be a straightforward process. Begin by listing all sources of income, such as salaries, wages, or any other forms of earnings. Next, outline all expenses, including rent, utilities, groceries, transportation, and any other recurring costs. Be sure to include both fixed expenses (those that stay the same each month) and variable expenses (those that fluctuate).

Once all income and expenses have been listed, calculate the total amount of income and expenses. This will give individuals a clear picture of their financial situation and allow them to see if they are living within their means. If expenses exceed income, adjustments may need to be made to ensure financial stability.

Using a printable budget worksheet can also help individuals set financial goals and track their progress over time. By regularly updating the worksheet and monitoring spending habits, individuals can make informed decisions about their finances and work towards achieving their financial goals.

In conclusion, a free printable low income budget beginner printable budget worksheet can be a valuable tool for individuals looking to take control of their finances. By outlining income and expenses in a clear and organized manner, individuals can track their spending habits, set financial goals, and work towards achieving financial stability.