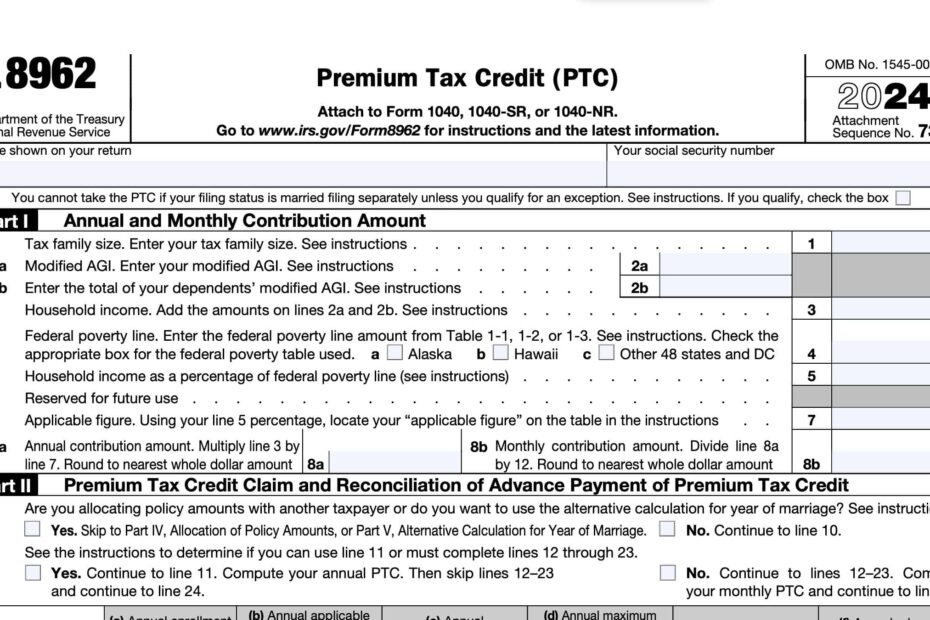

Are you looking for a way to easily file your taxes and claim the Premium Tax Credit? Look no further than the Free Printable IRS Form 8962. This form is essential for individuals who have purchased health insurance through the Health Insurance Marketplace and want to claim the Premium Tax Credit.

With this form, you can reconcile any advance payments of the Premium Tax Credit that were made to your insurance company on your behalf. It helps determine if you are eligible for the credit and if there are any discrepancies that need to be addressed. By accurately filling out Form 8962, you can ensure that you receive the appropriate amount of tax credit.

Save and Print Free Printable Irs Form 8962

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

Free Printable IRS Form 8962

When it comes to tax forms, finding a free printable version can save you time and money. With the Free Printable IRS Form 8962, you can easily access the form online, fill it out electronically, and submit it to the IRS without any hassle. This convenient option allows you to complete your tax filing process efficiently and accurately.

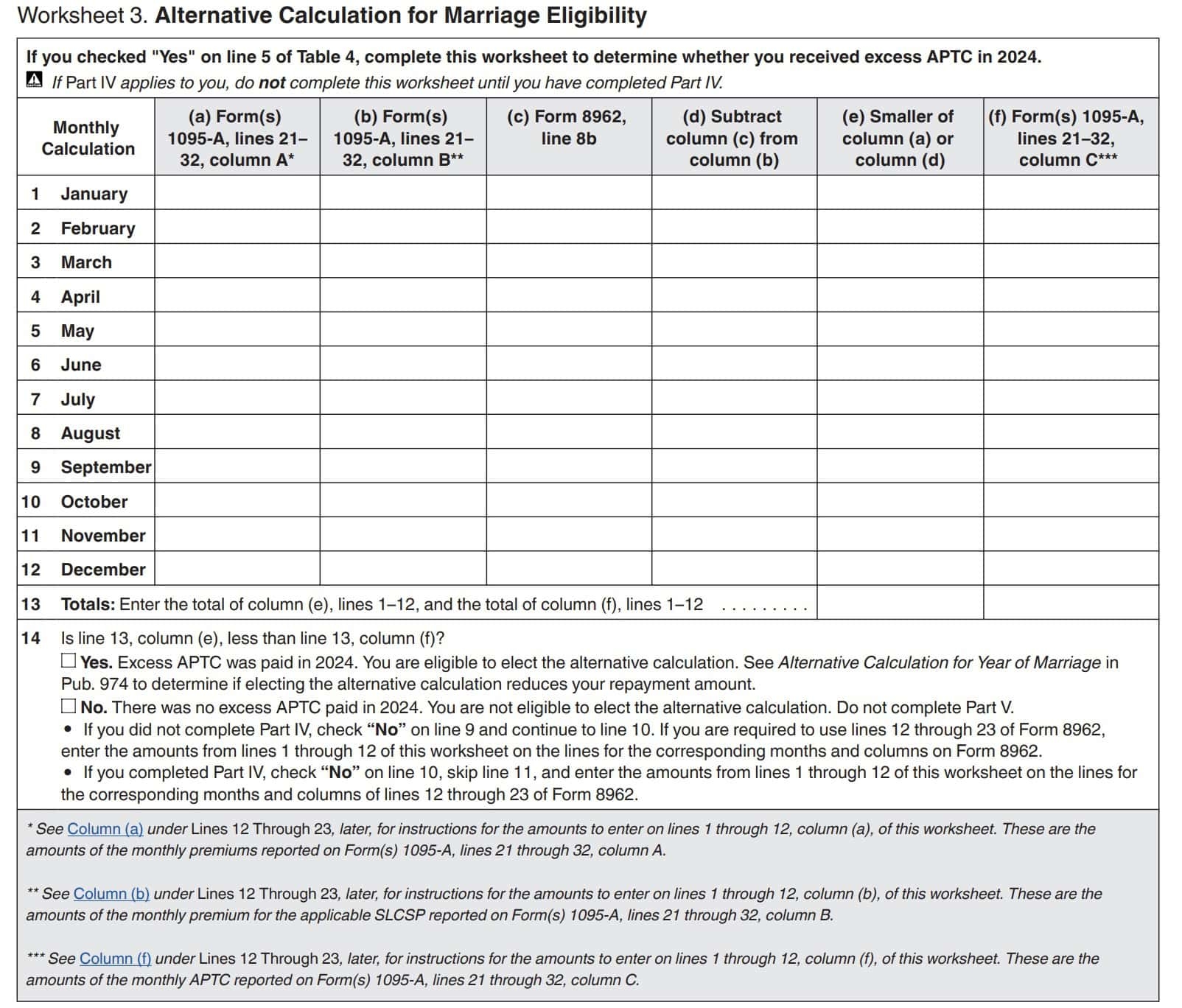

Form 8962 consists of various sections that require information about your household income, family size, and health insurance coverage. It is important to gather all the necessary documents, such as Form 1095-A from your insurance company, before filling out the form. By following the instructions provided with the form, you can ensure that you provide accurate information and avoid any delays in receiving your tax credit.

After completing Form 8962, you can submit it along with your tax return to the IRS. Make sure to double-check all the information before filing to avoid any errors that could impact your tax credit eligibility. By utilizing the Free Printable IRS Form 8962, you can simplify the process of claiming the Premium Tax Credit and ensure that you receive the maximum benefit available to you.

Overall, the Free Printable IRS Form 8962 is a valuable tool for individuals who have purchased health insurance through the Marketplace and want to claim the Premium Tax Credit. By utilizing this form, you can accurately reconcile any advance payments of the credit and ensure that you receive the appropriate amount of tax credit. So why wait? Download the form today and take the first step towards maximizing your tax benefits.