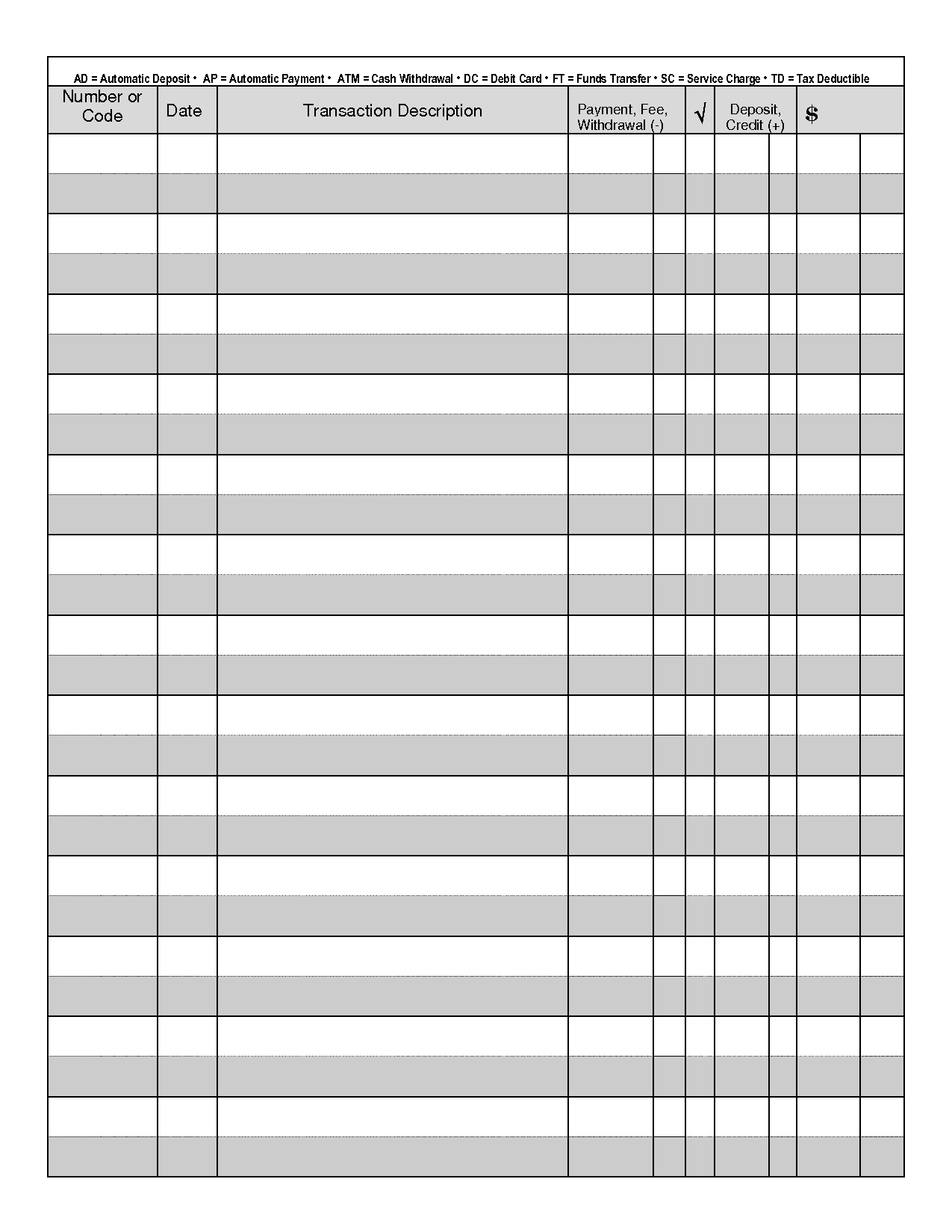

Keeping track of your finances is essential for maintaining financial stability and achieving your financial goals. One tool that can help you manage your finances effectively is a check register. A check register is a simple document that allows you to record all your transactions, including checks, deposits, and withdrawals. While there are many check register templates available online, finding a free printable check register template can save you time and money.

With a free printable check register template, you can easily keep track of your financial transactions without the need to purchase expensive software or hire a professional accountant. These templates are designed to be user-friendly and customizable, allowing you to input your financial information quickly and efficiently. Whether you prefer a simple design or a more detailed layout, there are plenty of free printable check register templates available to suit your needs.

Free Printable Check Register Template

Free Printable Check Register Template

Get and Print Free Printable Check Register Template

One of the benefits of using a free printable check register template is that it can help you monitor your spending habits and identify areas where you can cut back or save money. By recording all your transactions in one place, you can easily see where your money is going and make informed decisions about your finances. Additionally, a check register can help you avoid overdraft fees and late payment penalties by keeping track of your account balances and due dates.

Another advantage of using a free printable check register template is that it can serve as a valuable financial planning tool. By analyzing your transaction history, you can create a budget, set financial goals, and track your progress over time. With the help of a check register, you can make smarter financial decisions, reduce debt, and build a solid financial foundation for the future.

In conclusion, a free printable check register template is a useful tool for managing your finances effectively and achieving your financial goals. By recording all your transactions in one place, you can monitor your spending, avoid unnecessary fees, and plan for the future. Whether you are new to budgeting or a seasoned financial planner, a check register can help you stay organized and in control of your money.