Form 1040 is the standard individual income tax form used to report an individual’s gross income and calculate their tax liability to the Internal Revenue Service (IRS) in the United States. This form is used by taxpayers to file their annual income tax returns and determine whether they owe additional taxes or are eligible for a tax refund.

Form 1040 Printable is a downloadable version of the Form 1040 that taxpayers can access and fill out easily. This printable form allows individuals to manually input their income, deductions, credits, and other tax-related information before submitting it to the IRS. It is especially useful for those who prefer to file their taxes offline or need to make corrections to their electronic filing.

Get and Print Form 1040 Printable

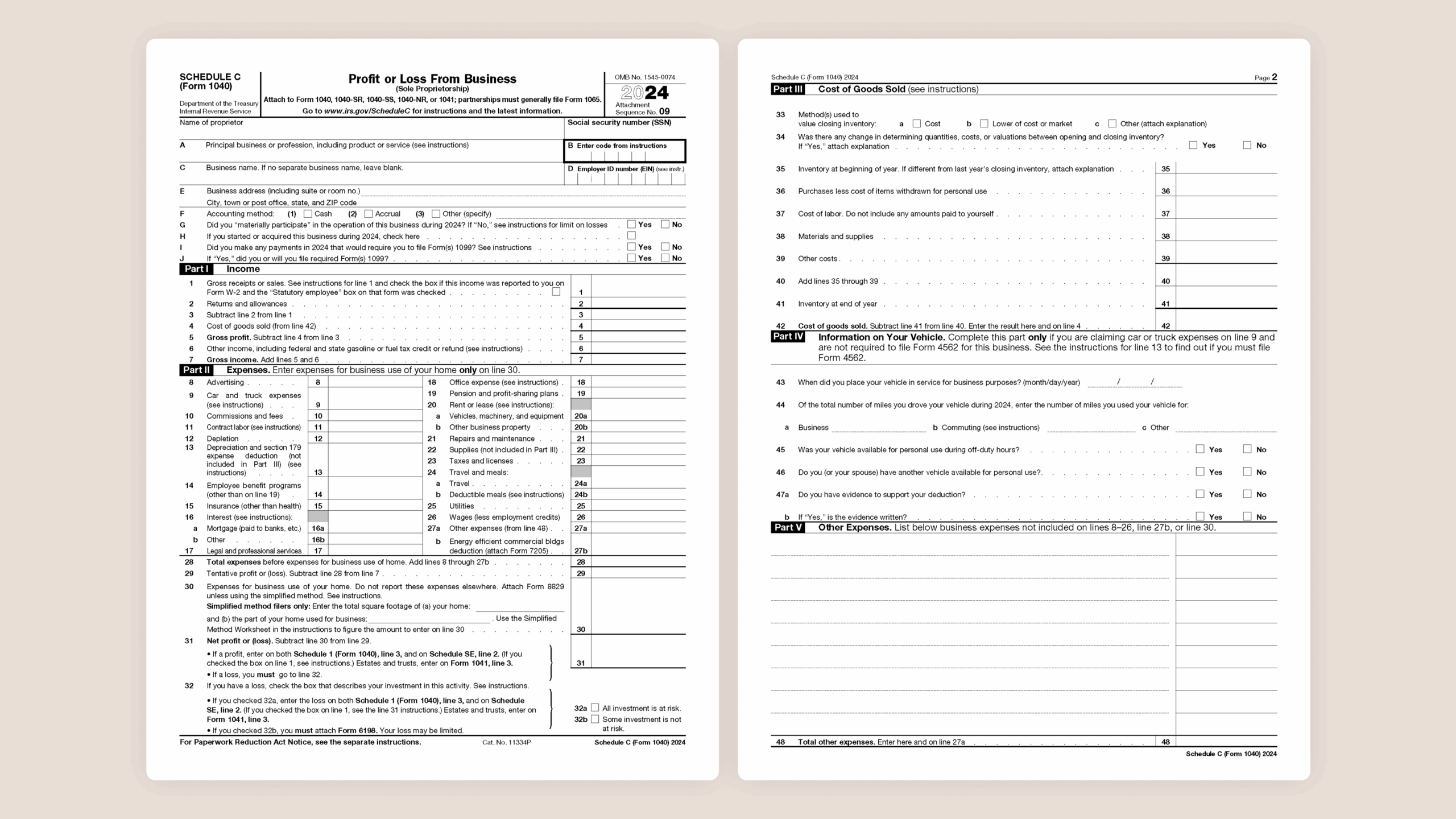

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

When using Form 1040 Printable, taxpayers must ensure that they accurately report all their income sources, including wages, interest, dividends, and any other income received during the tax year. They must also claim any deductions or credits they are eligible for, such as the standard deduction, itemized deductions, and tax credits for education or childcare expenses.

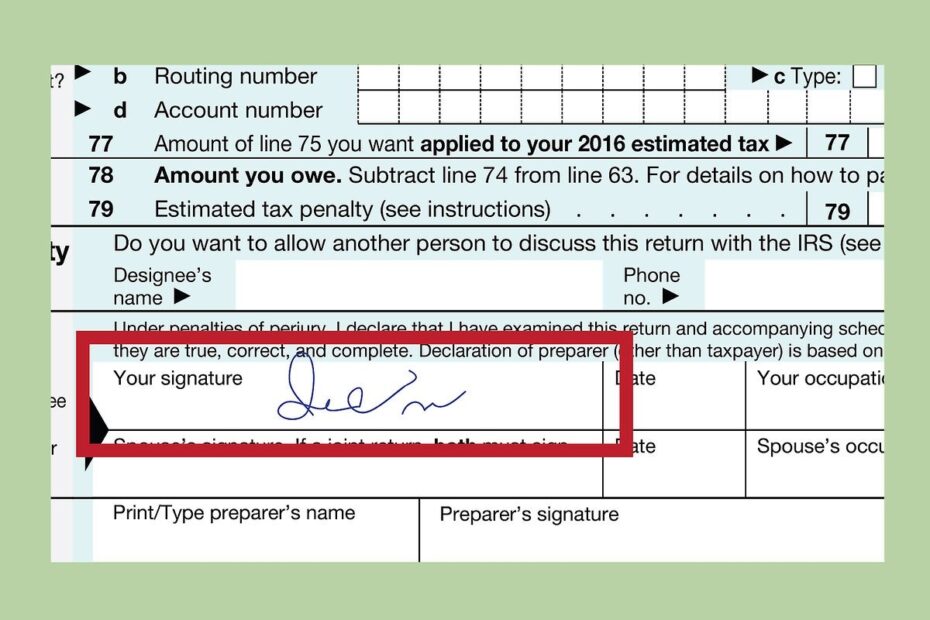

Once the taxpayer has completed filling out Form 1040 Printable, they can either mail it to the IRS or submit it electronically through the IRS e-file system. It is important to double-check all the information provided on the form to avoid any errors or discrepancies that may delay the processing of their tax return or result in penalties.

Overall, Form 1040 Printable offers taxpayers a convenient way to file their taxes accurately and in compliance with the IRS regulations. By following the instructions provided on the form and seeking assistance from tax professionals if needed, individuals can ensure that they fulfill their tax obligations and avoid any unnecessary complications.

So, whether you prefer to file your taxes manually or need to make corrections to your electronic filing, Form 1040 Printable is a valuable tool that can help you navigate the tax filing process effectively. Download the form, fill it out accurately, and submit it to the IRS to fulfill your tax obligations and possibly receive a tax refund.