Filing your taxes can be a daunting task, but having the right tools can make the process much easier. One of the most commonly used tax forms is the Form 1040 Federal Individual Income Tax Return. This form is used by individuals to report their income, deductions, and credits to the Internal Revenue Service (IRS).

It is important to accurately fill out Form 1040 to ensure that you are paying the correct amount of taxes and taking advantage of any available deductions or credits. The form is typically due on April 15th of each year, unless that date falls on a weekend or holiday.

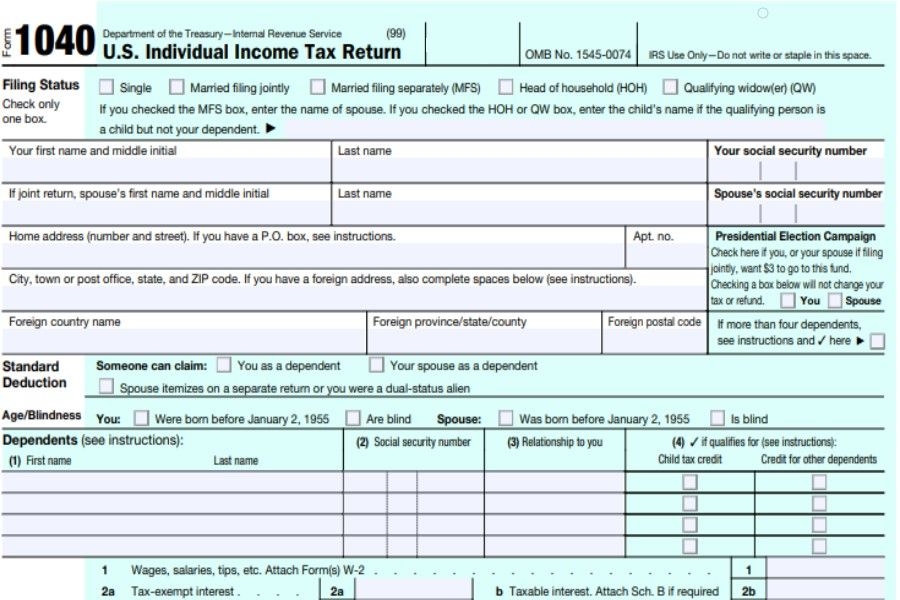

Form 1040 Federal Individual Income Tax Return Printable

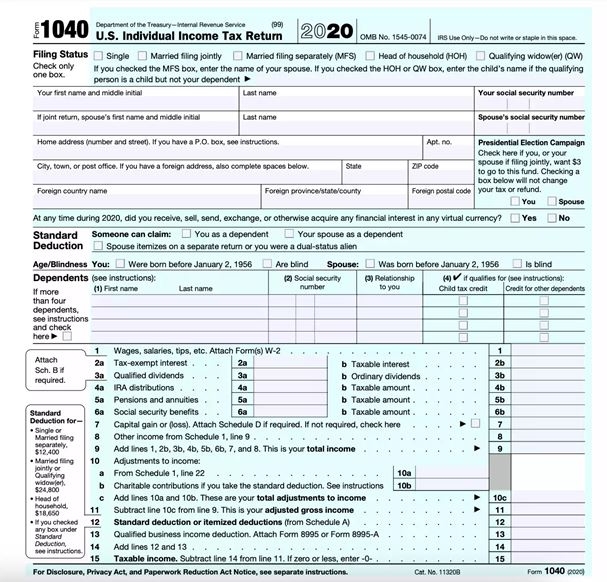

Form 1040 Federal Individual Income Tax Return Printable

Save and Print Form 1040 Federal Individual Income Tax Return Printable

When completing Form 1040, you will need to gather information such as your W-2 forms, 1099 forms, and any other relevant financial documents. You will also need to provide information about your filing status, dependents, and any income from self-employment or investments.

Once you have filled out the form, you can either file it electronically or mail it to the IRS. If you choose to file electronically, you can use tax preparation software or online services to submit your return. If you prefer to mail it, you can download and print a copy of Form 1040 from the IRS website.

It is important to keep a copy of your completed Form 1040 for your records, as well as any supporting documentation. This will help you in case you are ever audited by the IRS or need to reference your tax information in the future.

In conclusion, Form 1040 Federal Individual Income Tax Return is an essential document for filing your taxes each year. By accurately completing this form and submitting it on time, you can ensure that you are in compliance with federal tax laws and avoid any potential penalties or fees.