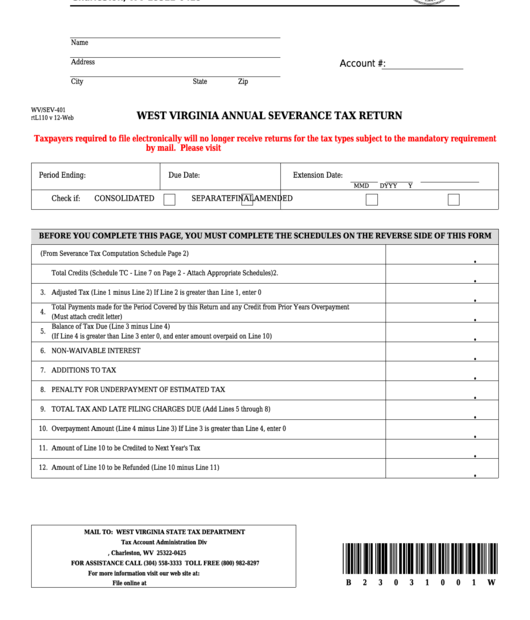

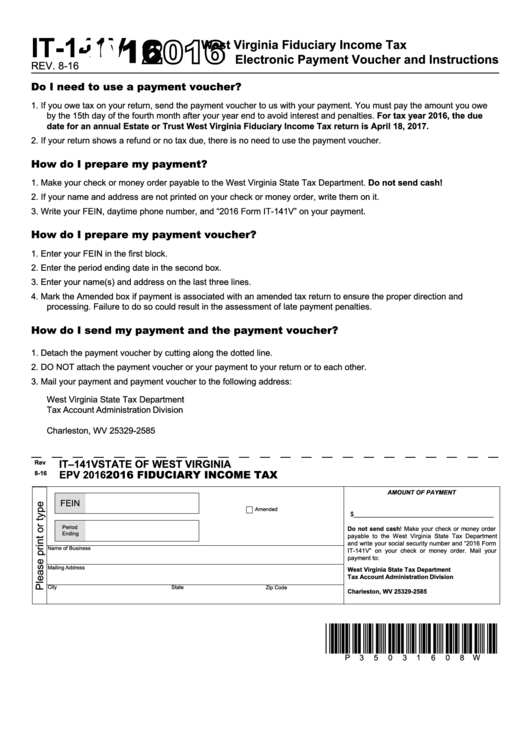

Filing your income taxes can be a daunting task, but having access to fillable and printable forms can make the process much easier. In West Virginia, taxpayers have the option to download, fill out, and print their 2017 income tax forms online. This convenient option saves time and ensures accuracy in reporting your income and deductions.

Whether you are a resident of West Virginia or earned income in the state during the tax year, having access to fillable and printable forms can streamline the filing process. These forms allow you to input your information directly into the document, making it easy to calculate your tax liability and deductions.

Fillable And Printable 2017 West Virginia Income Tax Forms

Fillable And Printable 2017 West Virginia Income Tax Forms

Quickly Access and Print Fillable And Printable 2017 West Virginia Income Tax Forms

By using fillable and printable forms for your 2017 West Virginia income taxes, you can avoid errors that may occur when filling out forms by hand. The online forms also provide helpful prompts and instructions to guide you through the filing process, ensuring that you report all necessary information accurately.

Additionally, having access to fillable and printable forms allows you to save a copy of your tax return for your records. This can be helpful in case you need to reference your return in the future or provide documentation for loans, scholarships, or other financial transactions.

Overall, utilizing fillable and printable 2017 West Virginia income tax forms can simplify the filing process and ensure that you meet the deadline for submitting your taxes. Take advantage of this convenient option to accurately report your income and deductions, and avoid potential errors that may delay your tax refund or result in penalties.

Don’t wait until the last minute to file your taxes – download the fillable and printable 2017 West Virginia income tax forms today and get started on completing your return. With these online forms, you can file your taxes with confidence and peace of mind, knowing that you have accurately reported your income and deductions.