As taxpayers prepare for the upcoming tax season, it is important to be aware of the various forms that need to be completed and submitted to the Internal Revenue Service (IRS). One of the most crucial tasks is filling out federal income tax forms accurately to ensure compliance with tax laws and regulations.

With the advancement of technology, taxpayers now have the option to access and download federal income tax forms online. This convenience allows individuals to easily obtain the necessary forms without having to visit an IRS office or wait for them to be mailed.

Federal Income Tax Forms 2025 Printable

Federal Income Tax Forms 2025 Printable

Easily Download and Print Federal Income Tax Forms 2025 Printable

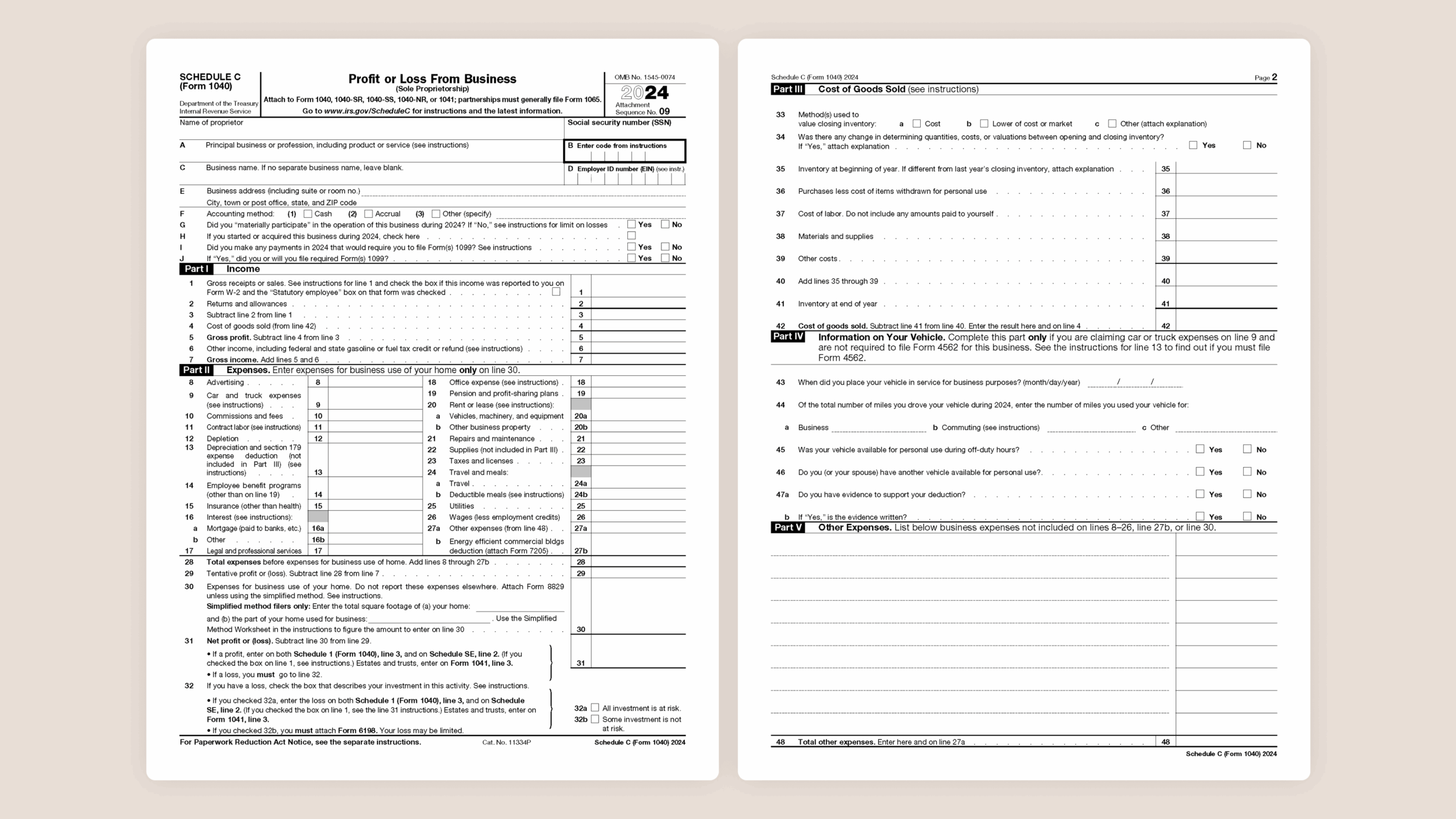

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

When it comes to federal income tax forms for the year 2025, taxpayers can expect some changes and updates to the forms. It is essential to stay informed about any modifications to the forms to avoid any errors or delays in processing your tax return.

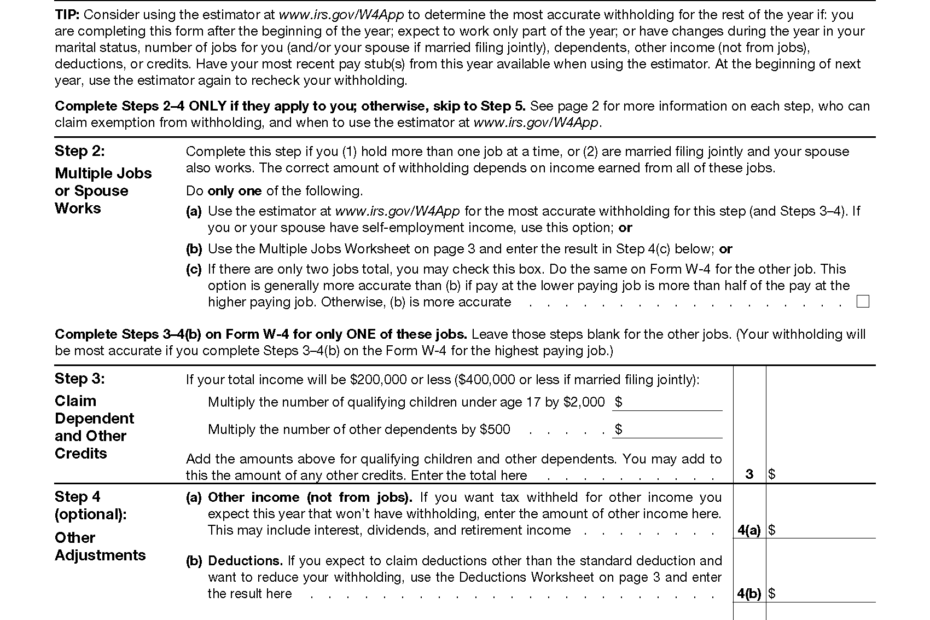

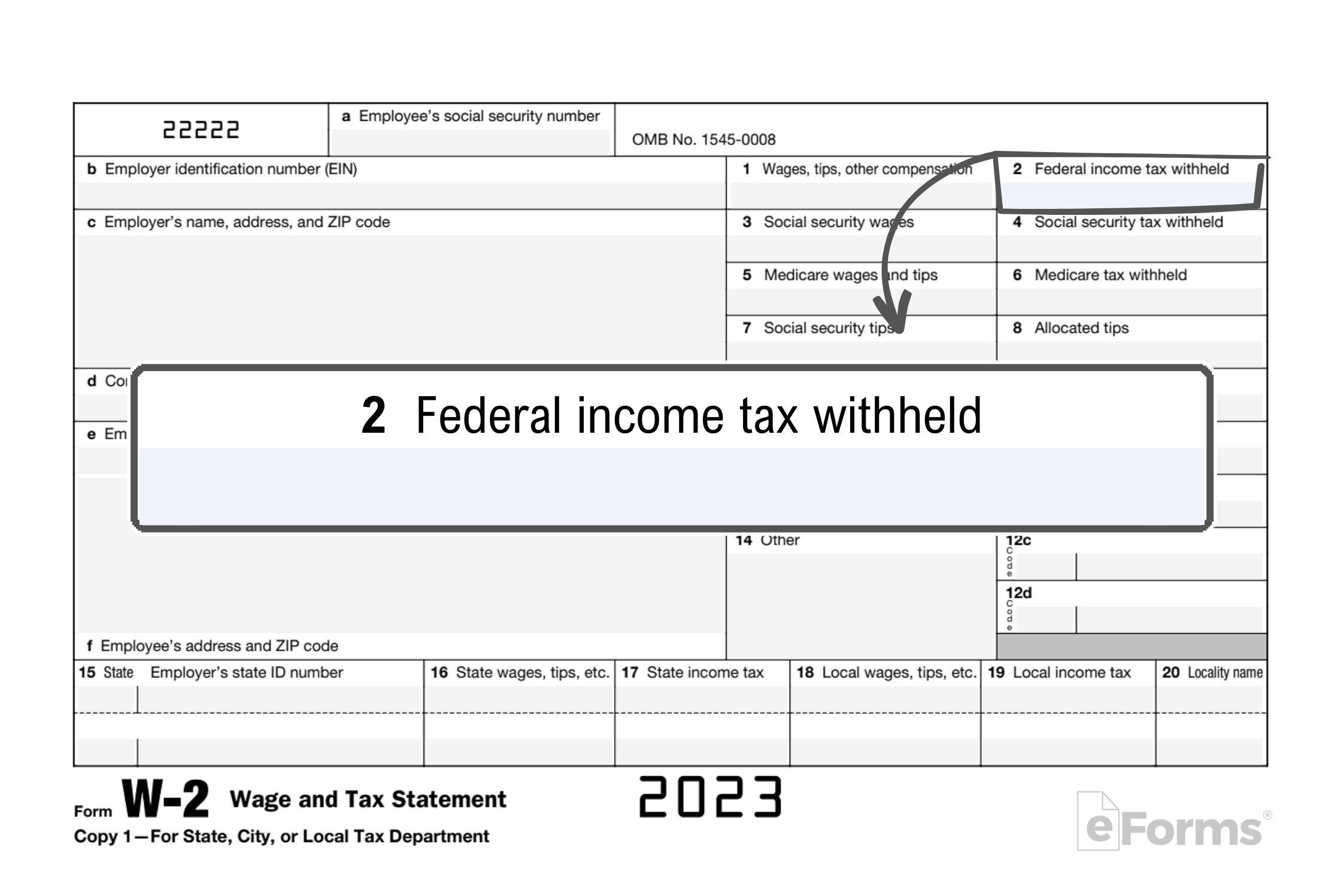

One of the most commonly used federal income tax forms is the Form 1040, which is used by individuals to report their annual income and calculate their tax liability. Additionally, there are various schedules and worksheets that may need to be attached to the Form 1040, depending on the individual’s financial situation.

For taxpayers with more complex financial situations, there are other forms such as the Form 1040-ES for estimated tax payments, Form 1099 for reporting income from sources other than wages, and Form 8962 for claiming the premium tax credit. It is important to carefully review the instructions for each form to ensure accurate completion.

As the tax filing deadline approaches, it is crucial to gather all necessary documents and information to accurately complete the federal income tax forms for the year 2025. By staying organized and informed, taxpayers can avoid potential errors and ensure a smooth tax filing process.

In conclusion, understanding and completing federal income tax forms accurately is essential for taxpayers to fulfill their legal obligations and avoid potential penalties. By utilizing printable forms and staying informed about any updates or changes, individuals can navigate the tax filing process with ease and confidence.