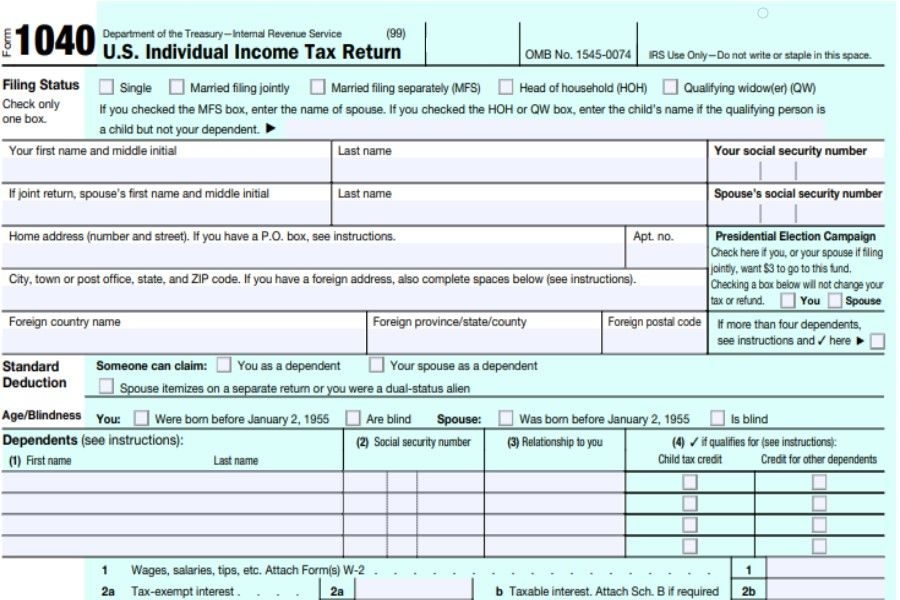

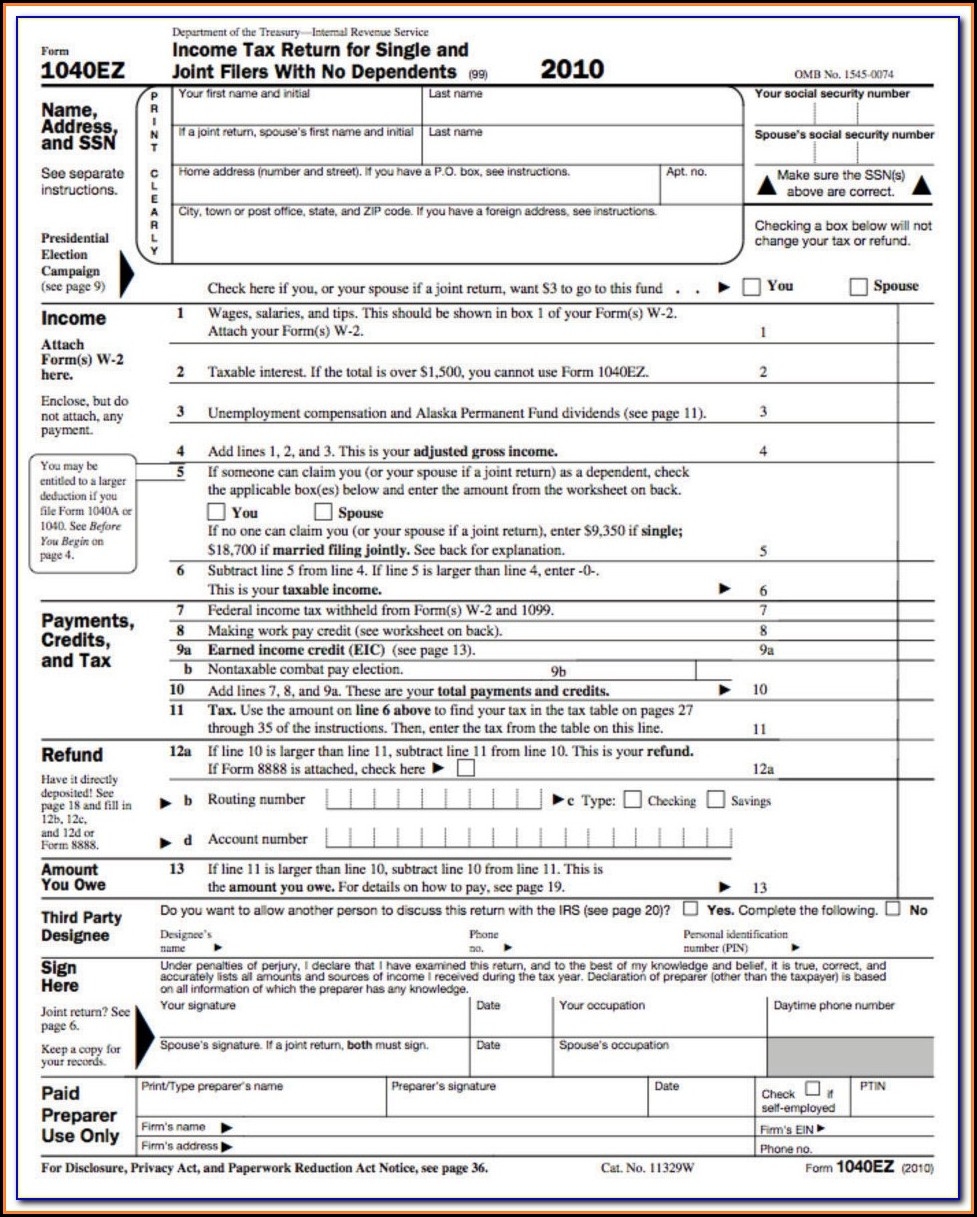

As tax season approaches, many individuals are looking for ways to file their taxes accurately and efficiently. One popular option is the Federal Income Tax Form 1040a Printable, which offers a simplified version of the standard Form 1040. This form is ideal for individuals with relatively straightforward tax situations, making it a convenient choice for many taxpayers.

With the Federal Income Tax Form 1040a Printable, taxpayers can easily report their income, deductions, and credits in a clear and concise manner. This form is designed to streamline the tax filing process, allowing individuals to quickly calculate their tax liability and determine any refunds or payments due to the IRS. Additionally, the form is available for free download on the IRS website, making it accessible to anyone who needs it.

Federal Income Tax Form 1040a Printable

Federal Income Tax Form 1040a Printable

Quickly Access and Print Federal Income Tax Form 1040a Printable

When filling out the Federal Income Tax Form 1040a Printable, taxpayers will need to provide information such as their income, deductions, and credits. They will also need to calculate their tax liability based on their total income and applicable tax rates. Once the form is completed, taxpayers can either mail it to the IRS or file electronically using IRS e-file, depending on their preference.

One of the key benefits of using the Federal Income Tax Form 1040a Printable is its simplicity and ease of use. The form is designed to be straightforward and user-friendly, making it a great option for individuals who are new to filing taxes or who have relatively uncomplicated tax situations. By using this form, taxpayers can save time and effort while still ensuring that their taxes are filed accurately and on time.

In conclusion, the Federal Income Tax Form 1040a Printable is a valuable resource for individuals looking to file their taxes efficiently and accurately. With its simplified format and user-friendly design, this form offers a convenient option for taxpayers with straightforward tax situations. By using this form, individuals can navigate the tax filing process with ease and confidence, ensuring that they meet their tax obligations while maximizing their refunds.