When it comes to filing taxes, knowing the federal income tax brackets for the year is crucial. In 2017, the tax brackets were updated, and having a printable version can make the process easier for taxpayers. Understanding where you fall in terms of income can help you determine how much you owe or if you are eligible for any deductions or credits.

With the constant changes in tax laws, having access to a printable version of the federal income tax brackets for 2017 can be a handy tool. Whether you are filing as an individual, married couple, or head of household, knowing the specific income ranges for each tax bracket can help you plan ahead and avoid any surprises come tax season.

Federal Income Tax Brackets 2017 Printable

Federal Income Tax Brackets 2017 Printable

Download and Print Federal Income Tax Brackets 2017 Printable

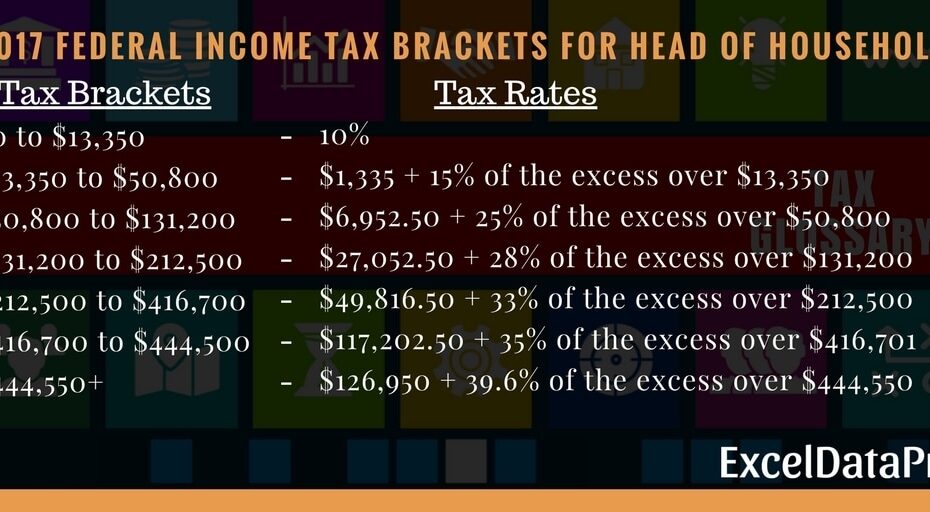

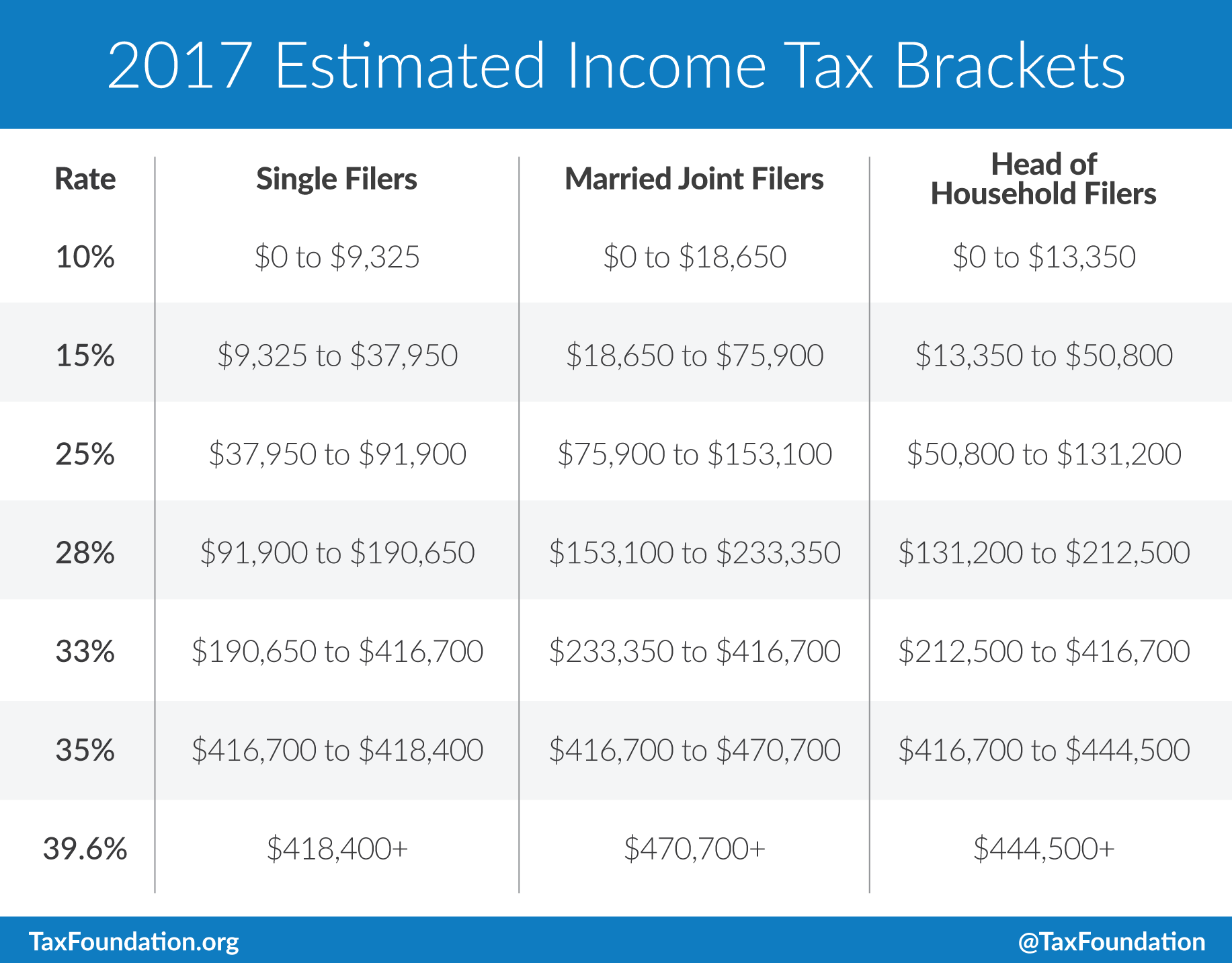

For the tax year 2017, the federal income tax brackets were as follows:

– 10% for income up to $9,325

– 15% for income between $9,326 and $37,950

– 25% for income between $37,951 and $91,900

– 28% for income between $91,901 and $191,650

– 33% for income between $191,651 and $416,700

Having a printable version of these tax brackets can help you calculate your taxes accurately and efficiently. It can also serve as a reference point for any tax planning strategies you may want to implement to minimize your tax liability.

As the tax laws can be complex and confusing, having a clear and concise resource like a printable federal income tax brackets for 2017 can simplify the process for taxpayers. It is important to stay informed and up to date with the latest tax laws to ensure compliance and avoid any penalties or audits.

In conclusion, having access to a printable version of the federal income tax brackets for 2017 can be a valuable resource for taxpayers. By knowing where you fall within the tax brackets, you can better plan and prepare for tax season. Make sure to consult with a tax professional or use reliable resources to ensure accuracy when filing your taxes.