As tax season approaches, many individuals and families are looking for ways to maximize their tax refunds. One valuable tool that can help individuals who qualify is the Earned Income Credit (EIC). This refundable tax credit is designed to help low to moderate-income individuals and families offset the burden of Social Security taxes and provide financial assistance to those who need it most.

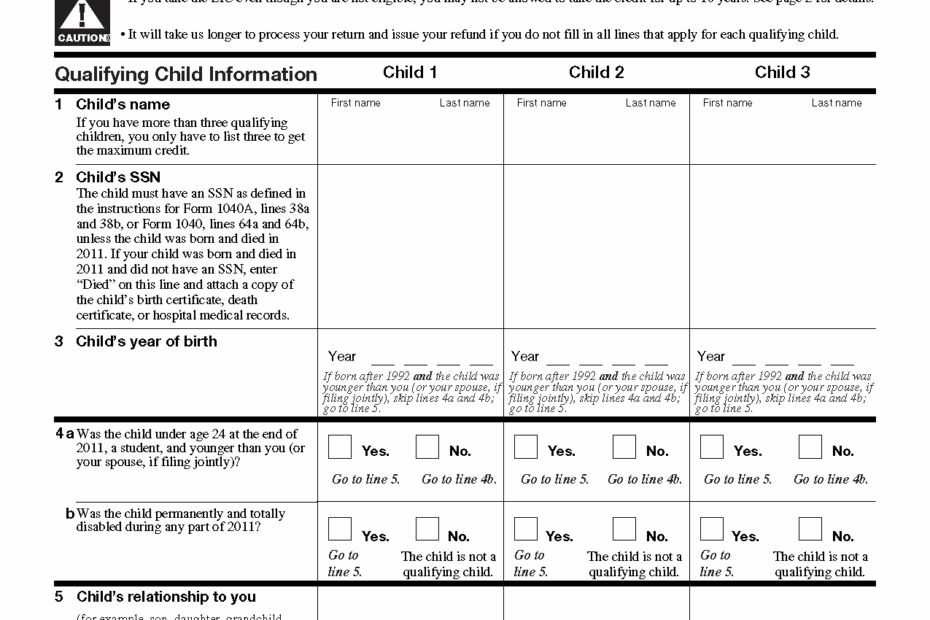

For the year 2016, the IRS offers a printable form for individuals to claim the Earned Income Credit. This form allows taxpayers to easily calculate their credit and determine if they qualify based on their income, filing status, and number of qualifying children. By filling out this form accurately and submitting it with their tax return, individuals can potentially receive a significant refund that can make a big difference in their financial situation.

Earned Income Credit 2016 Printable Form

Earned Income Credit 2016 Printable Form

Download and Print Earned Income Credit 2016 Printable Form

Earned Income Credit 2016 Printable Form

The Earned Income Credit 2016 Printable Form is a valuable resource for individuals who qualify for this tax credit. By filling out this form, taxpayers can determine the amount of credit they are eligible to receive based on their income and family situation. This form also helps individuals calculate any additional child tax credit they may be entitled to, further maximizing their refund.

It is important for individuals to carefully review the instructions provided with the Earned Income Credit 2016 Printable Form to ensure they are completing it accurately. By providing all the necessary information and supporting documentation, individuals can avoid delays in processing their tax return and receiving their refund. The IRS website also offers resources and tools to help individuals understand the Earned Income Credit and how to properly claim it on their tax return.

Overall, the Earned Income Credit 2016 Printable Form is a valuable tool for individuals and families who qualify for this tax credit. By taking advantage of this opportunity, taxpayers can potentially receive a significant refund that can help them cover expenses, pay off debt, or save for the future. It is important for individuals to take the time to review the requirements and guidelines for claiming the Earned Income Credit to ensure they receive the full benefit they are entitled to.

In conclusion, the Earned Income Credit 2016 Printable Form is a valuable resource for individuals looking to maximize their tax refund. By accurately completing this form and submitting it with their tax return, individuals can potentially receive a significant refund that can make a positive impact on their financial situation. It is important for individuals to take advantage of all available tax credits and deductions to ensure they are getting the most out of their tax return.