In today’s digital age, many people still prefer to keep track of their finances using a traditional checking account register. While online banking and mobile apps have made it easier to monitor transactions, some individuals find it helpful to have a physical record of their expenses and deposits. Fortunately, there are free printable templates available online that make it easy to maintain a manual register.

Checking account registers are useful tools for managing personal finances. They allow you to record all your transactions, including checks, ATM withdrawals, debit card purchases, and deposits. By regularly updating your register, you can keep track of your account balance and identify any discrepancies or errors. This can help you avoid overdraft fees and ensure that your financial records are accurate.

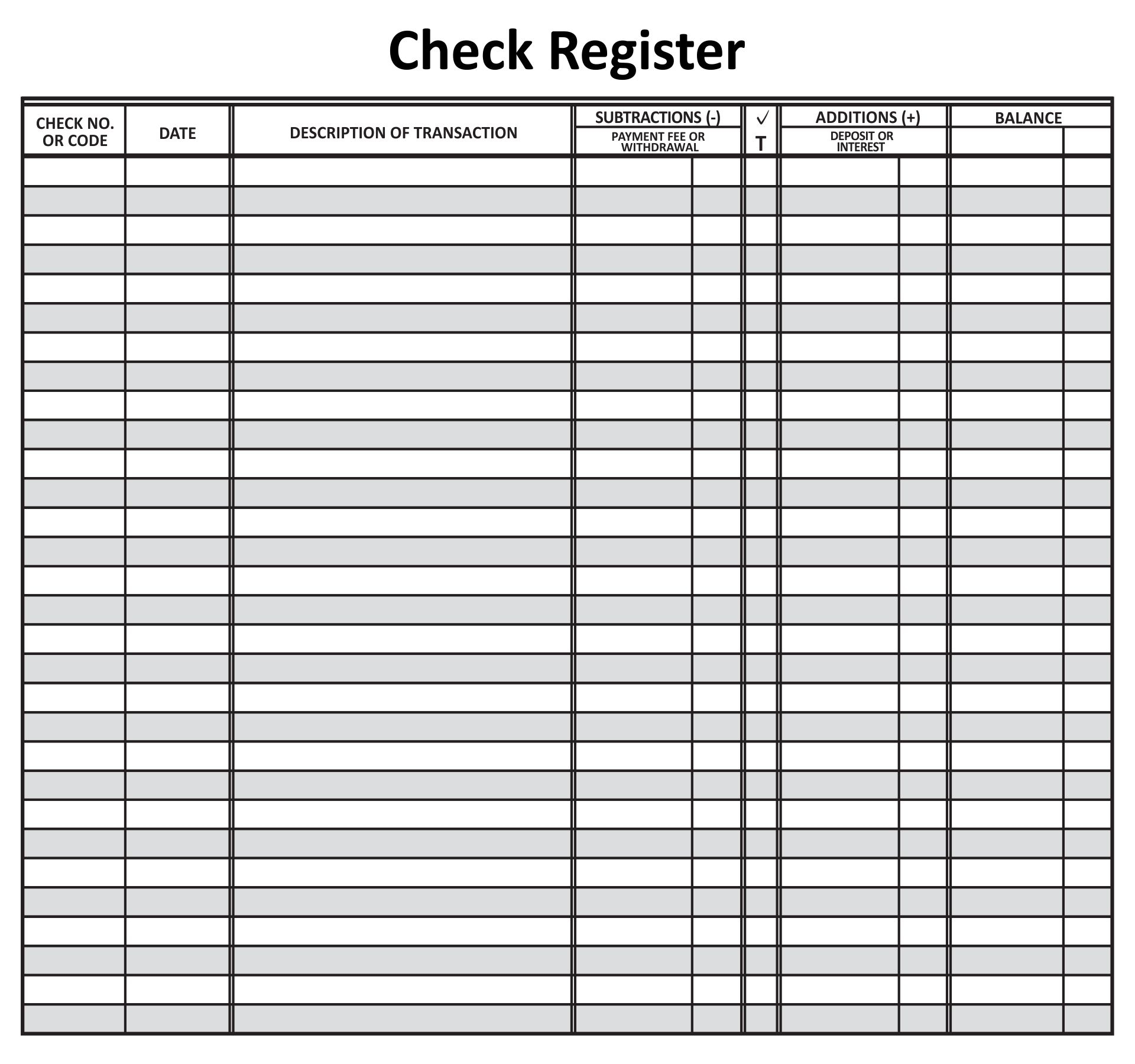

Checking Account Register Printable Free

Checking Account Register Printable Free

Get and Print Checking Account Register Printable Free

Many financial institutions provide checking account registers to their customers, but you can also find printable templates online for free. These templates typically include columns for the date, transaction description, check number, debit amount, credit amount, and running balance. Some templates may also have additional columns for categorizing transactions or noting any fees or charges.

Using a printable checking account register is a simple and effective way to stay organized and in control of your finances. By recording each transaction as it occurs, you can easily reconcile your account with your bank statement each month. This can help you identify any unauthorized charges or errors and ensure that you are staying within your budget.

In conclusion, a checking account register is a valuable tool for managing your finances and keeping track of your transactions. With free printable templates available online, it’s easy to create your own manual register and stay on top of your financial responsibilities. Whether you prefer to track your expenses digitally or with pen and paper, maintaining a register can help you make informed financial decisions and achieve your long-term goals.