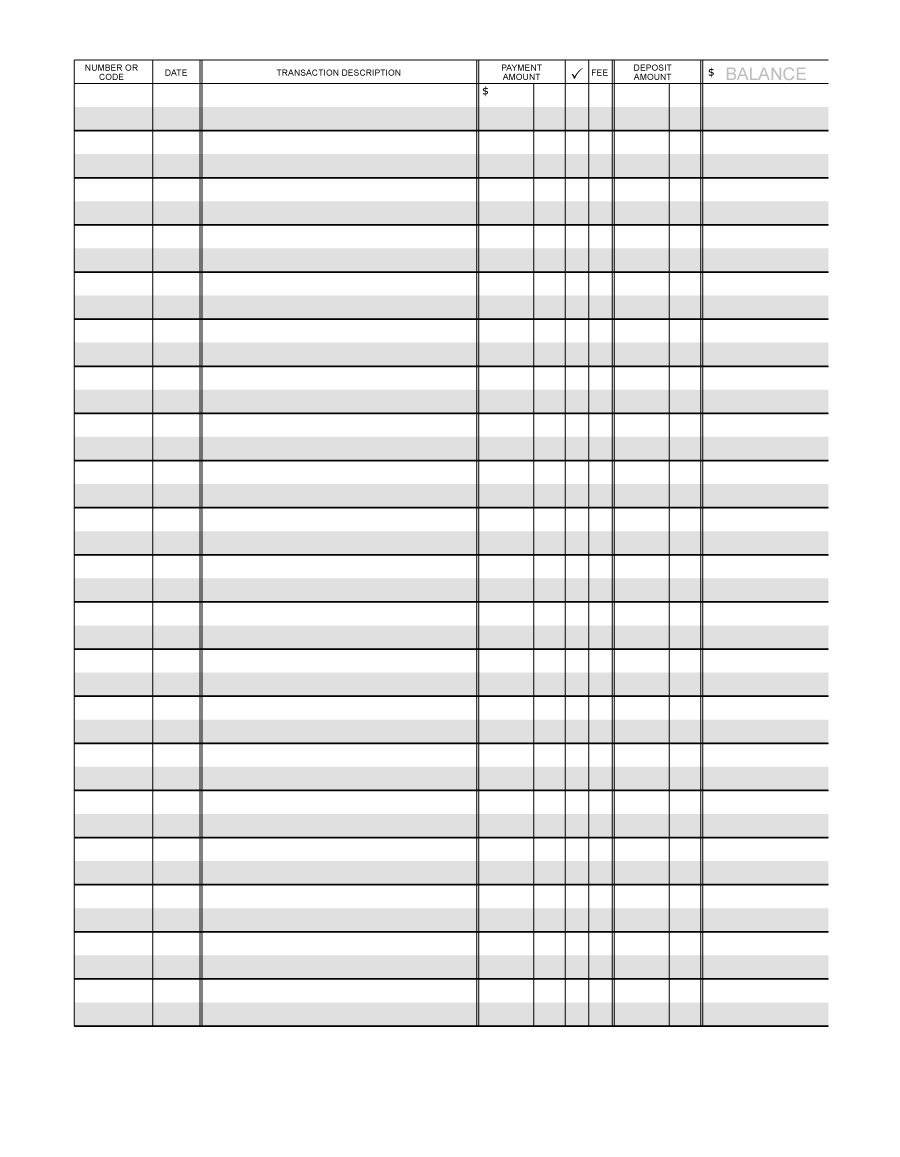

Keeping track of your finances is essential for managing your money effectively. One way to do this is by using a checking account register. A checking account register is a tool that helps you keep track of all your financial transactions, including deposits, withdrawals, and any fees associated with your account. Many people find it helpful to have a printable version of their checking account register so they can easily record and monitor their finances.

By using a checking account register printable, you can easily track your spending and balance your account. This can help you avoid overdraft fees and ensure that you have enough funds to cover your expenses. Having a clear record of your transactions can also help you identify any errors or discrepancies in your account, allowing you to address them promptly.

Checking Account Register Printable

Checking Account Register Printable

Easily Download and Print Checking Account Register Printable

One of the benefits of using a printable checking account register is that you can customize it to suit your specific needs. You can include additional columns for tracking specific expenses or income sources, or you can simply use the basic template to record your transactions. Having a physical copy of your register can also serve as a backup in case your online banking system is unavailable or if you prefer to have a hard copy for your records.

Using a checking account register printable can also help you set and track financial goals. By keeping a detailed record of your transactions, you can see where your money is going and identify areas where you can cut back on spending. This can help you save more money and work towards achieving your financial objectives, whether it’s building an emergency fund, paying off debt, or saving for a major purchase.

In conclusion, a checking account register printable is a valuable tool for managing your finances effectively. By tracking your transactions and monitoring your account balance, you can stay on top of your financial situation and make informed decisions about your money. Whether you prefer to use a digital or physical register, having a clear record of your finances can help you achieve your financial goals and maintain control over your money.