Managing your finances effectively is crucial for achieving financial stability. One tool that can help you keep track of your expenses and income is a checking account ledger. Keeping a detailed record of your transactions can help you budget better and avoid overdrafts. With a checking account ledger printable, you can easily monitor your account activity and stay organized.

A checking account ledger printable is a convenient way to track your expenses and income. It allows you to record every transaction, including deposits, withdrawals, and transfers. By maintaining an accurate ledger, you can monitor your account balance and identify any discrepancies or errors. This tool can help you avoid overdraft fees and ensure that you have enough funds to cover your expenses.

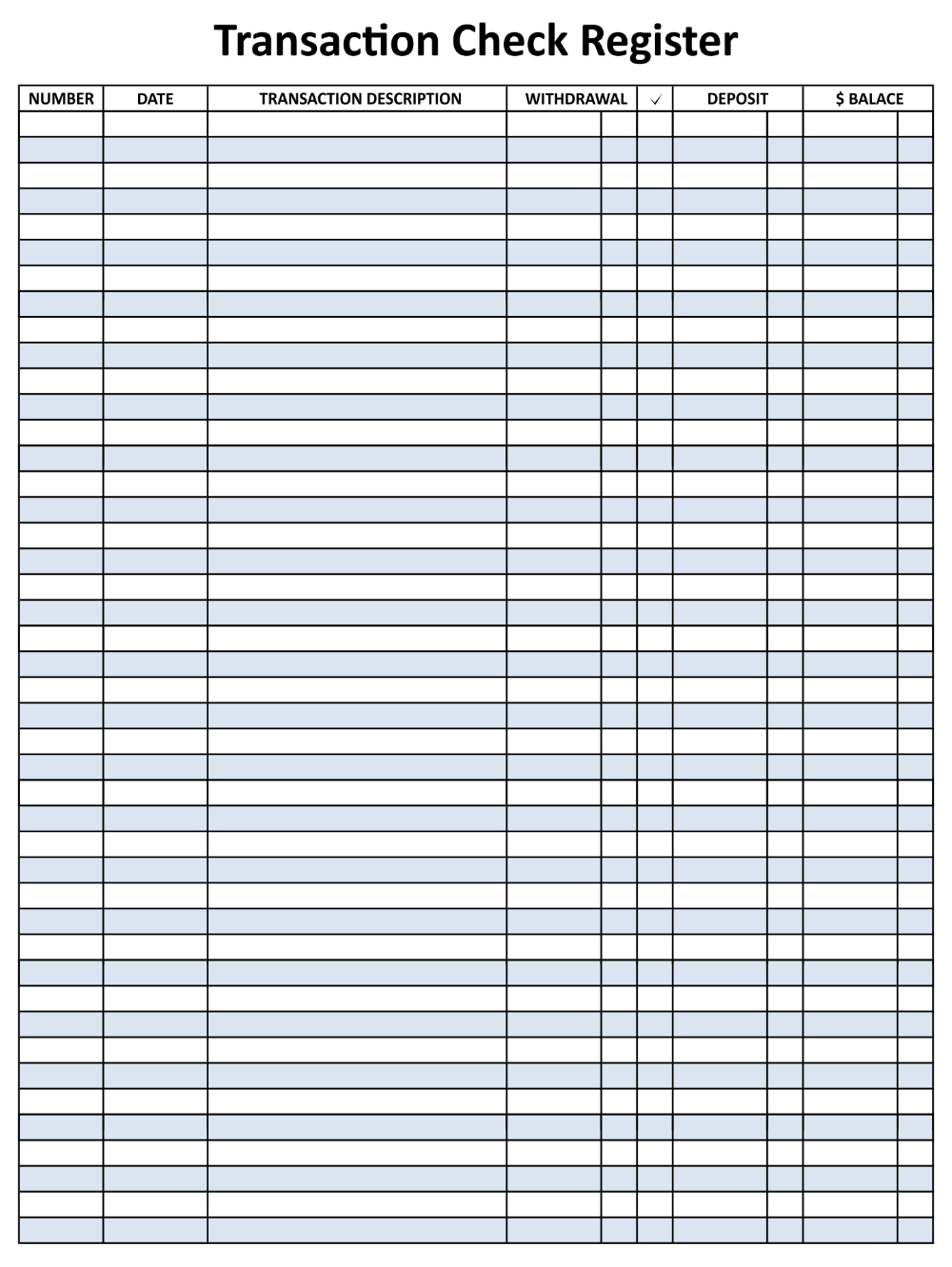

Checking Account Ledger Printable

Checking Account Ledger Printable

Quickly Access and Print Checking Account Ledger Printable

Using a checking account ledger printable can also help you identify spending patterns and areas where you can cut back. By categorizing your transactions, you can see where your money is going and make adjustments to your budget. Additionally, having a written record of your transactions can be helpful for tax purposes or in case of disputes with your bank.

There are many free checking account ledger printables available online that you can download and use. These templates typically include columns for the date, description of the transaction, withdrawal or deposit amount, and current balance. You can print out multiple copies of the ledger to keep in your checkbook or wallet for easy access.

In conclusion, a checking account ledger printable is a valuable tool for managing your finances and staying organized. By keeping track of your transactions and monitoring your account balance, you can avoid overdrafts and make informed financial decisions. Consider using a checking account ledger printable to take control of your finances and achieve your financial goals.