Managing your finances is an essential part of adulting. It’s important to know where your money is going, how much you’re spending, and whether you’re staying within your budget. One way to stay on top of your finances is by keeping a check transaction register.

A check transaction register is a simple tool that allows you to record all your transactions, including checks written, deposits made, and withdrawals. By keeping track of these transactions, you can easily monitor your spending habits, detect any unauthorized or fraudulent charges, and reconcile your bank statement.

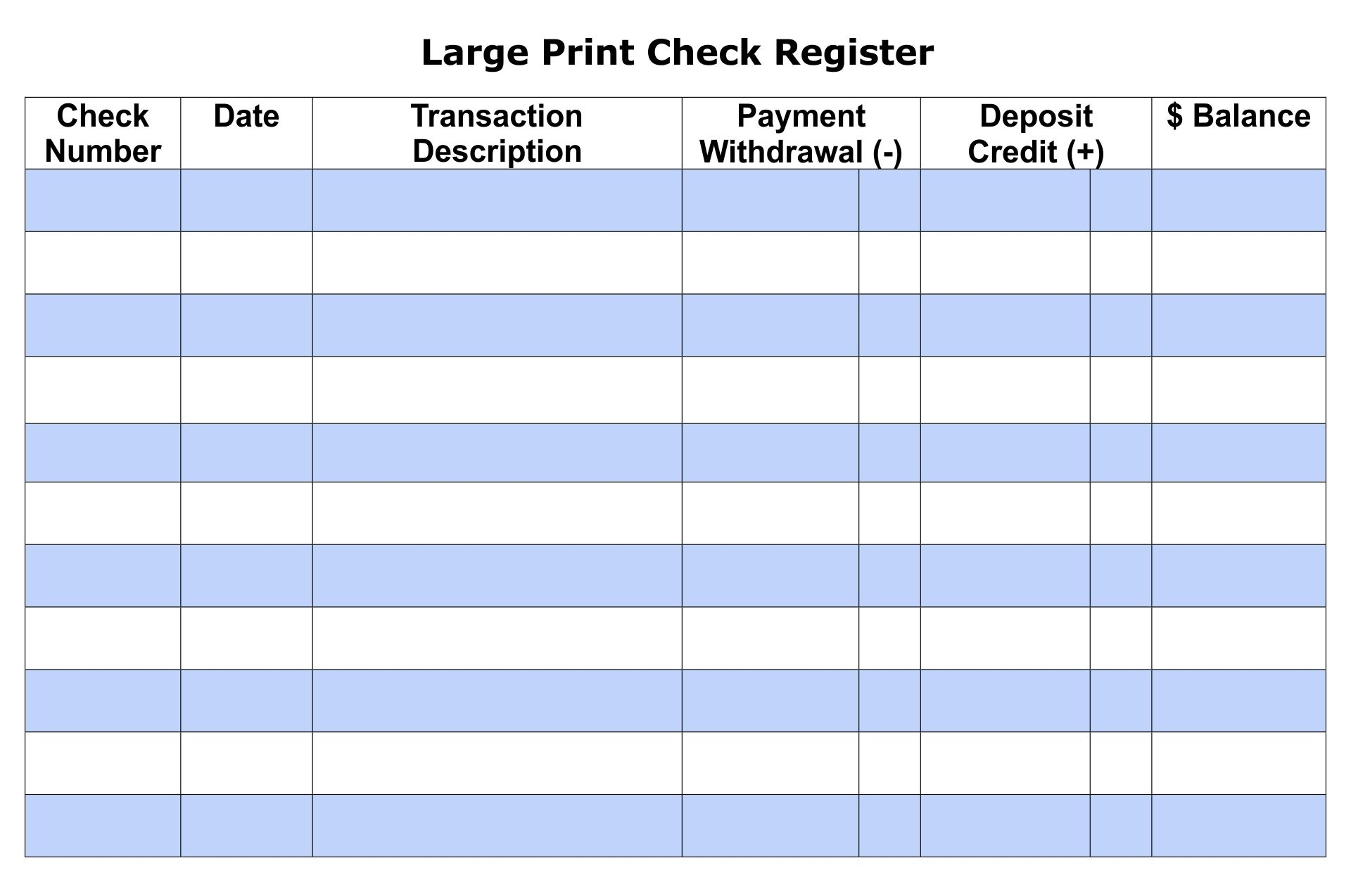

Check Transaction Register Printable

Check Transaction Register Printable

Save and Print Check Transaction Register Printable

Check Transaction Register Printable

Having a check transaction register printable can make it even easier to stay organized and on top of your finances. With a printable register, you can easily record your transactions by hand or input them into a spreadsheet for a more detailed analysis.

Printable check registers often come with pre-formatted columns for the date of the transaction, description, check number, debit or credit amount, and running balance. This makes it simple to enter your transactions in an orderly manner and quickly see your current balance at a glance.

Using a check transaction register printable can also help you identify any recurring expenses or areas where you may be overspending. By reviewing your transactions regularly, you can make adjustments to your budget and financial goals to ensure you are on track.

Additionally, having a physical record of your transactions can be helpful in case of any disputes or discrepancies with your bank. You can easily refer back to your register to verify the accuracy of your transactions and resolve any issues quickly.

In conclusion,

Keeping a check transaction register printable is a simple yet effective way to stay on top of your finances and ensure you are making informed financial decisions. By recording your transactions regularly and reviewing your register, you can better manage your money, track your spending, and achieve your financial goals.