Managing your finances is crucial for a successful financial future. One way to keep track of your financial health is by regularly checking your balance sheet. A balance sheet provides a snapshot of your assets, liabilities, and equity at a specific point in time. By reviewing your balance sheet, you can assess your financial position and make informed decisions about your money management.

Having a printable balance sheet can make it easier for you to track your finances and monitor any changes over time. With a printable balance sheet, you can easily update your financial information and analyze your financial health at a glance. This tool can be especially useful for individuals who prefer a tangible document to work with or who want to keep a physical record of their finances.

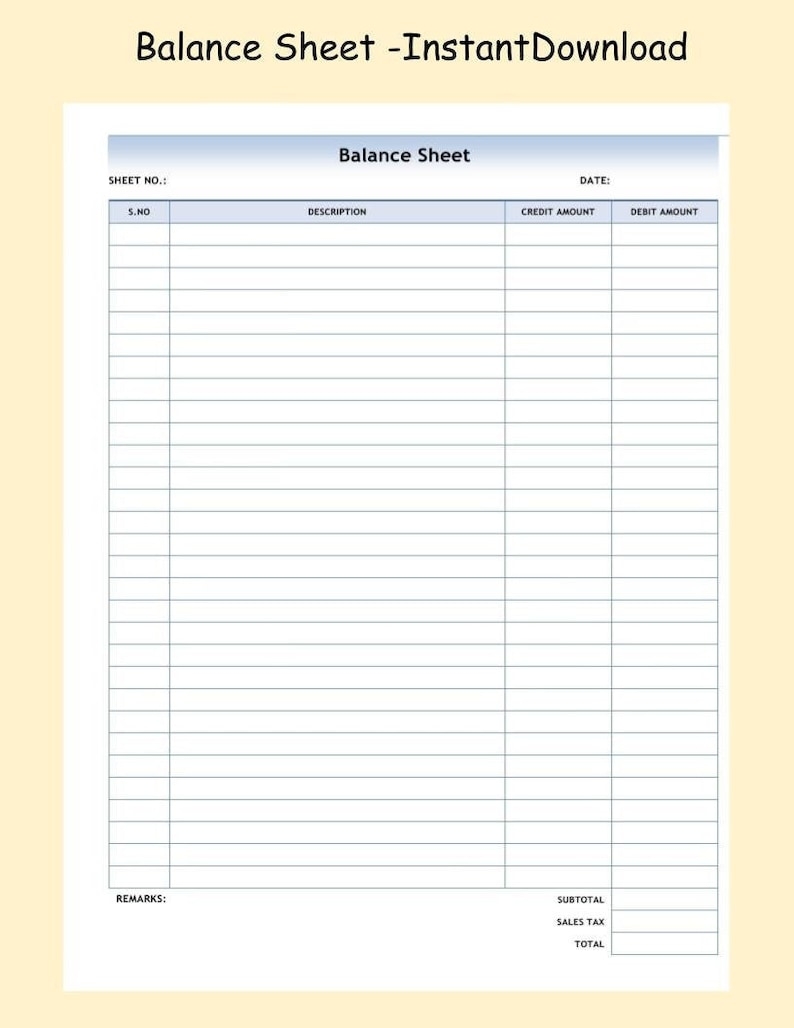

Easily Download and Print Check Balance Sheet Printable

When using a printable balance sheet, it’s important to ensure that all the necessary information is included. This typically includes your assets (such as cash, investments, and property), liabilities (such as loans and credit card debt), and equity (the difference between your assets and liabilities). By accurately documenting this information on your balance sheet, you can gain a comprehensive understanding of your financial situation.

Regularly checking your balance sheet can help you identify any financial issues or trends that may require attention. For example, if you notice a significant increase in your liabilities or a decrease in your assets, you may need to adjust your financial priorities or seek professional advice. By staying proactive and informed about your finances, you can make strategic decisions to improve your financial well-being.

In conclusion, using a printable balance sheet is a valuable tool for managing your finances effectively. By regularly checking and updating your balance sheet, you can gain insight into your financial health and make informed decisions about your money management. Whether you prefer a digital or physical format, a balance sheet can help you stay organized and in control of your finances.