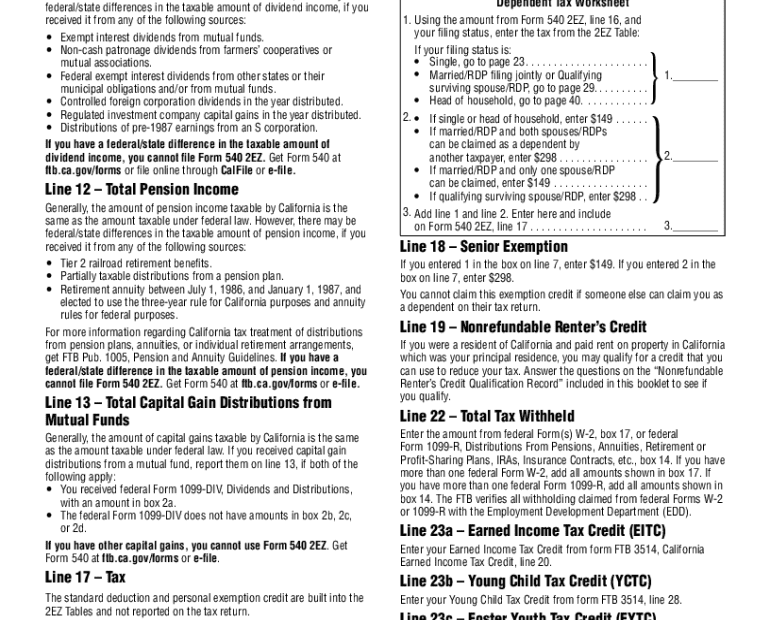

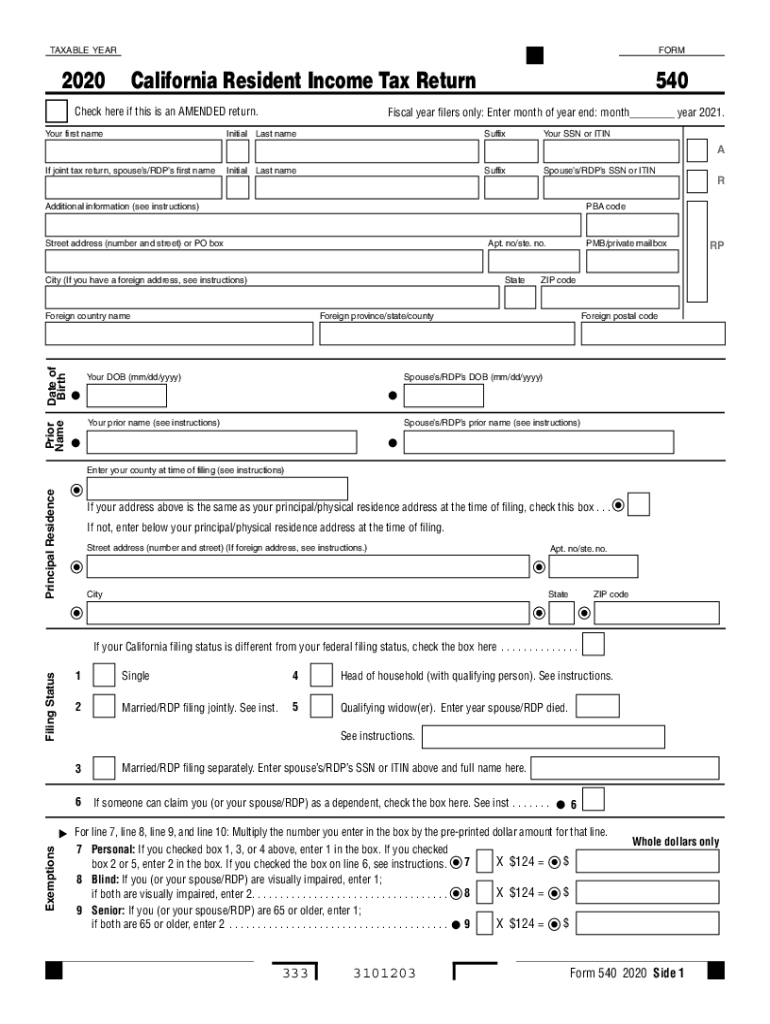

Filing your California Resident Income Tax Return 540 can seem like a daunting task, but with the right instructions, it can be a smooth process. These instructions will guide you through the necessary steps to complete your tax return accurately and efficiently.

It is important to make sure you have all the necessary documents and information before starting your tax return. This includes W-2 forms, 1099 forms, and any other relevant financial documents. Having everything organized will make the process much easier.

California Resident Income Tax Return 540 Printable Instructions

California Resident Income Tax Return 540 Printable Instructions

Get and Print California Resident Income Tax Return 540 Printable Instructions

When filling out your California Resident Income Tax Return 540, be sure to follow the instructions carefully. The form will ask for information such as your income, deductions, and credits. Double-checking your entries can help avoid errors and potential audits.

Make sure to review your completed tax return before submitting it. Look for any mistakes or missing information that could affect your tax liability. Once you are confident in the accuracy of your return, you can file it electronically or by mail.

If you have any questions or need assistance with your California Resident Income Tax Return 540, don’t hesitate to reach out to the California Franchise Tax Board. They can provide guidance and support to ensure you complete your tax return correctly.

By following these instructions and staying organized throughout the process, you can successfully complete your California Resident Income Tax Return 540. Remember to file your taxes on time to avoid any penalties or late fees. With proper planning and attention to detail, you can navigate the tax filing process with ease.