Keeping track of your finances is essential for managing your budget effectively. One tool that can help you stay organized is a check register. A check register is a document used to record all transactions, including checks written, deposits made, and any fees or charges incurred. By maintaining a check register, you can easily track your spending, identify any discrepancies, and ensure that you have enough funds to cover your expenses.

While there are many digital tools available for tracking your finances, some people prefer a more traditional approach. A blank printable check register allows you to manually record your transactions, providing a tangible record of your financial activity. This can be especially helpful for those who prefer to have a physical copy of their financial information or who may not have access to online banking services.

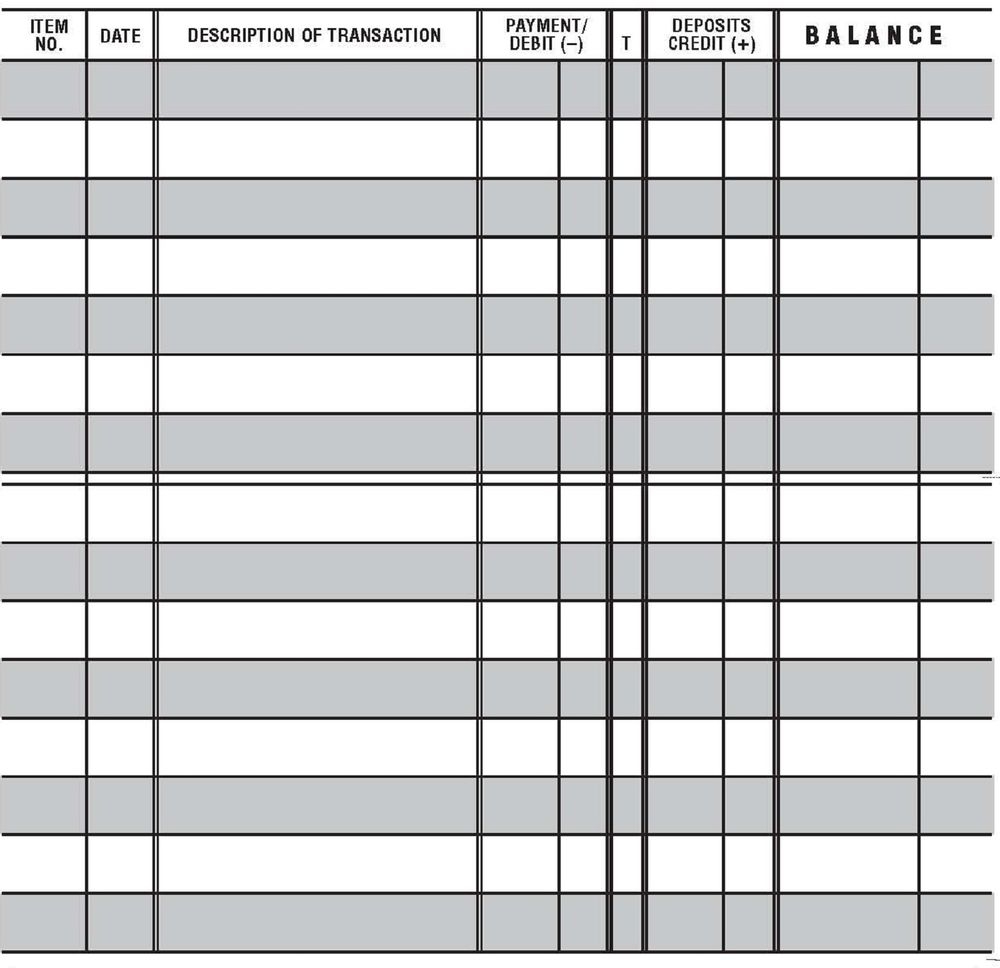

Blank Printable Check Register

Blank Printable Check Register

Quickly Access and Print Blank Printable Check Register

When using a blank printable check register, it’s important to stay organized and consistent. Make sure to record each transaction accurately, including the date, description, and amount. You can also use the register to track your account balance and reconcile it with your bank statement regularly. By staying on top of your finances and using a check register effectively, you can better manage your money and avoid overspending.

Many websites offer free templates for blank printable check registers that you can download and print at home. These templates typically include columns for the date, check number, description, debit or credit amount, and running balance. You can customize the template to suit your needs and preferences, making it easy to track your finances in a way that works best for you.

In conclusion, a blank printable check register is a useful tool for managing your finances and staying organized. By diligently recording your transactions and maintaining an accurate account balance, you can take control of your budget and make informed financial decisions. Whether you prefer a digital or traditional approach to tracking your finances, using a check register can help you achieve your financial goals and ensure that you are on the right track towards financial stability.