When it comes to tax season, one of the most important forms that individuals and businesses need to fill out is the 1099 form. This form is used to report various types of income, such as freelance earnings, rental income, and more. Having a blank 1099 form ready to fill out can save you time and hassle when it’s time to submit your taxes.

For the year 2024, having a printable blank 1099 form on hand can make the process much easier. Whether you are an individual who receives income from various sources or a business owner who needs to report payments to contractors or vendors, having a blank form ready to fill out can streamline the tax preparation process.

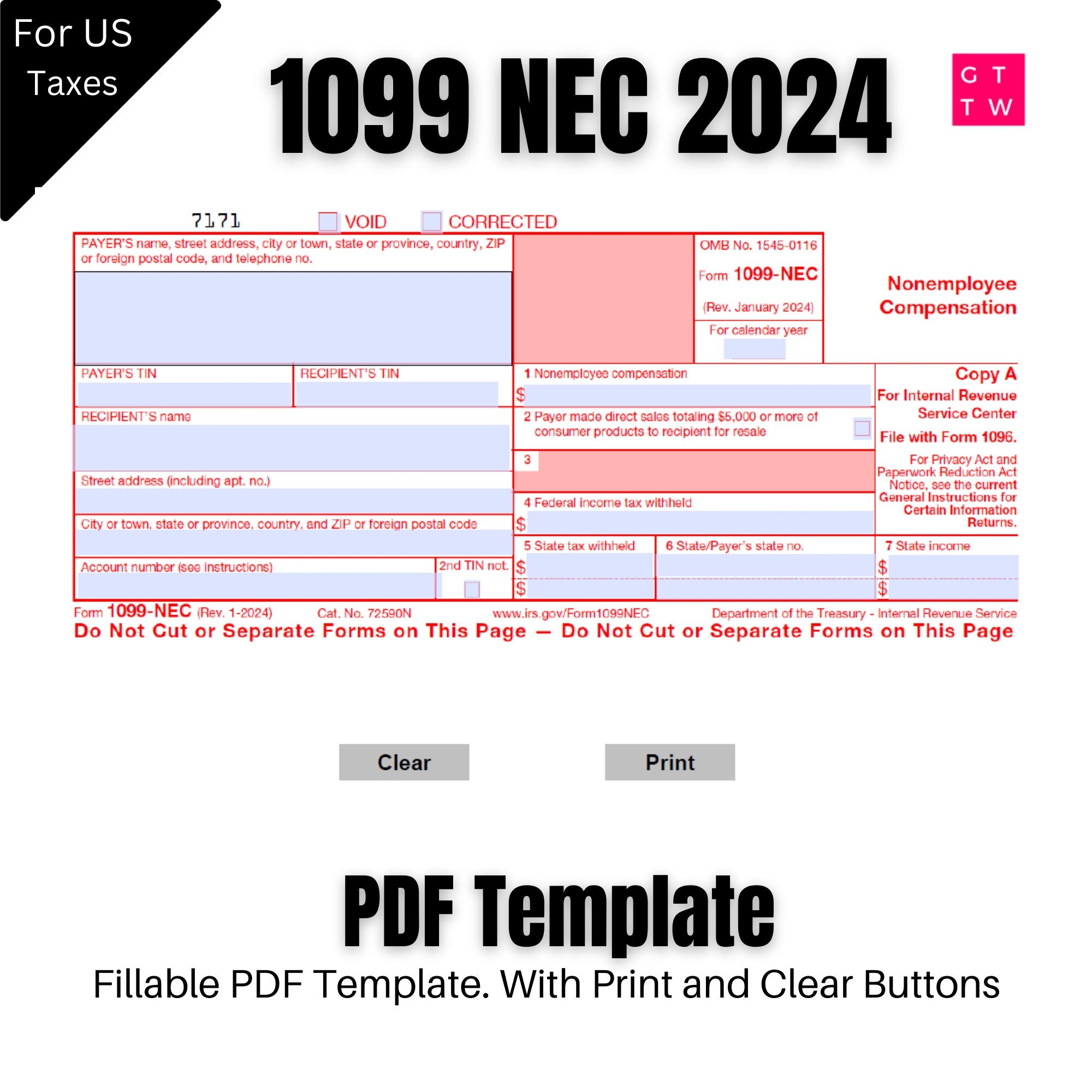

Blank 1099 Form 2024 Printable

Blank 1099 Form 2024 Printable

Get and Print Blank 1099 Form 2024 Printable

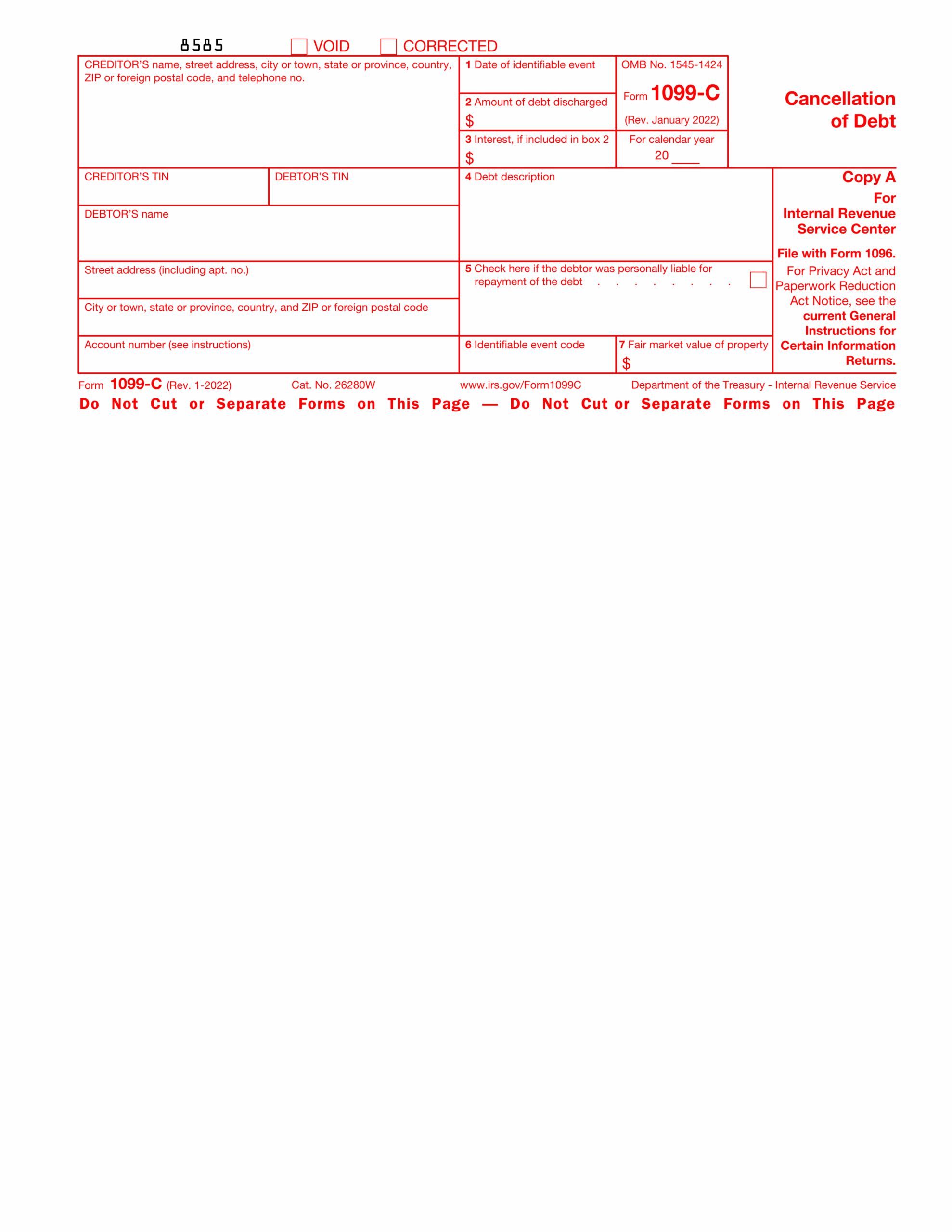

Form 1099 C 2024 2025 Fill Out U0026 Download Online PDF Guru

Form 1099 C 2024 2025 Fill Out U0026 Download Online PDF Guru

There are many websites and resources available online where you can find a printable blank 1099 form for the year 2024. These forms are usually available in PDF format, making it easy to download and print them out for your use. Having a physical copy of the form can also serve as a helpful reminder to gather all the necessary information before filing your taxes.

When filling out the blank 1099 form, make sure to double-check all the information you provide. Accuracy is key when it comes to tax reporting, as any errors or omissions could lead to delays or penalties. If you are unsure about how to fill out certain sections of the form, it’s always a good idea to seek advice from a tax professional.

Overall, having a blank 1099 form for the year 2024 printable can make the tax preparation process much smoother and efficient. By being proactive and organized, you can ensure that you are reporting your income accurately and in compliance with IRS regulations. So, don’t wait until the last minute – download a blank 1099 form today and get started on your tax preparation!

Get ahead of the game this tax season by having a blank 1099 form for the year 2024 printable and ready to fill out. With the right tools and resources at your disposal, you can navigate the tax reporting process with ease and confidence. Don’t let tax season stress you out – be prepared and proactive in managing your financial obligations.