Alabama income tax forms for the year 2017 are essential documents that taxpayers in the state need to file their taxes accurately. These forms provide taxpayers with a structured way to report their income, deductions, and credits to determine the amount of tax they owe or the refund they are entitled to.

Whether you are an individual, a business owner, or a corporation in Alabama, having access to printable tax forms can simplify the tax filing process and ensure compliance with state tax laws. By utilizing these forms, taxpayers can easily organize their financial information and submit it to the Alabama Department of Revenue.

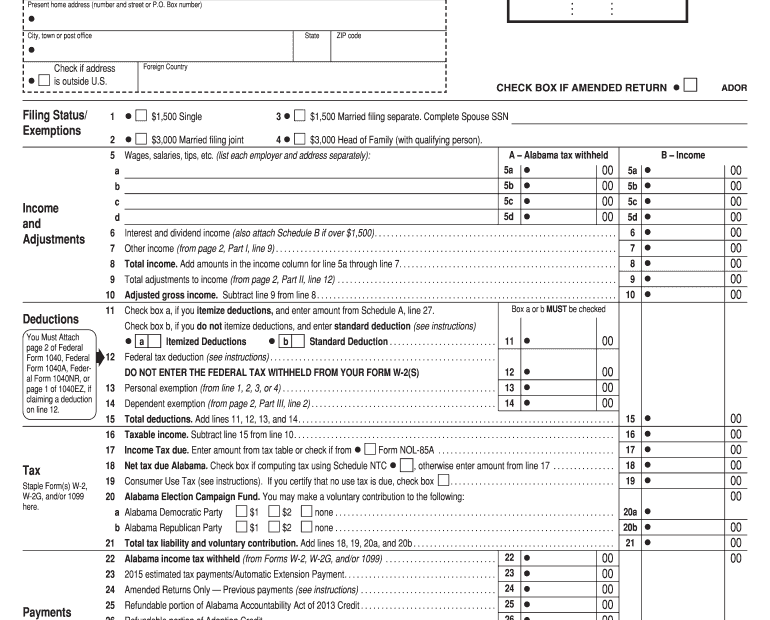

Alabama Income Tax Printable Forms 2017

Alabama Income Tax Printable Forms 2017

Easily Download and Print Alabama Income Tax Printable Forms 2017

How to Obtain Alabama Income Tax Printable Forms 2017

Alabama income tax printable forms for the year 2017 can be obtained directly from the official website of the Alabama Department of Revenue. The website provides a comprehensive list of tax forms that taxpayers can download, print, and fill out at their convenience. These forms cover various tax scenarios, including individual income tax, corporate income tax, and business privilege tax.

In addition to the official website, taxpayers can also visit local tax offices, libraries, or post offices to pick up physical copies of the required tax forms. It is important to ensure that you are using the correct forms for the tax year 2017 to avoid any delays or errors in the processing of your tax return.

Once you have obtained the necessary forms, carefully review the instructions provided by the Alabama Department of Revenue to accurately complete the forms. Be sure to include all relevant information, attach any required documentation, and double-check your entries before submitting your tax return.

By utilizing Alabama income tax printable forms for the year 2017, taxpayers can effectively fulfill their tax obligations and avoid potential penalties or fines for non-compliance. These forms serve as a valuable tool for taxpayers to report their income, claim deductions, and take advantage of available tax credits to minimize their tax liability.

Overall, being proactive in obtaining and completing the necessary tax forms is crucial for a smooth and efficient tax filing process. By utilizing the resources provided by the Alabama Department of Revenue, taxpayers can ensure that they are meeting their tax obligations accurately and timely.