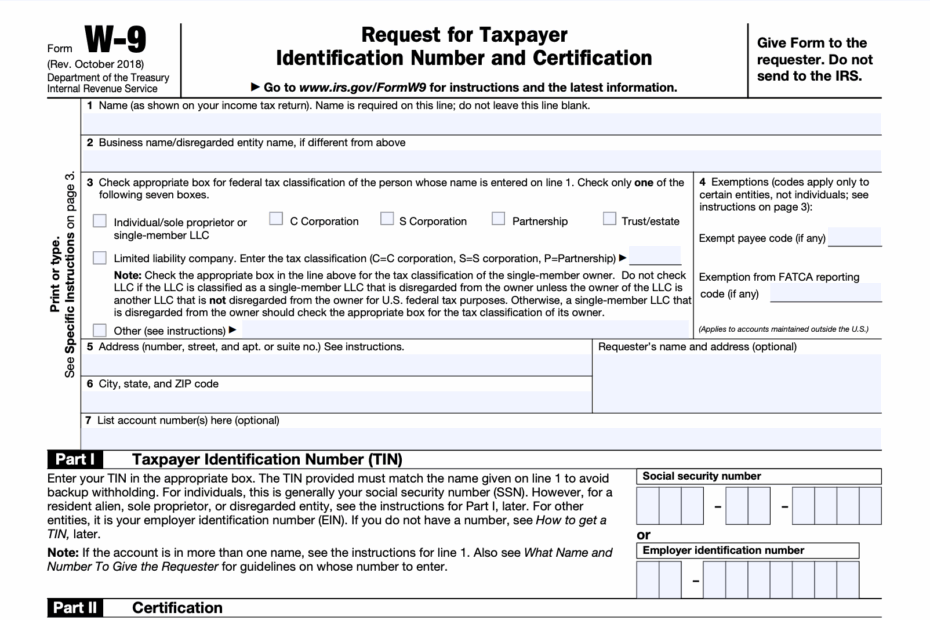

Form W-9 is a document that is used by businesses to request taxpayer identification information from individuals, contractors, freelancers, or vendors who they plan to pay for services rendered. The form is provided by the Internal Revenue Service (IRS) and is important for tax reporting purposes.

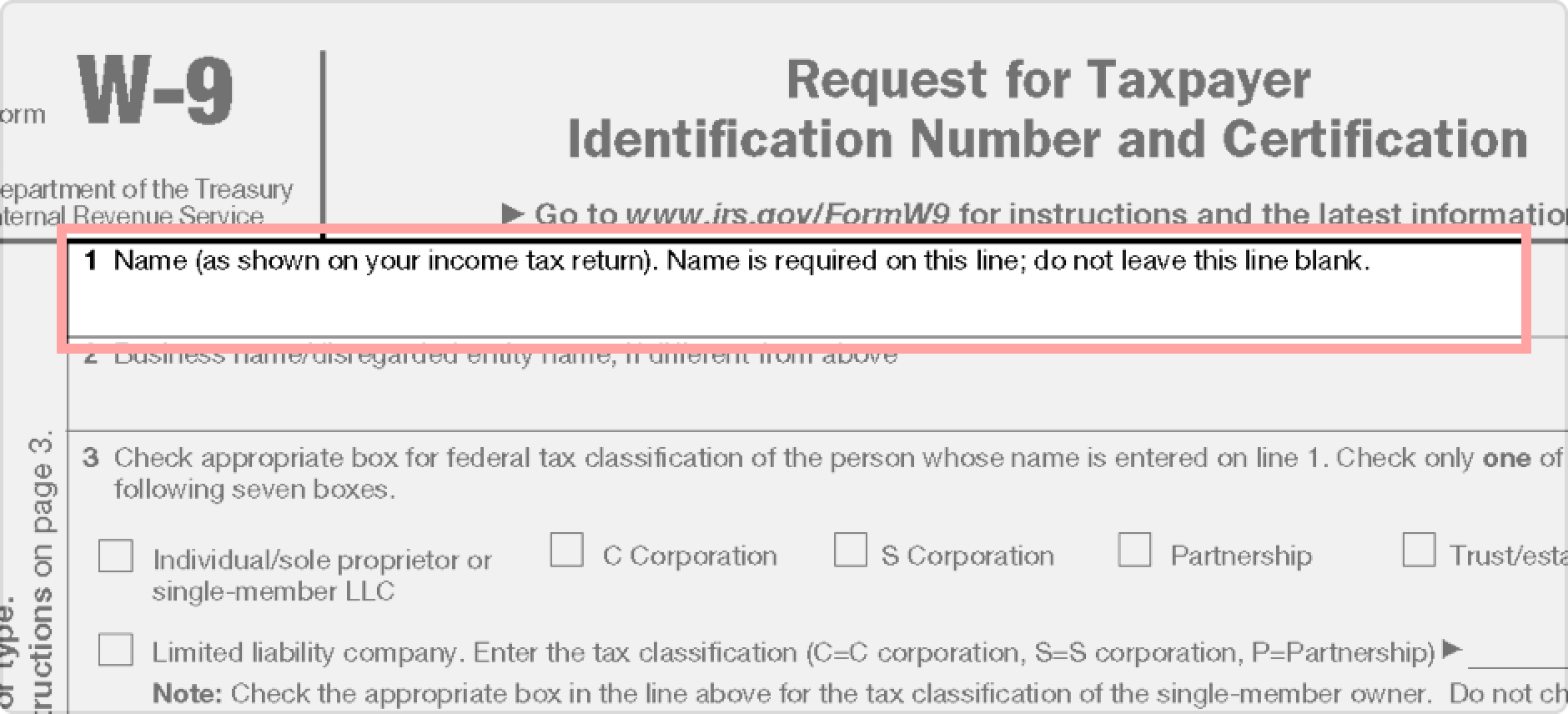

When a company hires a contractor or freelancer, they are required to collect certain information in order to report payments made to the IRS. This information includes the individual’s name, address, and taxpayer identification number (TIN) or social security number. The Form W-9 is used to collect this crucial information.

Get and Print Form W-9 Printable

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

Form W-9 Printable

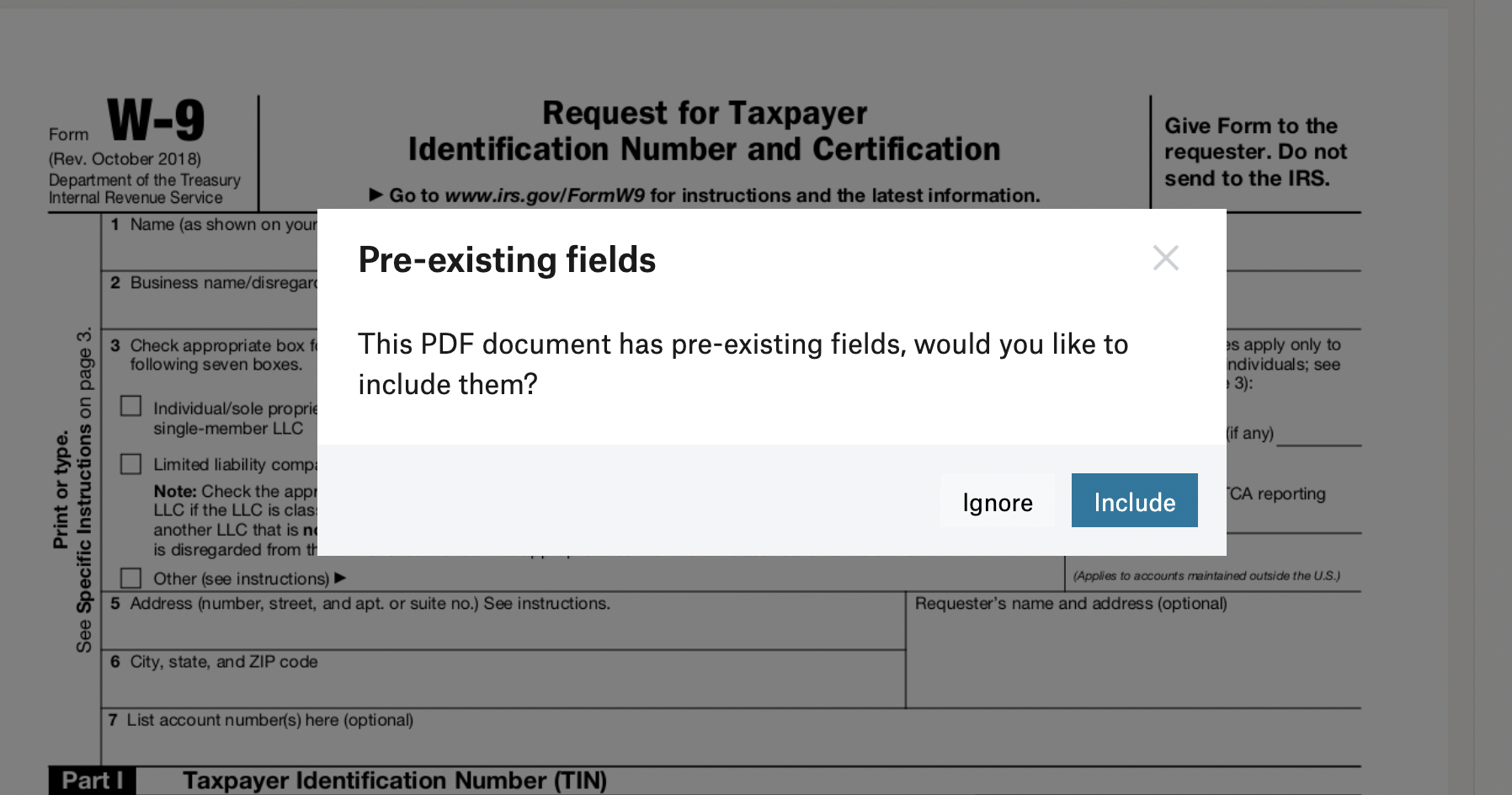

Form W-9 is typically a one-page document that can be easily downloaded and printed from the IRS website. The form is straightforward and includes fields for the individual to fill in their name, address, TIN or social security number, and signature. Once completed, the form can be submitted back to the requesting company.

It is important for individuals to fill out the Form W-9 accurately and completely to avoid any issues with tax reporting. Failure to provide the required information can result in delays in payment or potential penalties from the IRS. It is also important to keep a copy of the completed form for your records.

Businesses that utilize the services of contractors or freelancers must keep accurate records of the payments made and report this information to the IRS at the end of the year. The information collected on the Form W-9 is used to complete Form 1099, which is sent to both the individual and the IRS to report income earned.

Overall, Form W-9 is a necessary document for both businesses and individuals who engage in contractor or freelance work. By accurately completing the form and providing the required information, both parties can ensure compliance with IRS regulations and avoid any potential issues with tax reporting.

So, whether you are a business owner or an independent contractor, make sure to familiarize yourself with Form W-9 and use the printable version available on the IRS website for any necessary tax reporting purposes.