As tax season approaches, it’s important for businesses to be prepared and organized when it comes to filing their taxes. One crucial form that businesses need to be aware of is the 1099-NEC form. This form is used to report nonemployee compensation, such as payments made to independent contractors or freelancers. It’s essential for businesses to understand the requirements for filing this form accurately and on time to avoid any penalties or issues with the IRS.

Many businesses may be familiar with the 1099-MISC form, which was previously used to report nonemployee compensation. However, starting in 2020, the IRS introduced the 1099-NEC form specifically for reporting nonemployee compensation. It’s important for businesses to use the correct form to ensure compliance with IRS regulations and avoid any potential errors in reporting.

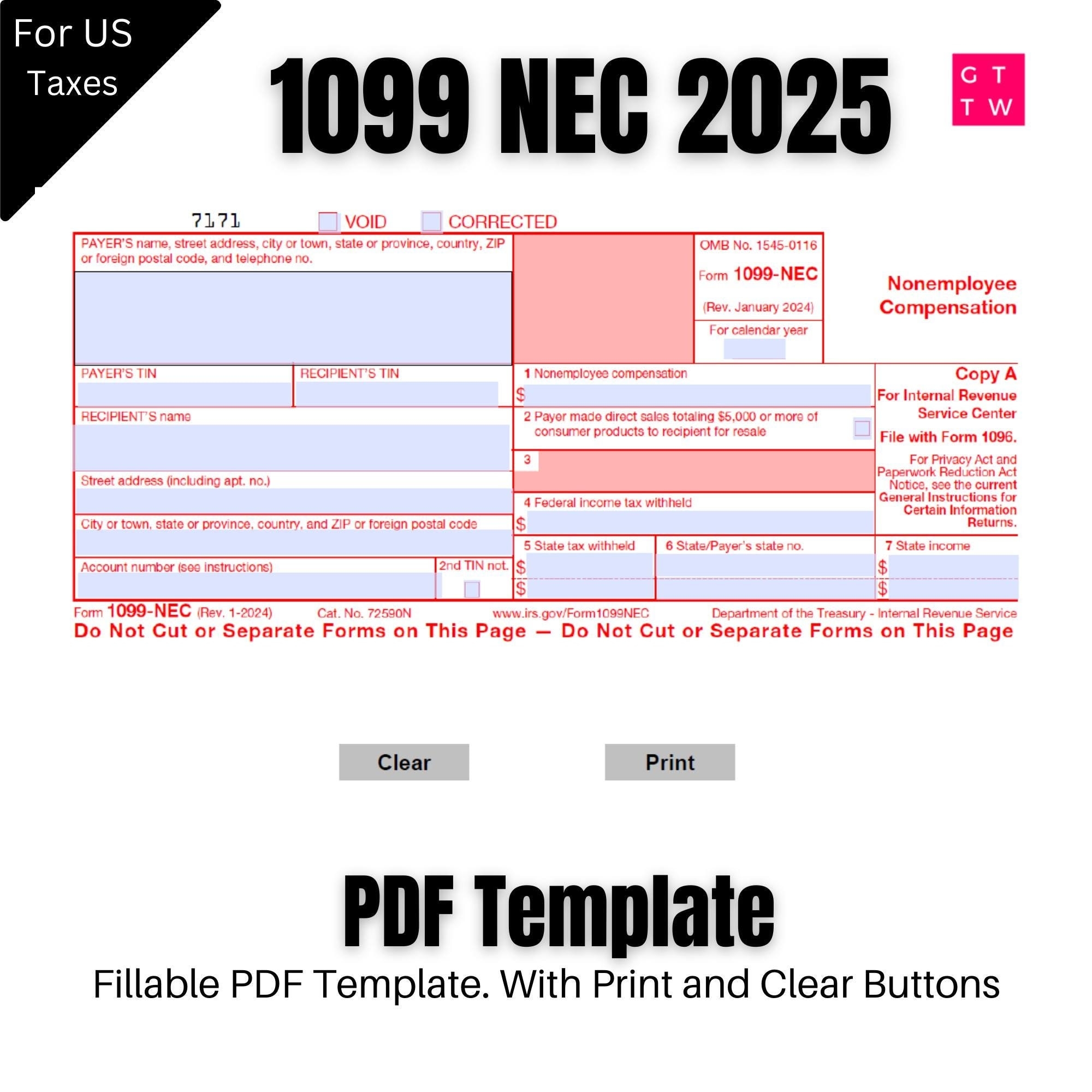

Save and Print 1099-Nec Printable Form

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

1099-NEC Printable Form

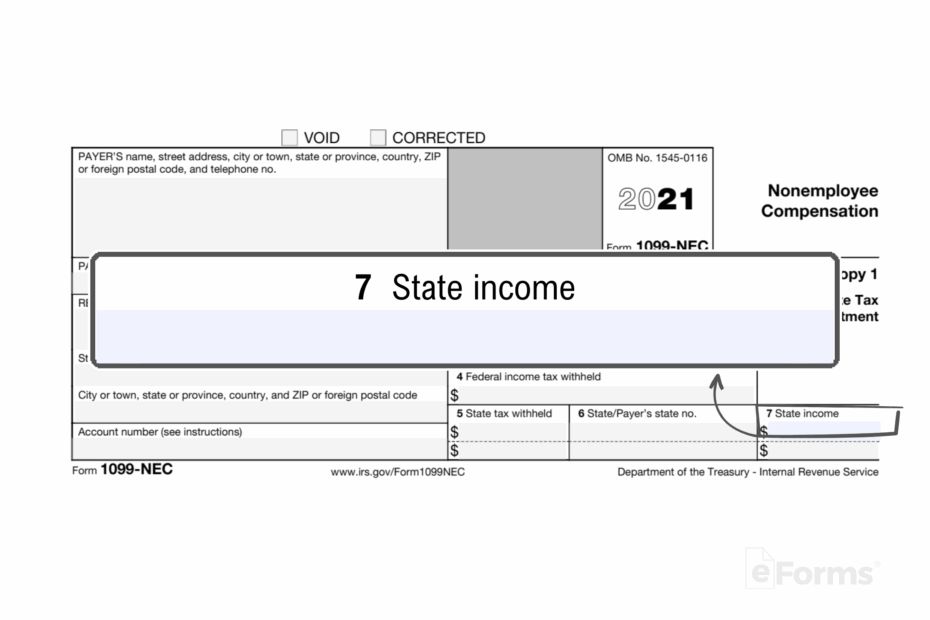

The 1099-NEC form is a crucial document for businesses that have paid nonemployee compensation of $600 or more during the tax year. This form must be provided to the recipient by January 31st and filed with the IRS by the end of February. The form includes important information such as the recipient’s name, address, and taxpayer identification number, as well as the total amount of nonemployee compensation paid.

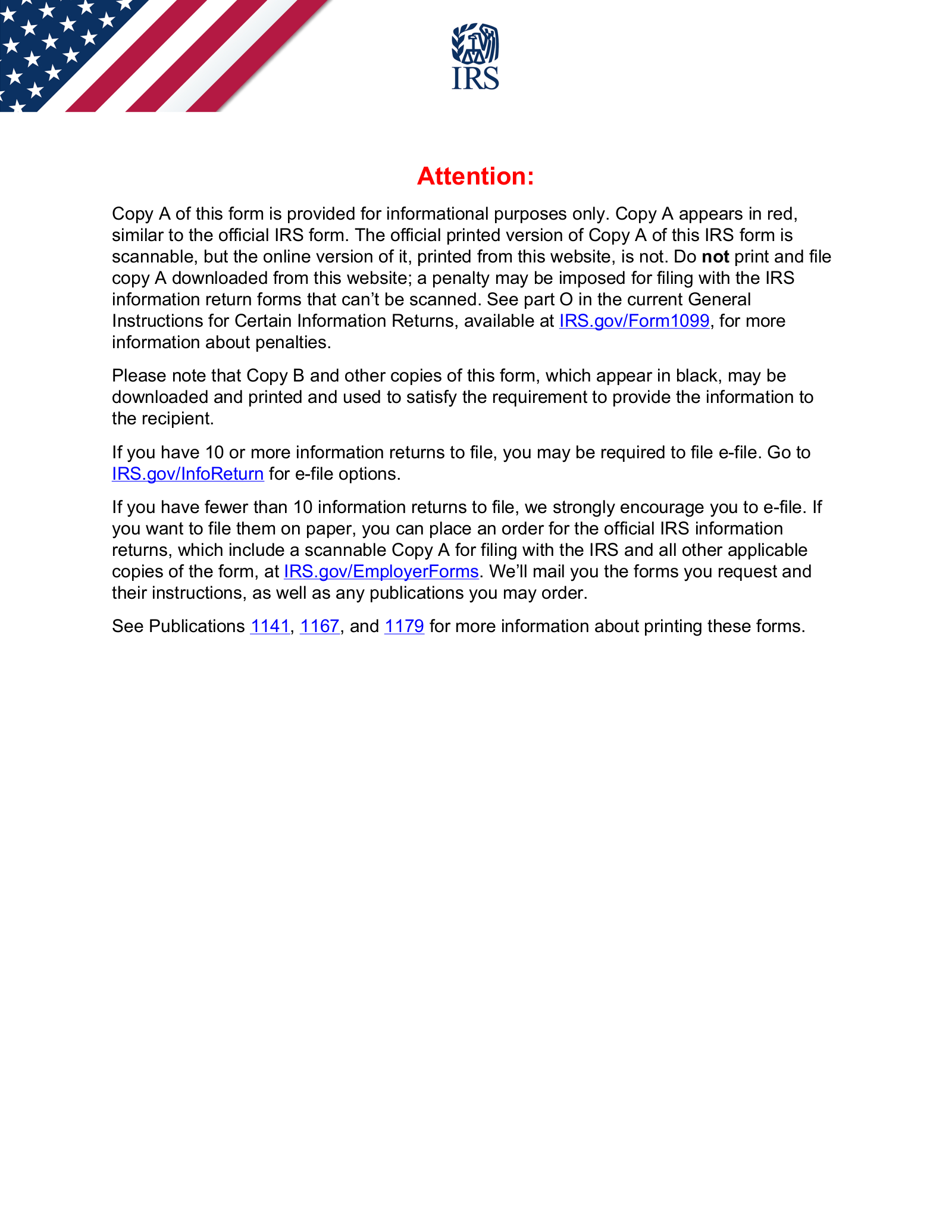

Businesses can easily access and download the 1099-NEC printable form from the IRS website or through various tax preparation software. It’s important to ensure that the form is filled out accurately and completely to avoid any discrepancies or issues with the IRS. Businesses should also keep detailed records of all payments made to independent contractors or freelancers to support the information reported on the form.

Failure to file the 1099-NEC form on time or accurately can result in penalties from the IRS. It’s crucial for businesses to be diligent in their tax reporting and compliance to avoid any potential issues. By understanding the requirements for the 1099-NEC form and using the printable form provided by the IRS, businesses can ensure that they are meeting their tax obligations and avoiding any unnecessary penalties.

In conclusion, the 1099-NEC printable form is a key document for businesses that have paid nonemployee compensation during the tax year. By understanding the requirements for filing this form and using the resources provided by the IRS, businesses can ensure compliance with tax regulations and avoid any potential penalties. It’s essential for businesses to be organized and accurate in their tax reporting to maintain good standing with the IRS.