As tax season approaches, it is important for businesses to be aware of the necessary forms they need to file with the IRS. One such form is the 1099 NEC Form, which is used to report nonemployee compensation. This form is crucial for businesses that have paid independent contractors, freelancers, or other nonemployees throughout the year.

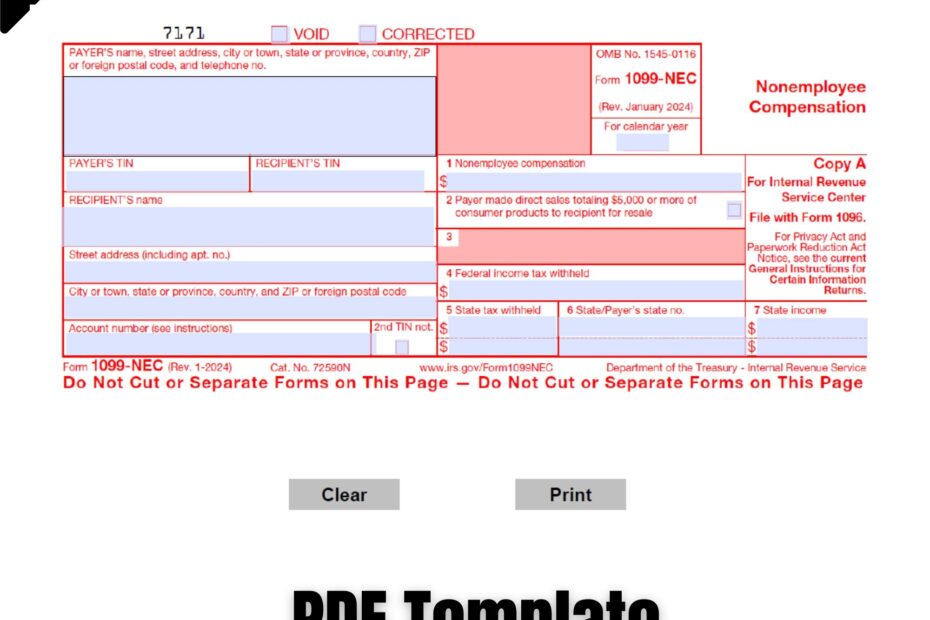

For the year 2024, the IRS has released the printable version of the 1099 NEC Form. This form can be easily accessed and printed from the IRS website, making it convenient for businesses to file their taxes accurately and on time. By utilizing the printable form, businesses can ensure that they are in compliance with IRS regulations and avoid any potential penalties.

Easily Download and Print 1099 Nec Form 2024 Printable

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

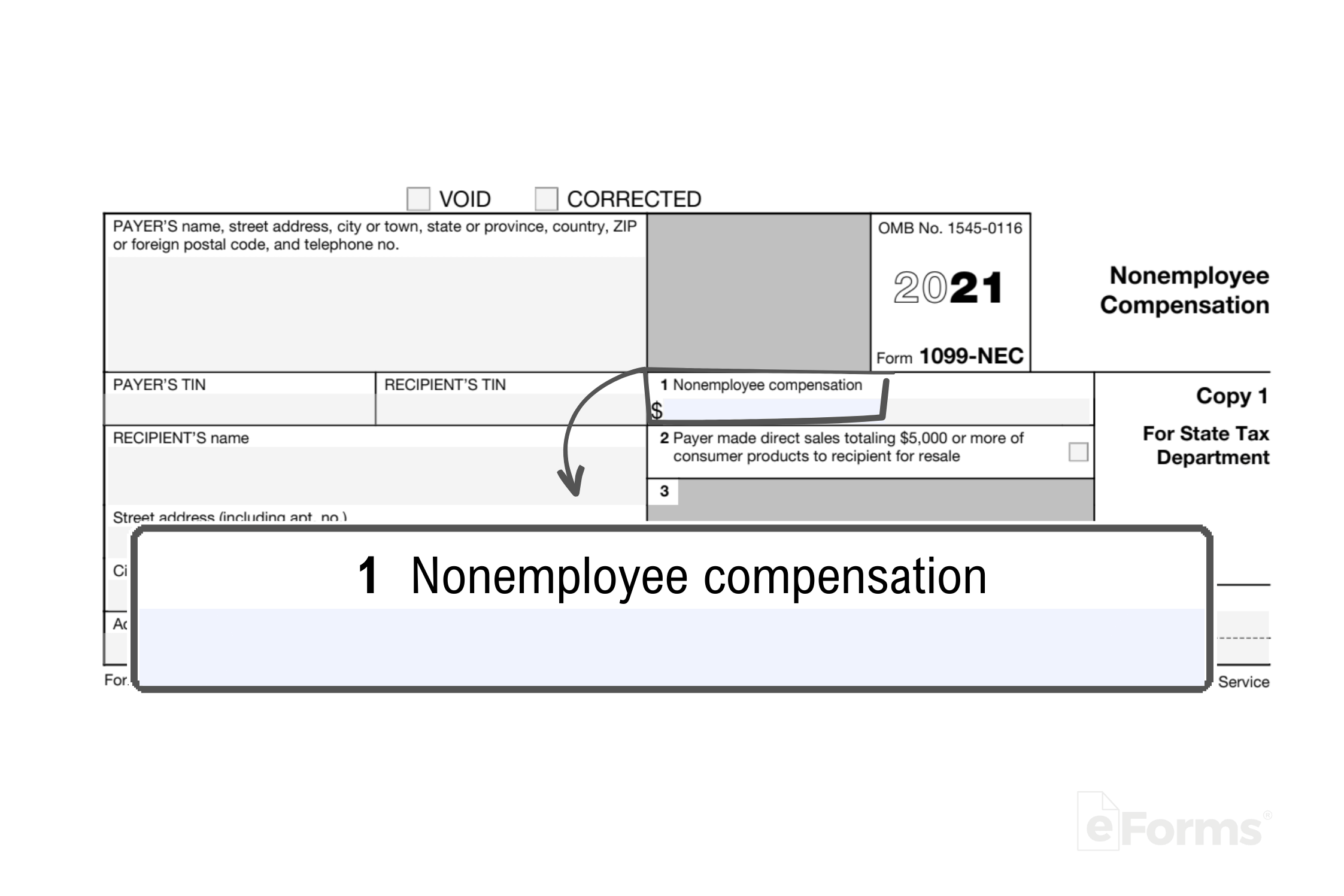

When filling out the 1099 NEC Form, businesses will need to provide information such as the recipient’s name, address, and Social Security number, as well as the amount of nonemployee compensation paid during the year. It is important to double-check all information before submitting the form to ensure accuracy and prevent any discrepancies that could lead to audits or fines.

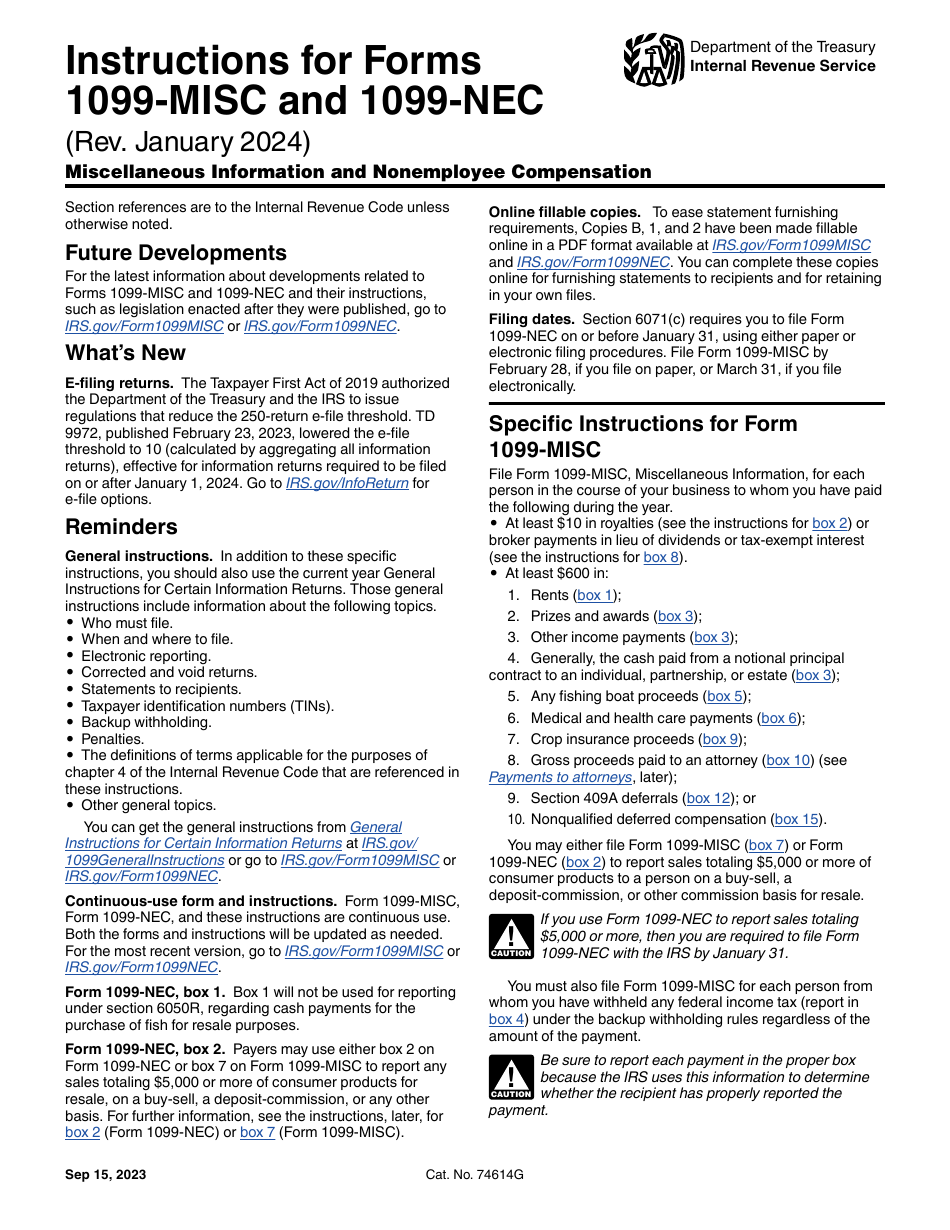

Businesses should also keep in mind the deadline for filing the 1099 NEC Form, which is typically January 31st of the following year. Failure to file on time can result in penalties, so it is essential to be proactive and submit the form promptly. By utilizing the printable version of the form, businesses can stay organized and on track with their tax obligations.

In conclusion, the 1099 NEC Form 2024 Printable is a valuable resource for businesses to report nonemployee compensation accurately and efficiently. By taking advantage of this form, businesses can streamline their tax filing process and avoid any potential issues with the IRS. It is essential for businesses to stay informed and compliant with tax regulations, and the printable 1099 NEC Form is a helpful tool in achieving this goal.