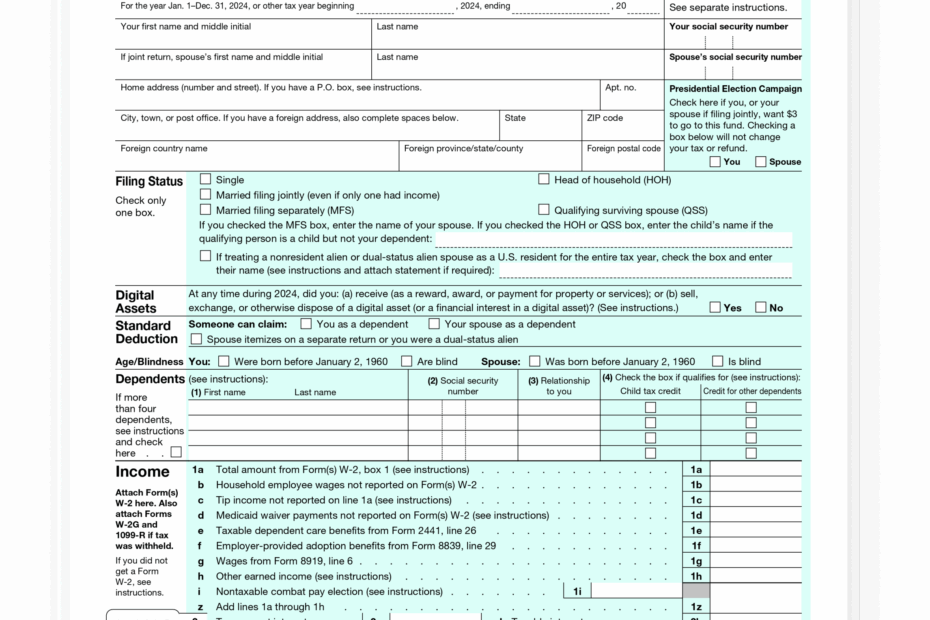

Are you looking for a simple and convenient way to file your taxes? The 1040 Easy Form Printable might be the perfect solution for you. This form is designed for individuals with straightforward tax situations, making the filing process quick and easy. With this form, you can easily report your income, claim deductions, and calculate your tax liability without the need for complicated schedules or additional forms.

The 1040 Easy Form Printable is a simplified version of the standard 1040 form, designed for taxpayers with uncomplicated tax situations. This form is ideal for individuals who have only W-2 income, claim the standard deduction, and do not have any additional sources of income or deductions to report. By using this form, you can streamline the tax filing process and avoid unnecessary complications.

Download and Print 1040 Easy Form Printable

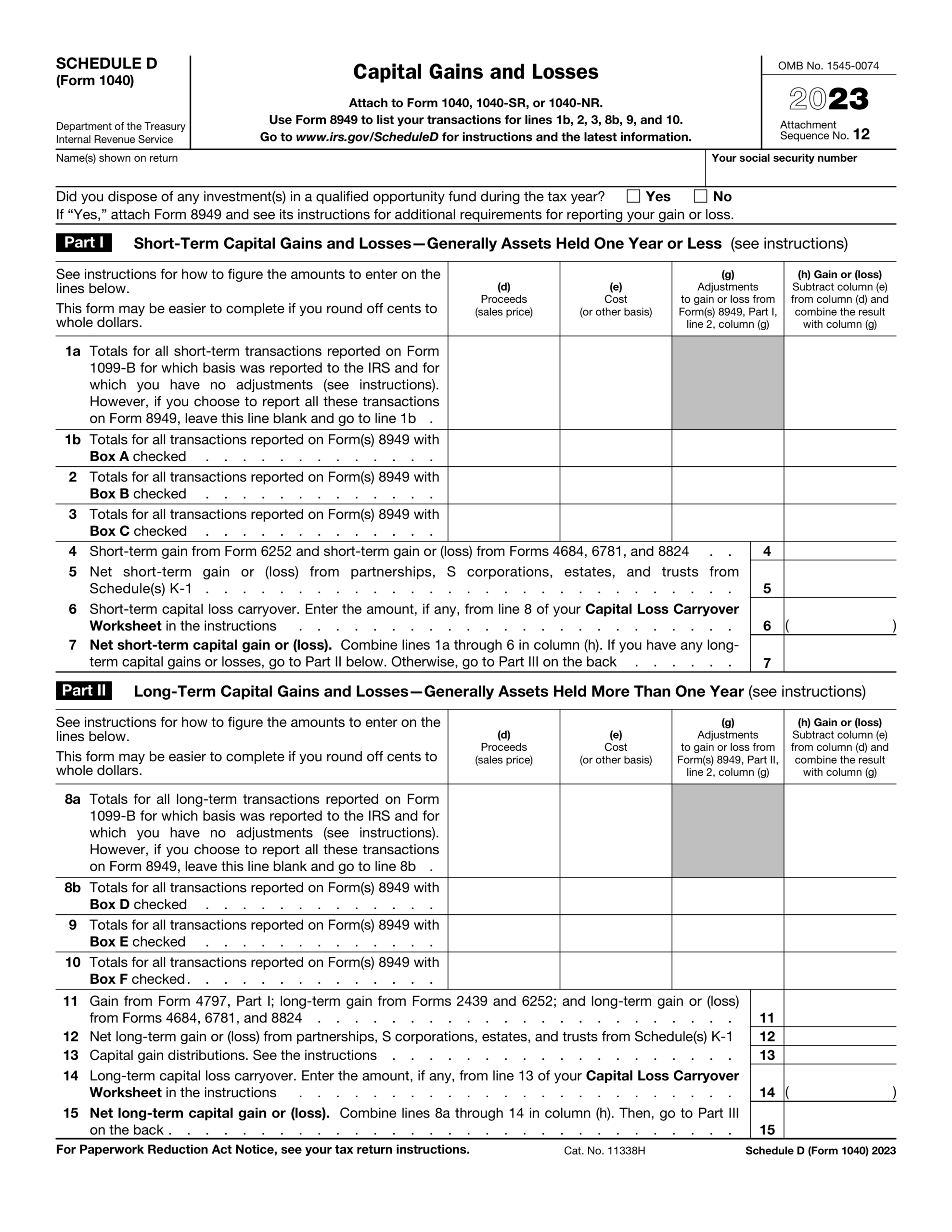

Form 1040 U0026 Schedules Simplified Instructions Tax Guide 101 Worksheets Library

Form 1040 U0026 Schedules Simplified Instructions Tax Guide 101 Worksheets Library

When using the 1040 Easy Form Printable, all you need to do is fill in your personal information, report your income, claim any applicable deductions, and calculate your tax liability. This form eliminates the need for complex calculations and additional schedules, making it easy to complete in just a few simple steps. Additionally, the form is available for free download online, making it convenient and accessible for all taxpayers.

By using the 1040 Easy Form Printable, you can save time and effort during tax season. This simplified form is designed to make the filing process as straightforward as possible, allowing you to quickly and accurately submit your tax return without any unnecessary hassle. Whether you are filing on your own or seeking assistance from a tax professional, this form can help simplify the process and ensure that your taxes are filed correctly.

In conclusion, the 1040 Easy Form Printable is a convenient and user-friendly option for individuals with uncomplicated tax situations. By using this form, you can easily report your income, claim deductions, and calculate your tax liability without the need for additional forms or schedules. Whether you are a first-time filer or a seasoned taxpayer, this form can help simplify the tax filing process and ensure that your taxes are filed accurately and on time.