When it comes to tax season, filling out forms can be a daunting task. One form that is commonly used by businesses and individuals is the W-9 form. This form is used to request taxpayer identification information from individuals or businesses who are hired to provide services. It is important to fill out this form accurately to ensure that the correct information is reported to the IRS.

One of the key reasons why the W-9 form is important is that it helps businesses report payments made to independent contractors to the IRS. By collecting this information upfront, businesses can avoid penalties for failing to report payments or for inaccurately reporting payments. Additionally, having the taxpayer identification information on file makes it easier for businesses to issue 1099 forms at the end of the year.

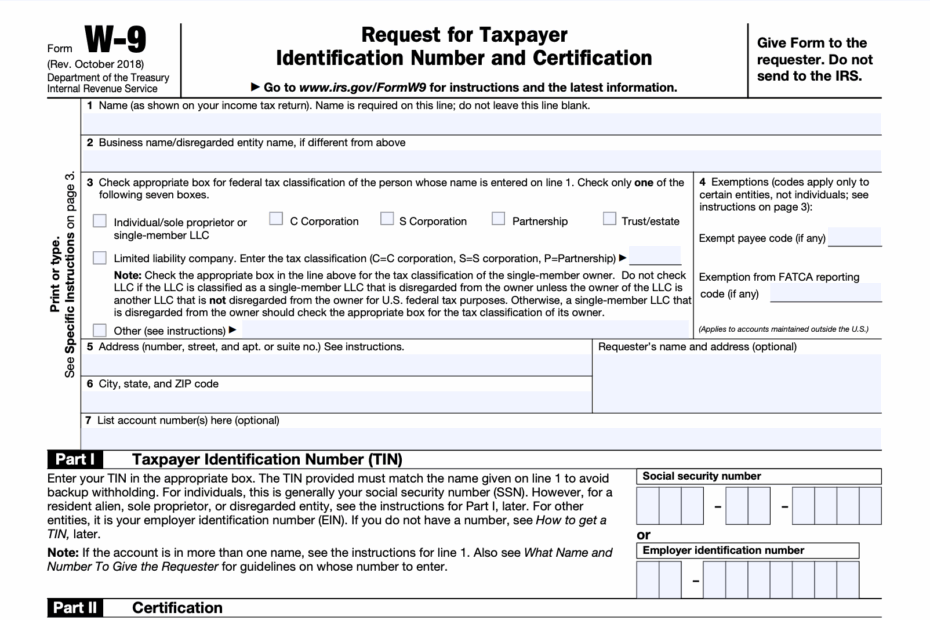

Download and Print W 9 Printable Form Irs

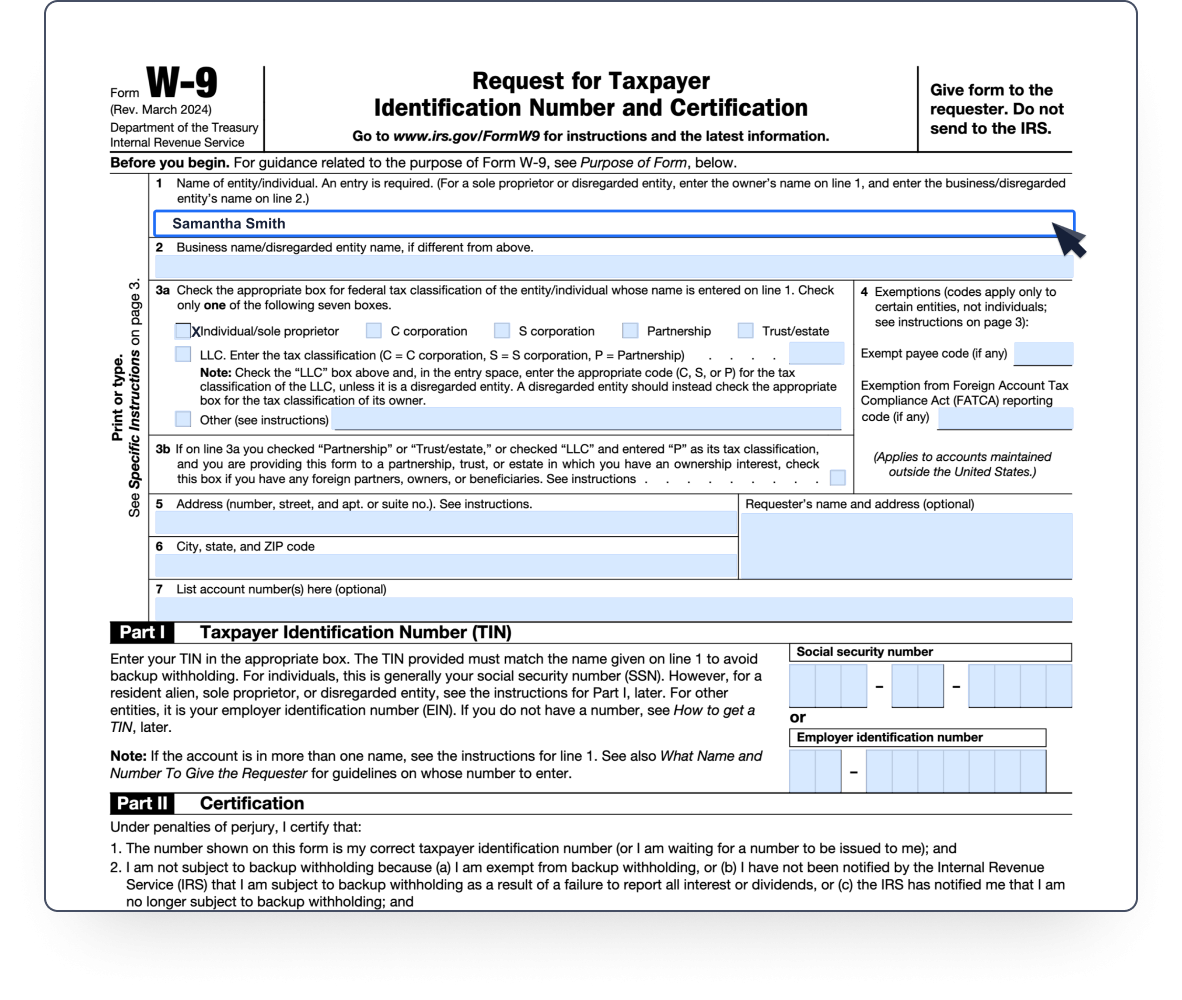

Fillable W 9 Form Template Formstack Documents

Fillable W 9 Form Template Formstack Documents

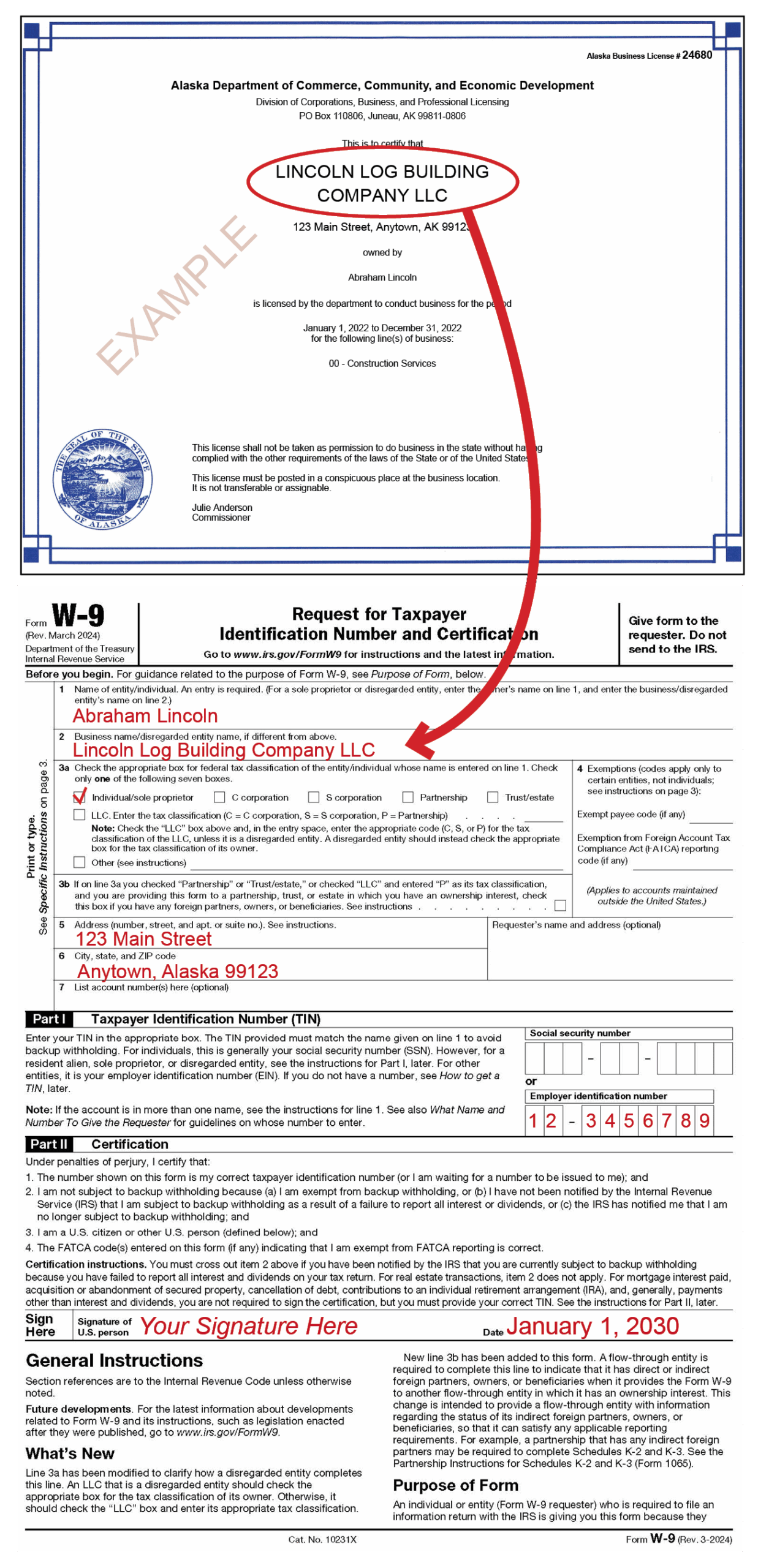

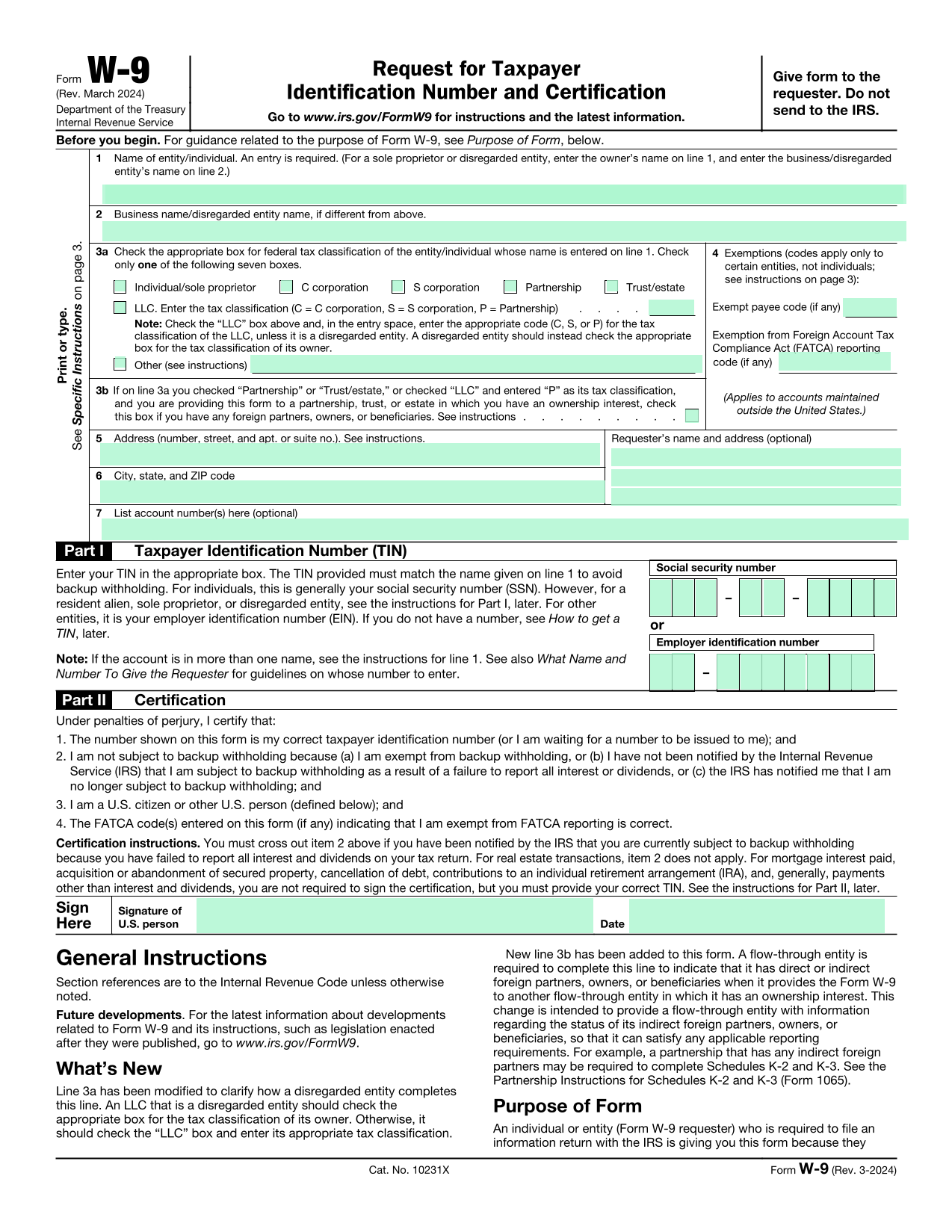

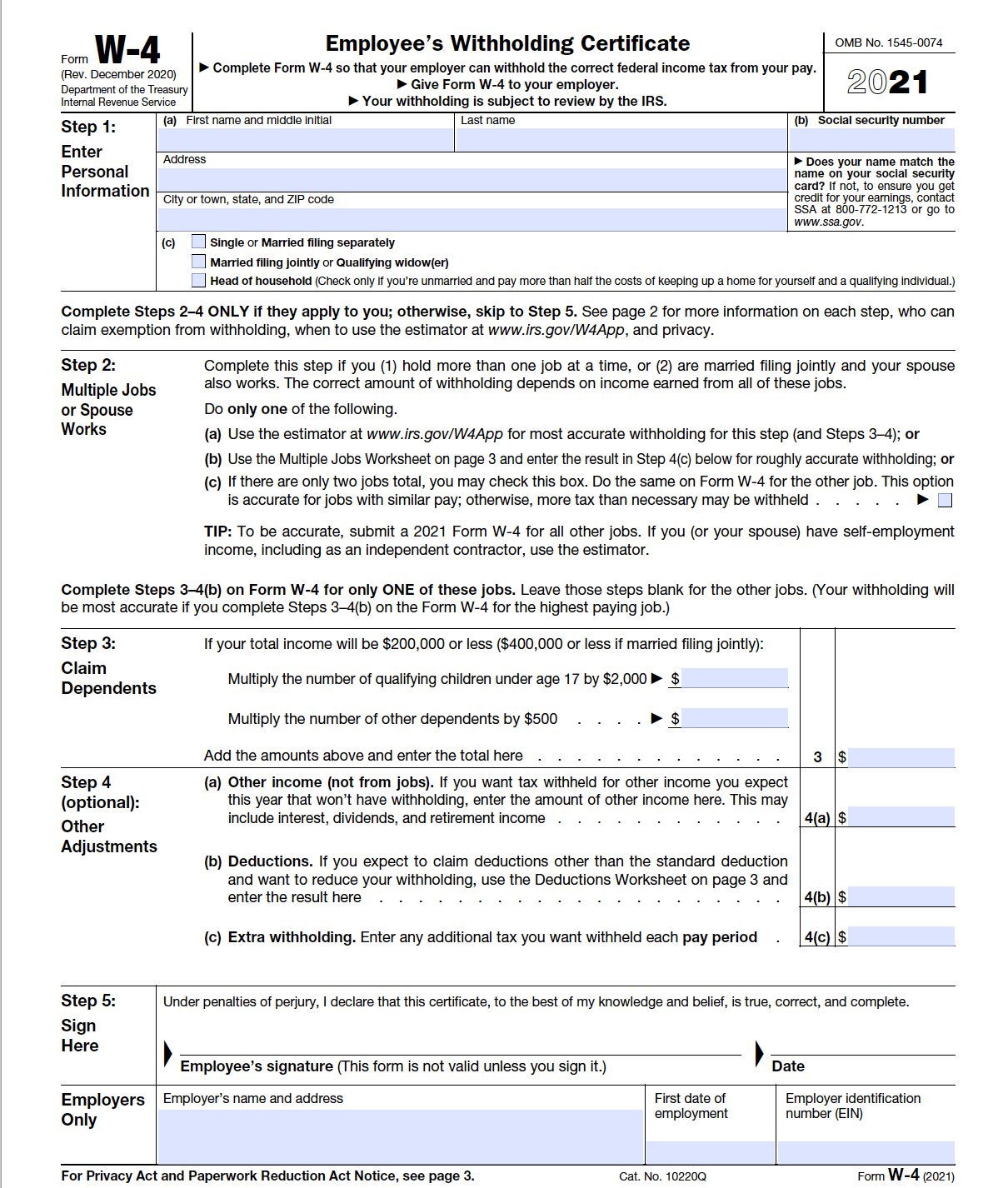

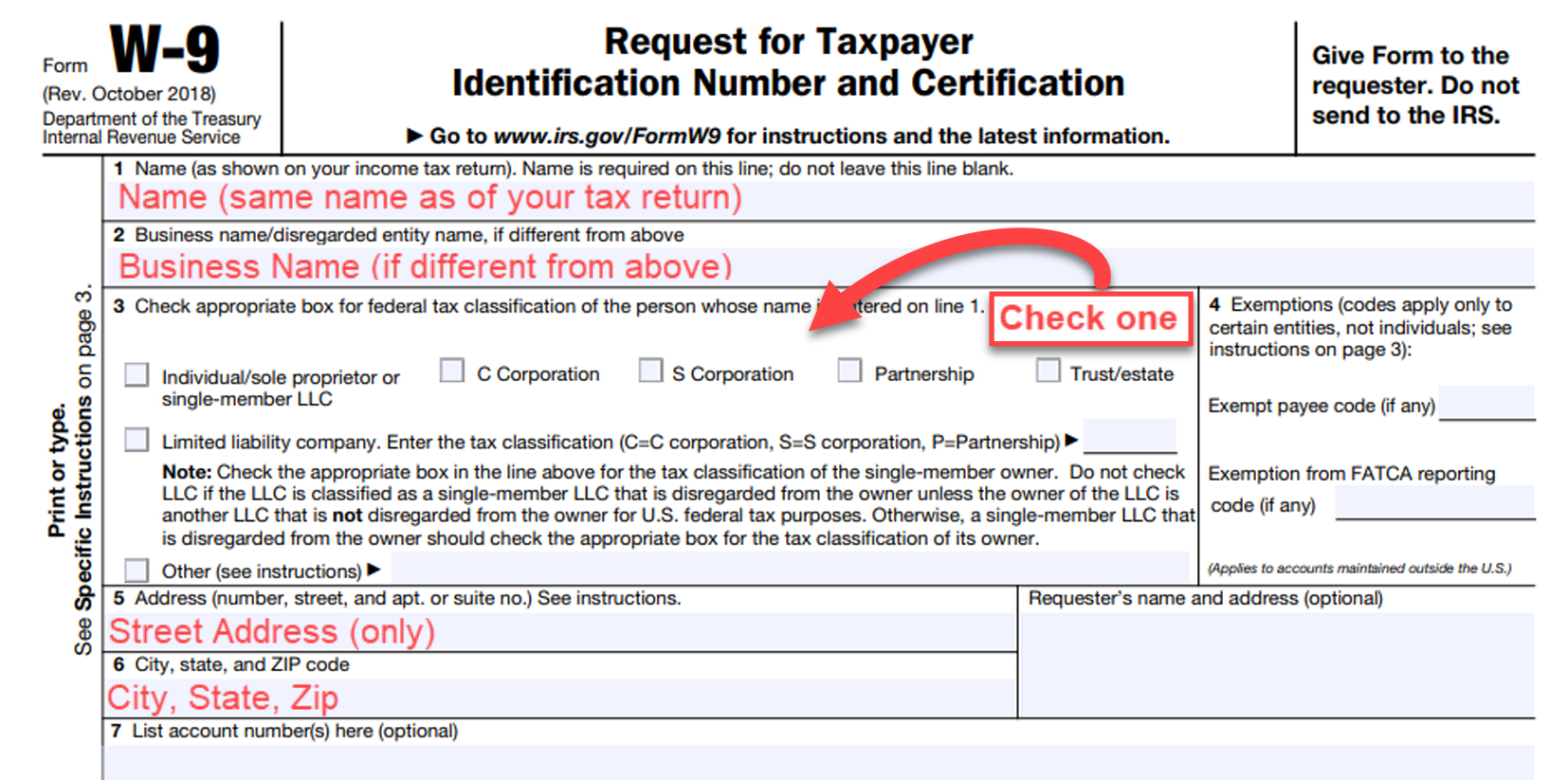

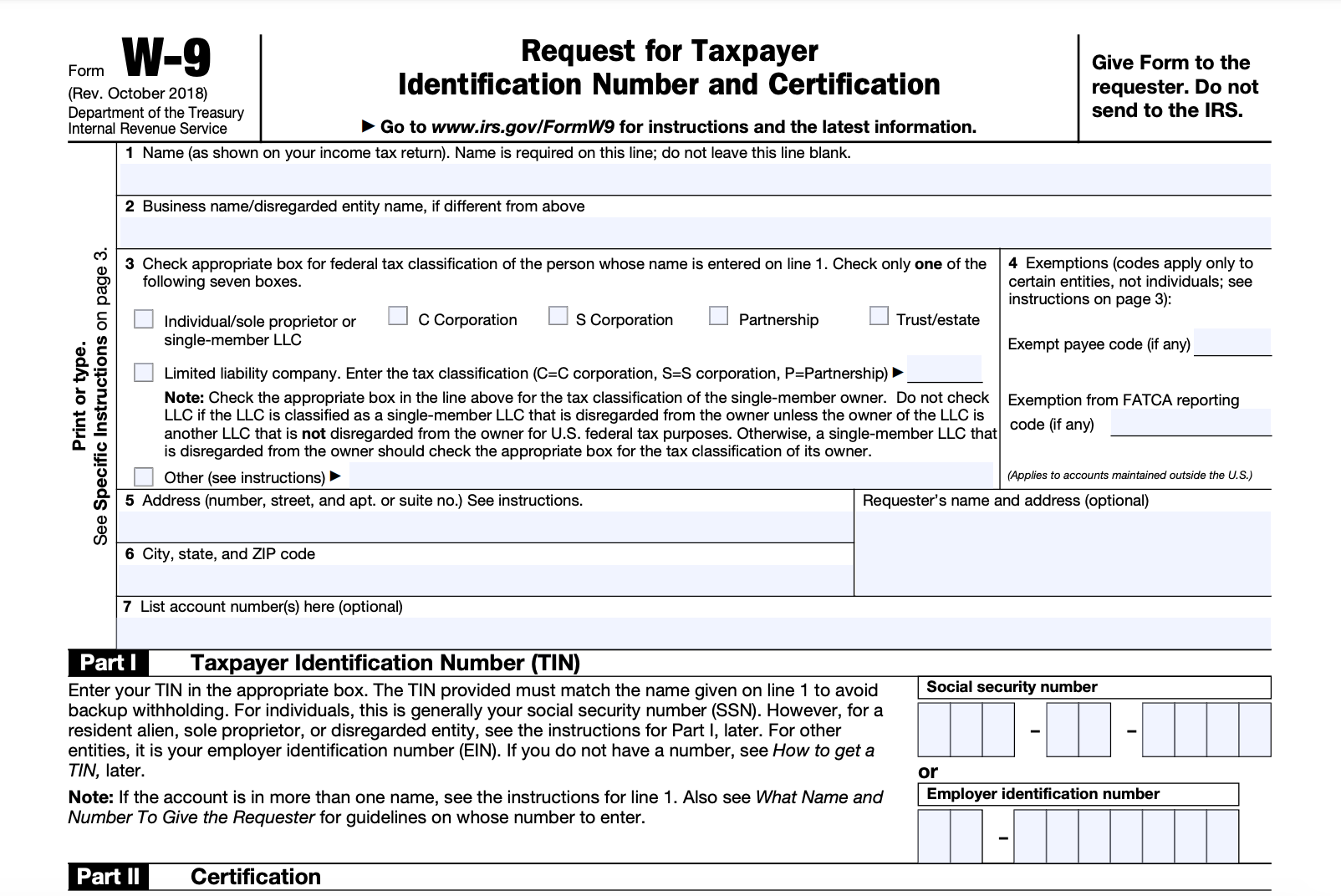

When filling out the W-9 form, individuals or businesses will need to provide their name, address, taxpayer identification number (usually their social security number or employer identification number), and certify that the information provided is correct. The form must be signed and dated to be valid. Once completed, the form can be submitted to the business that requested it.

It is important to note that the W-9 form is not filed with the IRS. Instead, it is kept on file by the business that requested it. However, the information provided on the form may be used by the IRS to verify income reported on tax returns. Therefore, it is crucial to provide accurate information on the form.

Overall, the W-9 form is a vital tool for businesses and individuals to collect taxpayer identification information for reporting purposes. By accurately filling out this form, businesses can ensure compliance with IRS regulations and avoid penalties for incorrect reporting. So, the next time you are asked to fill out a W-9 form, make sure to do so accurately and promptly.

In conclusion, the W-9 form is an essential document for businesses and individuals to collect taxpayer identification information. By accurately filling out this form, businesses can avoid penalties and ensure compliance with IRS regulations. So, next time you are asked to fill out a W-9 form, take the time to do so carefully and accurately.

Free IRS Form W9 2024 PDF EForms

Free IRS Form W9 2024 PDF EForms

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

W 9 Form Fill Out The IRS W 9 Form Online For 2023 Smallpdf

Searching for a hassle-free method to manage your finances? Our printable checks for free offer a straightforward, safe, and personalizable option you can use at home. Perfect for individual purposes, small enterprises, or budgeting, W 9 Printable Form Irs save money and effort without lowering professionalism. Supports popular bookkeeping tools and easy to print, they’re a wise alternative to pre-ordered checks. Start printing today and gain full control over your financial transactions—no waiting, zero charges. Check out our collection of templates and select the one that matches your purpose. With our easy-to-use features, handling your money has never been this streamlined. Access your free printable checks and optimize your transactions with ease!.