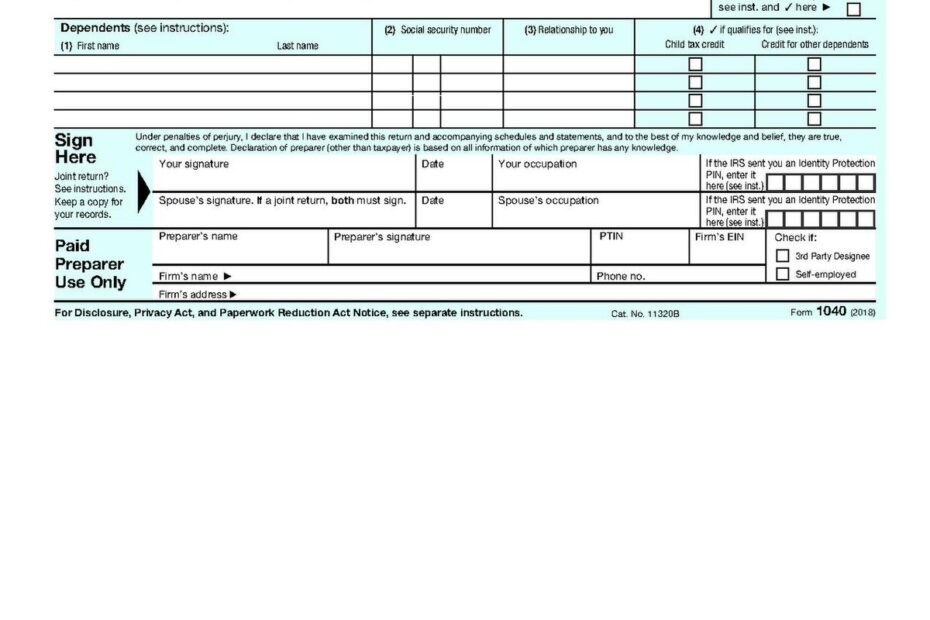

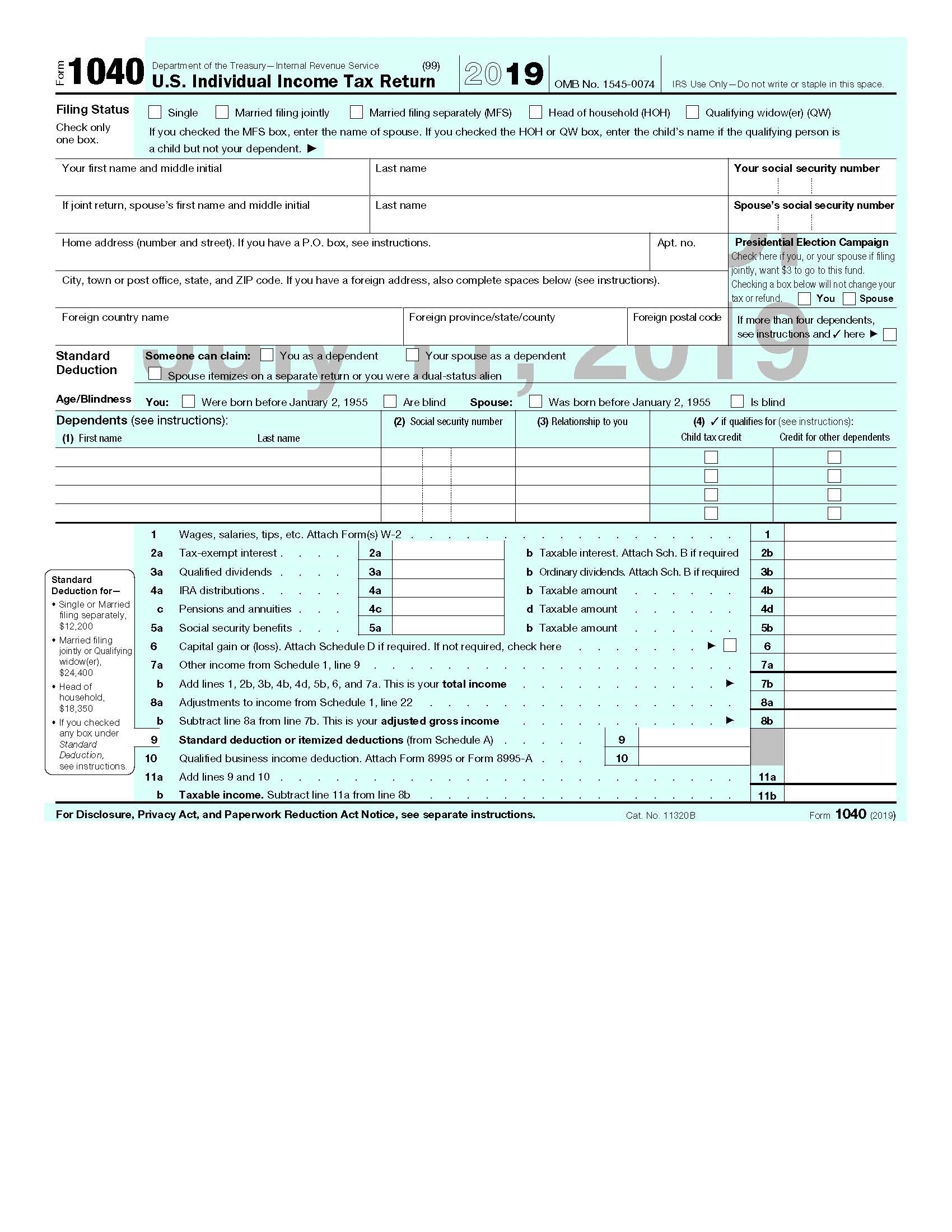

When tax season rolls around, it’s important to have all the necessary forms and documents ready to file your taxes accurately and on time. One of the most commonly used tax forms is the IRS Form 1040, which is used by individuals to report their annual income and calculate their tax liability. This form is essential for anyone who earns income in the United States and must be completed and filed with the IRS by the annual tax deadline.

IRS Form 1040 can be quite complex, especially for individuals with multiple sources of income or various deductions and credits to claim. However, the IRS provides printable versions of Form 1040 on their website for taxpayers to easily access and fill out. These printable forms can be downloaded and printed from the IRS website, making it convenient for individuals to prepare their taxes at home or with the help of a tax professional.

Download and Print Irs Printable Tax Forms 1040

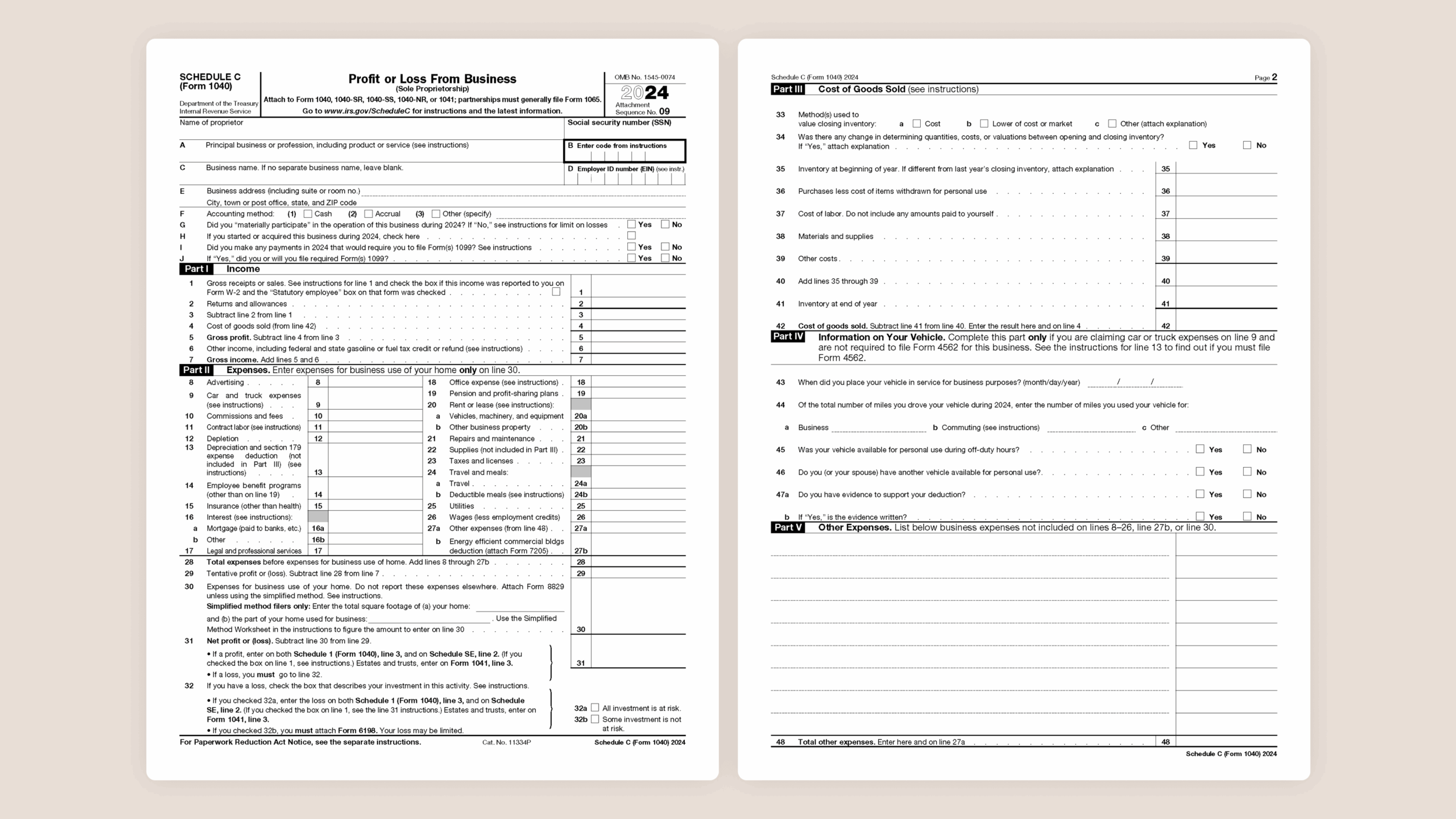

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

When filling out Form 1040, taxpayers will need to provide information such as their income, deductions, credits, and any taxes already paid. It’s important to double-check all the information entered on the form to ensure accuracy and avoid any potential errors that could lead to delays in processing or penalties from the IRS. Once the form is completed, it can be mailed to the IRS or filed electronically using IRS e-file for faster processing.

Using the IRS printable tax forms 1040 simplifies the tax filing process for individuals, allowing them to easily access and fill out the necessary forms without the need to visit an IRS office or request forms by mail. By following the instructions provided with the form and gathering all the required documents, taxpayers can ensure a smooth and hassle-free filing experience. Additionally, using printable forms can save time and resources compared to traditional paper forms.

Overall, IRS Form 1040 is a crucial document for individuals to report their income and taxes accurately to the IRS. By utilizing the IRS printable tax forms 1040, taxpayers can easily access and fill out the necessary forms to meet their tax obligations and avoid any potential issues with the IRS. It’s important to file taxes on time and accurately to avoid penalties or interest charges, so having the right forms ready is essential during tax season.