As tax season approaches, it is crucial for individuals and businesses to be aware of the various forms they need to file with the IRS. One of these essential documents is the 1099 form, which is used to report income other than wages, salaries, and tips. It is important to accurately file this form to avoid any penalties or audits from the IRS.

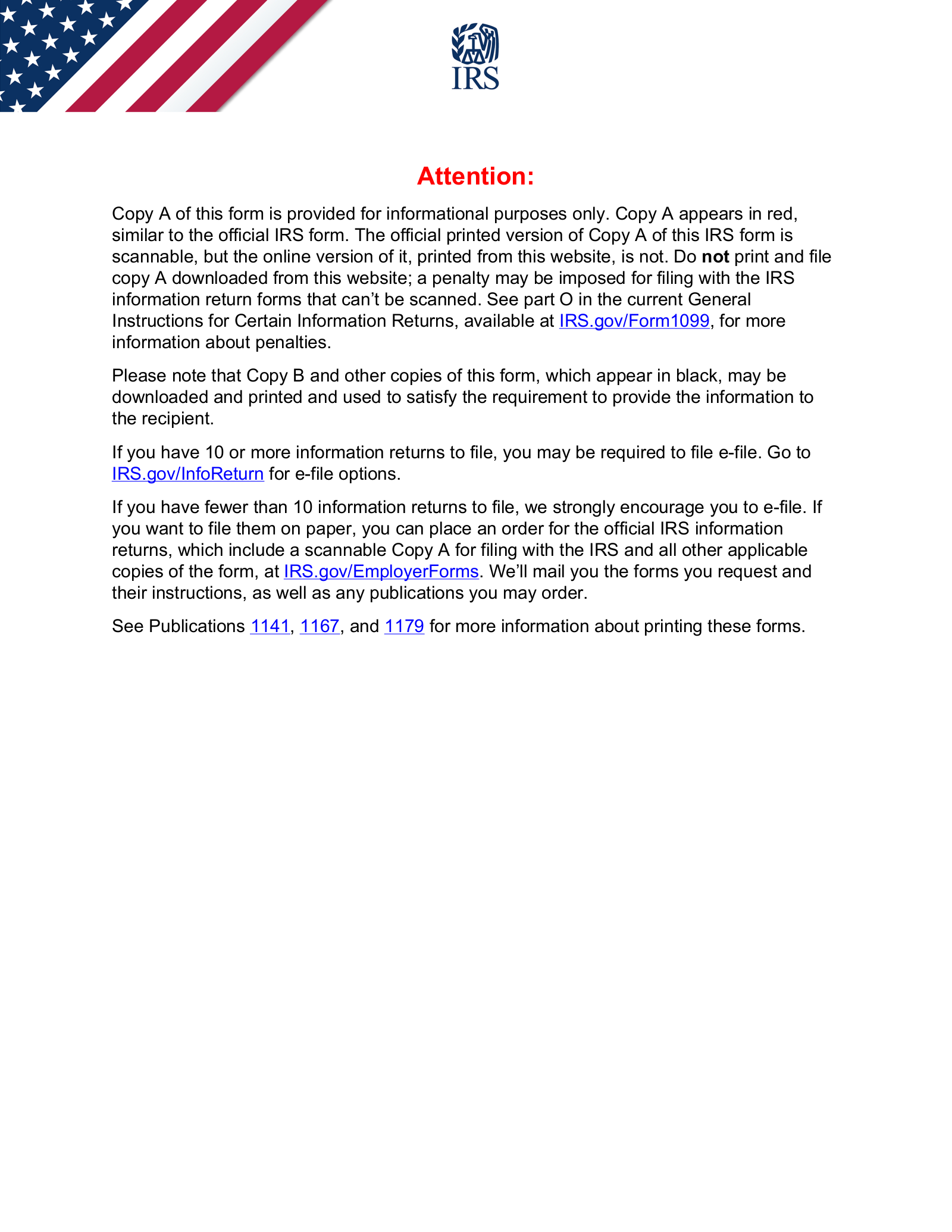

For the year 2023, the IRS has made available the printable version of the 1099 form online for individuals and businesses to easily access and fill out. This form is crucial for reporting income from sources such as freelance work, rental income, interest, dividends, and more. It is important to accurately report this income to ensure compliance with tax laws and regulations.

Get and Print Irs 1099 Form 2023 Printable

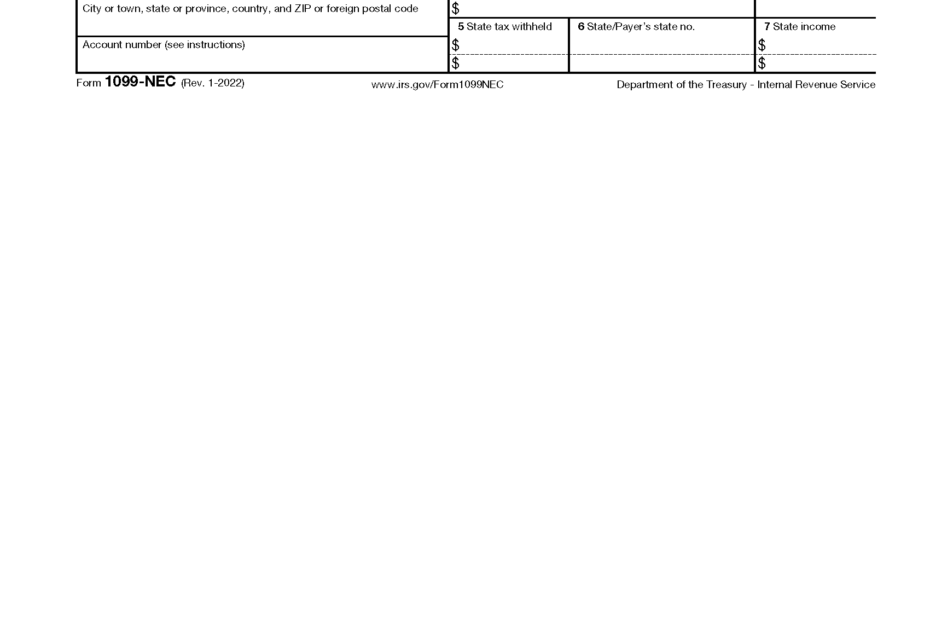

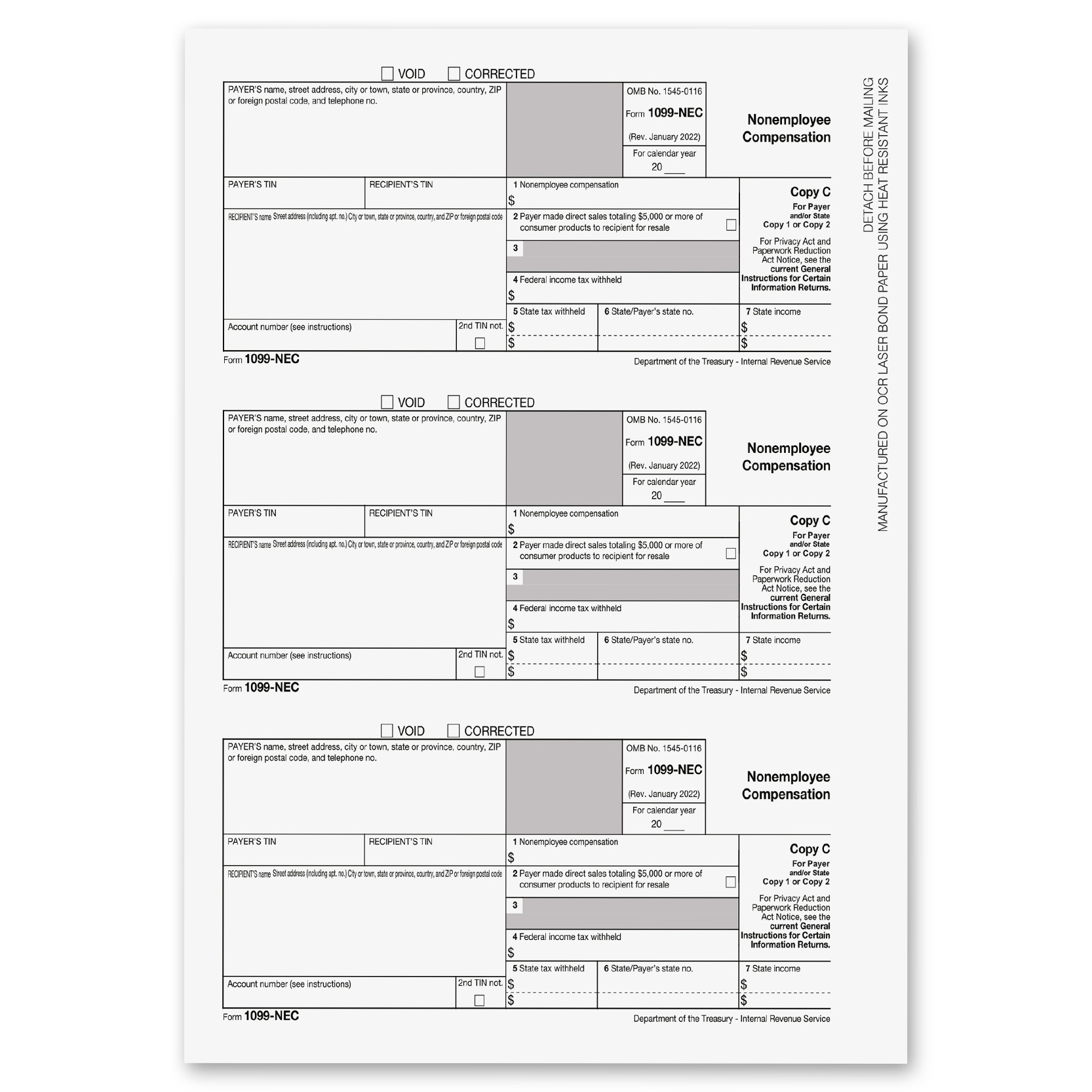

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Free IRS 1099 NEC Form 2021 2025 PDF EForms

Irs 1099 Form 2023 Printable

The IRS 1099 form for the year 2023 is designed to make it easier for taxpayers to report various types of income. This printable form includes sections for different types of income, such as nonemployee compensation, interest income, and dividend income. It is important to carefully review each section and accurately report all relevant income to avoid any issues with the IRS.

One of the benefits of using the printable 1099 form is that it allows individuals and businesses to fill out the form at their own pace and convenience. This can help reduce errors and ensure that all income is reported accurately. Additionally, the printable form can be easily accessed online, making it convenient for taxpayers to file their taxes on time.

It is important for individuals and businesses to keep accurate records of their income throughout the year to ensure that they are able to accurately report it on their tax return. By using the IRS 1099 form for the year 2023, taxpayers can streamline the process of reporting various types of income and avoid any potential issues with the IRS.

In conclusion, the IRS 1099 form for the year 2023 is an essential document for reporting various types of income. By using the printable version of this form, individuals and businesses can easily report their income and ensure compliance with tax laws. It is important to accurately fill out this form to avoid any penalties or audits from the IRS.