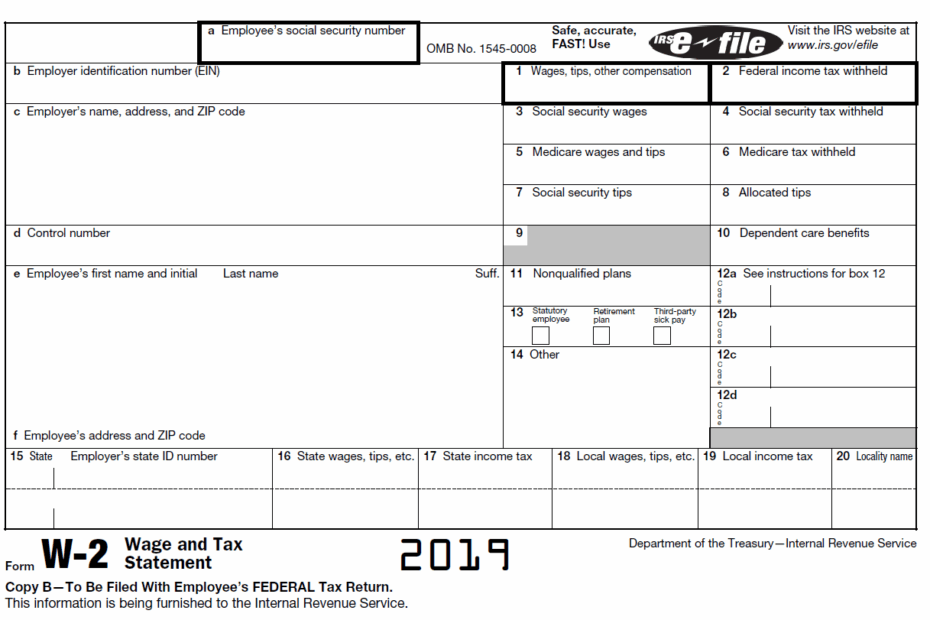

As tax season approaches, it’s important to make sure you have all the necessary forms to file your taxes accurately. One essential document you’ll need is the W2 Printable Form, which provides a summary of your annual earnings and the taxes withheld by your employer. Understanding how to fill out and submit this form can help ensure a smooth tax filing process and prevent any potential errors that could lead to penalties or delays in receiving your refund.

Whether you’re a full-time employee, part-time worker, or independent contractor, receiving a W2 form is crucial for accurately reporting your income to the IRS. This document provides detailed information about your wages, tips, bonuses, and other compensation received throughout the year, as well as the amount of federal and state taxes withheld from your paychecks. By carefully reviewing your W2 form, you can confirm that the information is correct and report any discrepancies to your employer before filing your taxes.

Quickly Access and Print W2 Printable Form

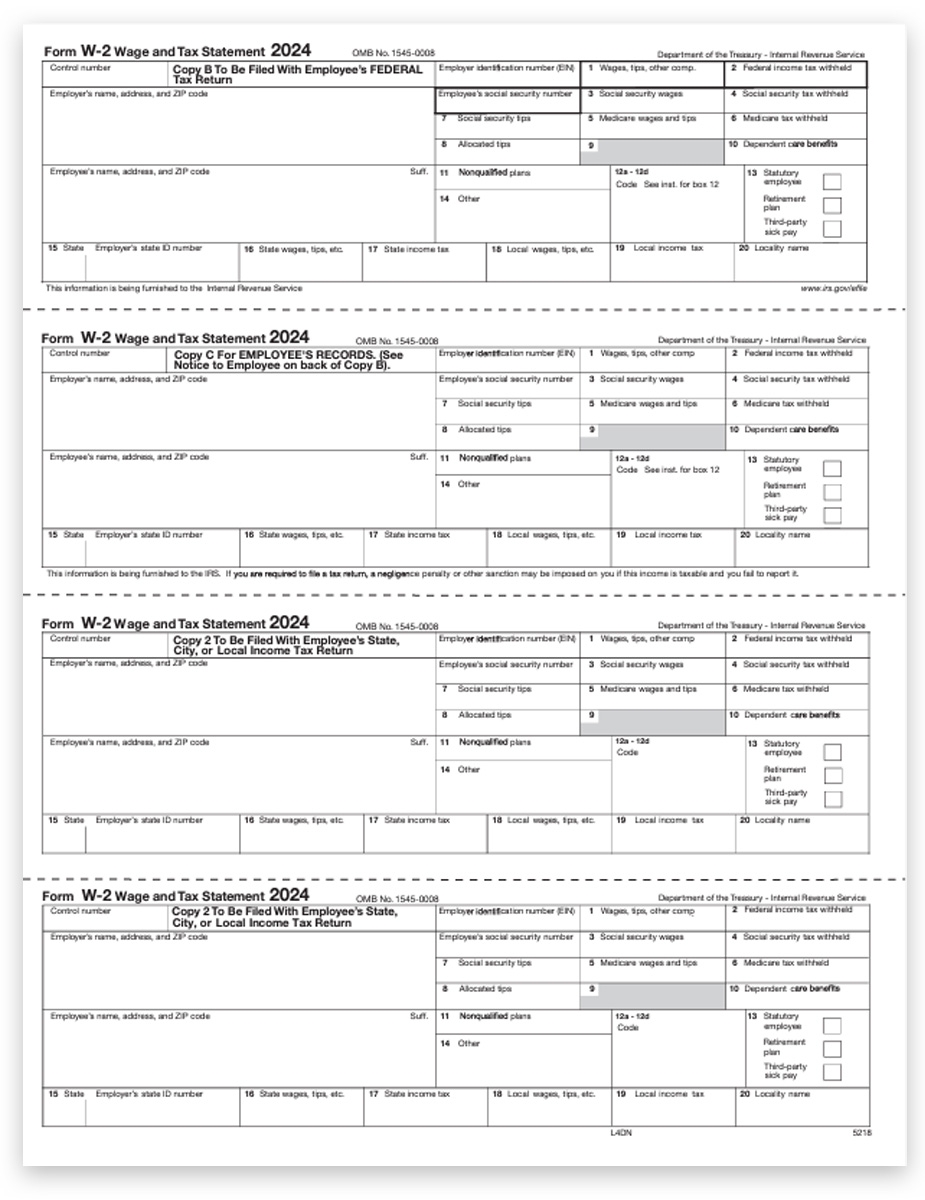

W2 Tax Forms Condensed 4up V2 For Employees DiscountTaxForms

W2 Tax Forms Condensed 4up V2 For Employees DiscountTaxForms

W2 Printable Form

When it comes to filling out your W2 form, it’s important to pay attention to the specific boxes and fields that need to be completed. You’ll need to provide your personal information, including your name, address, and Social Security number, as well as your employer’s details and identification number. Additionally, you’ll need to report your total wages, tips, and other compensation in Box 1, and the federal income tax withheld in Box 2. Make sure to double-check all the information before submitting your form to avoid any errors that could result in processing delays.

In addition to providing a summary of your earnings and tax withholdings, your W2 form also includes information about any contributions you’ve made to retirement accounts, health savings plans, or other benefits provided by your employer. These details can help you maximize your tax deductions and credits when filing your tax return, so it’s important to review them carefully and consult with a tax professional if you have any questions about how to report them accurately.

Overall, the W2 Printable Form is a critical document that provides a comprehensive overview of your income and taxes withheld throughout the year. By understanding how to fill out and submit this form correctly, you can ensure that your tax filing process goes smoothly and avoid any potential issues that could arise from inaccuracies or omissions. If you have any concerns or questions about your W2 form, don’t hesitate to reach out to your employer or a tax professional for assistance.

Make sure to keep your W2 form in a safe place and store it securely for future reference. This document contains sensitive information about your income and taxes, so it’s important to handle it with care and protect it from unauthorized access. By staying organized and keeping track of all your tax documents, you can make the tax filing process easier and more efficient, allowing you to focus on maximizing your deductions and credits to minimize your tax liability.