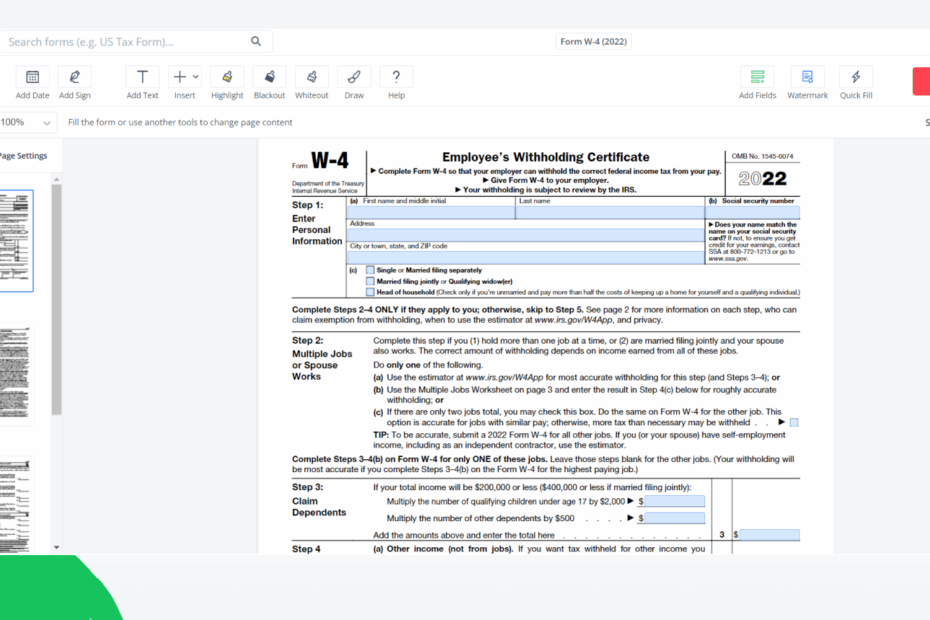

Completing a W4 form is an essential step for any employee starting a new job. This form determines how much federal income tax will be withheld from your paycheck. It’s important to fill it out accurately to avoid any surprises come tax time.

While many employers provide a paper W4 form for their employees to fill out, some individuals may prefer to have a digital version that they can easily access and print. That’s where printable W4 forms come in handy. These forms can be found online and allow you to fill them out electronically before printing them out for submission to your employer.

Save and Print Printable W4 Form

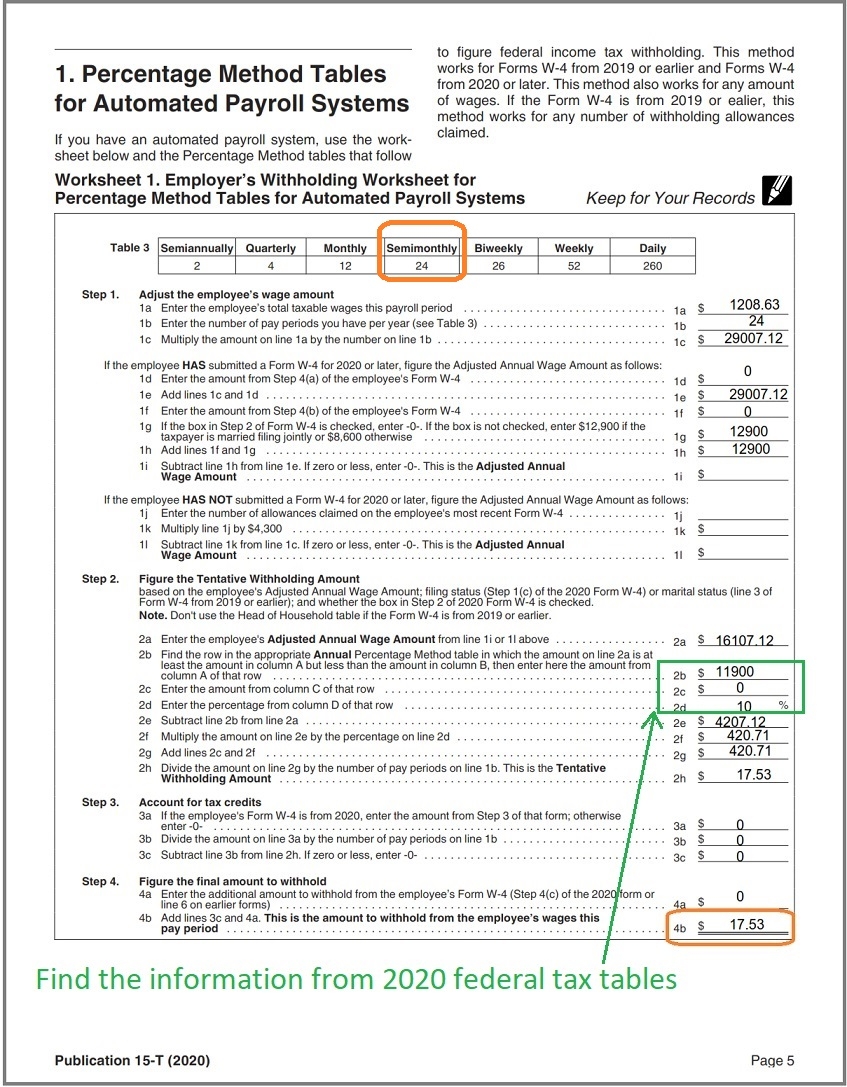

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

Printable W4 Form

Printable W4 forms typically include all the necessary fields for you to enter your personal information, filing status, number of allowances, and any additional withholding amounts. They are designed to be user-friendly and easy to navigate, making the process of completing them a breeze.

When filling out a printable W4 form, it’s crucial to review the instructions carefully and double-check your entries to ensure accuracy. Any mistakes or omissions could result in incorrect withholding amounts, potentially leading to a larger tax bill or a smaller refund.

Once you have filled out your printable W4 form, be sure to sign and date it before submitting it to your employer. They will use the information provided on the form to calculate the appropriate amount of federal income tax to withhold from your paychecks.

Remember that you can update your W4 form at any time if your tax situation changes, such as getting married, having a child, or taking on a second job. It’s essential to keep your withholding information up to date to avoid any issues with your tax obligations.

In conclusion, printable W4 forms offer a convenient and efficient way to complete this essential tax document. By taking the time to fill out the form accurately and staying on top of any changes in your tax situation, you can ensure that your withholding amounts are correct and avoid any surprises when it comes time to file your taxes.