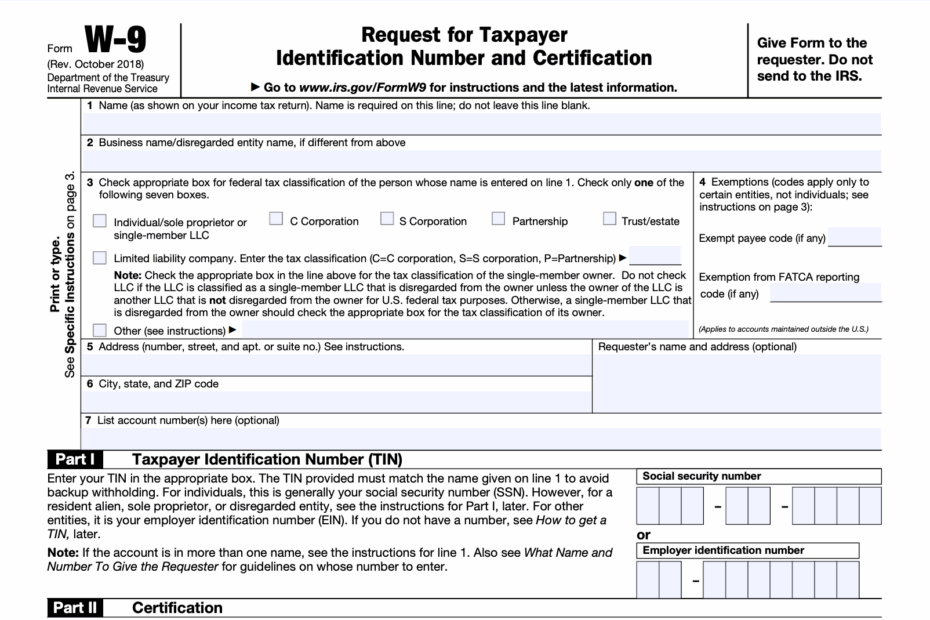

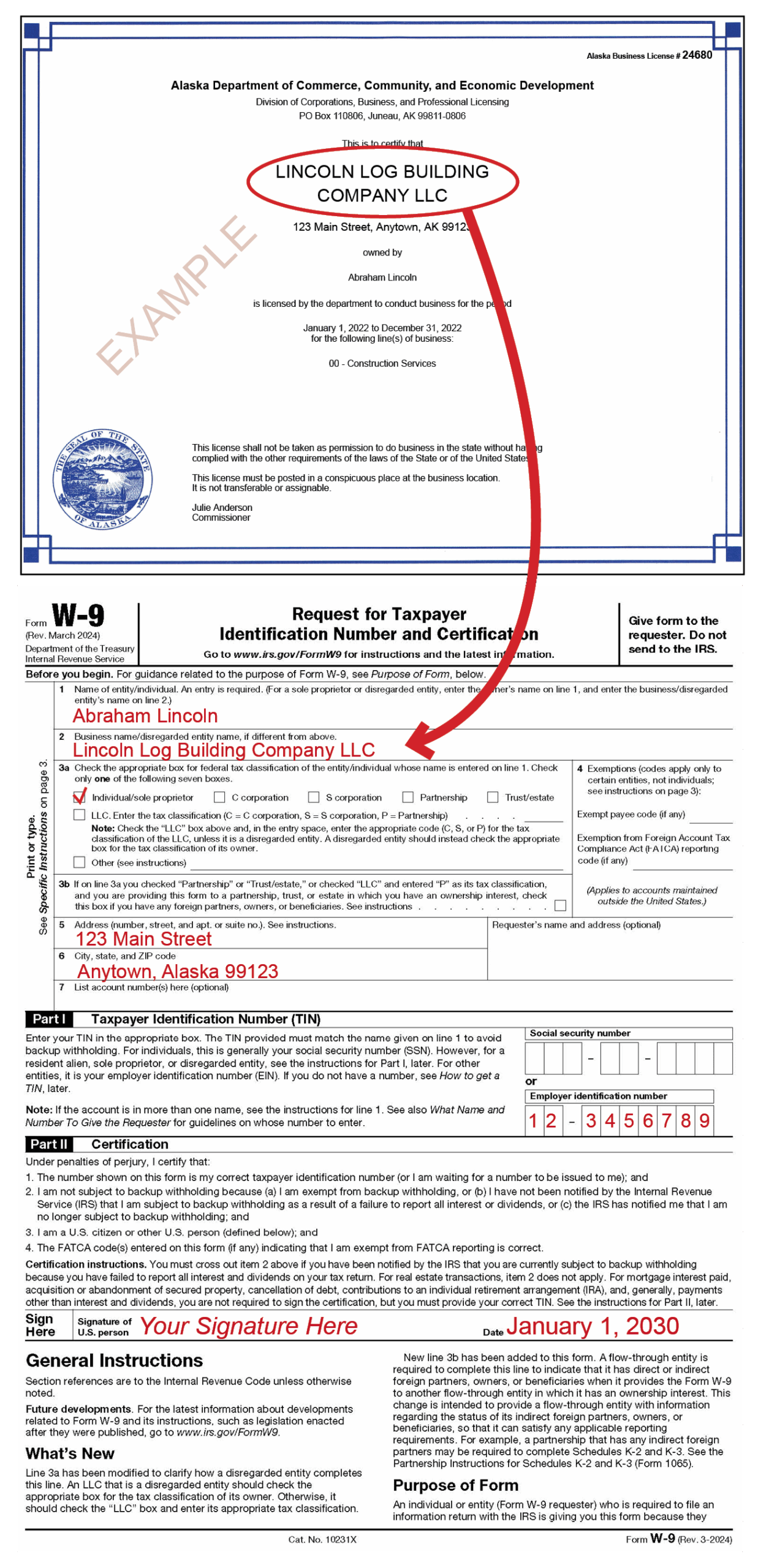

For individuals or businesses who need to provide their taxpayer identification number to payers or brokers who are required to file information returns with the IRS, the IRS Form W-9 is essential. This form is used to request this information and is crucial for tax reporting purposes.

By completing the IRS Form W-9, individuals or businesses are certifying that the taxpayer identification number provided is correct and that they are not subject to backup withholding. It is important to accurately fill out this form to avoid any penalties or issues with the IRS.

Quickly Access and Print Irs Form W 9 Printable

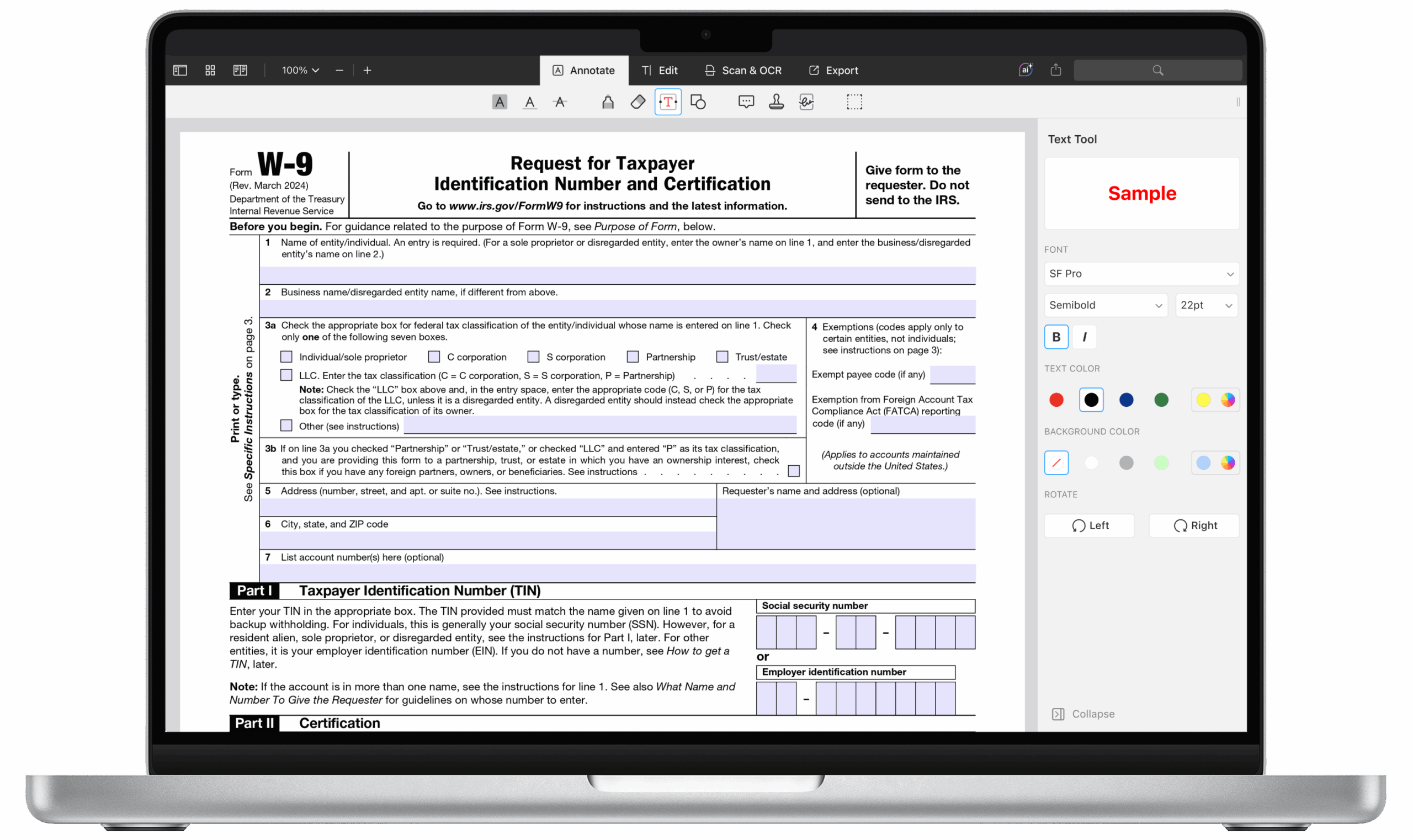

The IRS Form W-9 is available in a printable format on the IRS website, making it easily accessible for anyone who needs to provide their taxpayer identification number. This form can be downloaded, printed, and filled out as needed, ensuring that all necessary information is provided to the requesting party.

When completing the IRS Form W-9, individuals or businesses will need to provide their name, business name (if applicable), taxpayer identification number, address, and signature. Once the form is filled out, it can be submitted to the requester to ensure that accurate information is on file for tax reporting purposes.

It is important to keep a copy of the completed IRS Form W-9 for your records, as well as to provide to the IRS if requested. By maintaining accurate records and ensuring that this form is properly filled out, individuals and businesses can avoid any potential issues with tax reporting requirements.

Overall, the IRS Form W-9 is a critical document for individuals and businesses who need to provide their taxpayer identification number to payers or brokers. By utilizing the printable version of this form, individuals and businesses can easily provide the necessary information to ensure compliance with tax reporting requirements.