When starting a new job, one of the first forms you’ll be asked to fill out is the W4 form. This form is used by employers to determine how much federal income tax to withhold from your paycheck. It’s important to fill out this form accurately to avoid any issues with your taxes down the line.

While some employers may provide a paper copy of the W4 form for you to fill out in person, many now offer a printable version that you can download from their website. This makes it convenient for employees to fill out the form at their own pace and from the comfort of their own home.

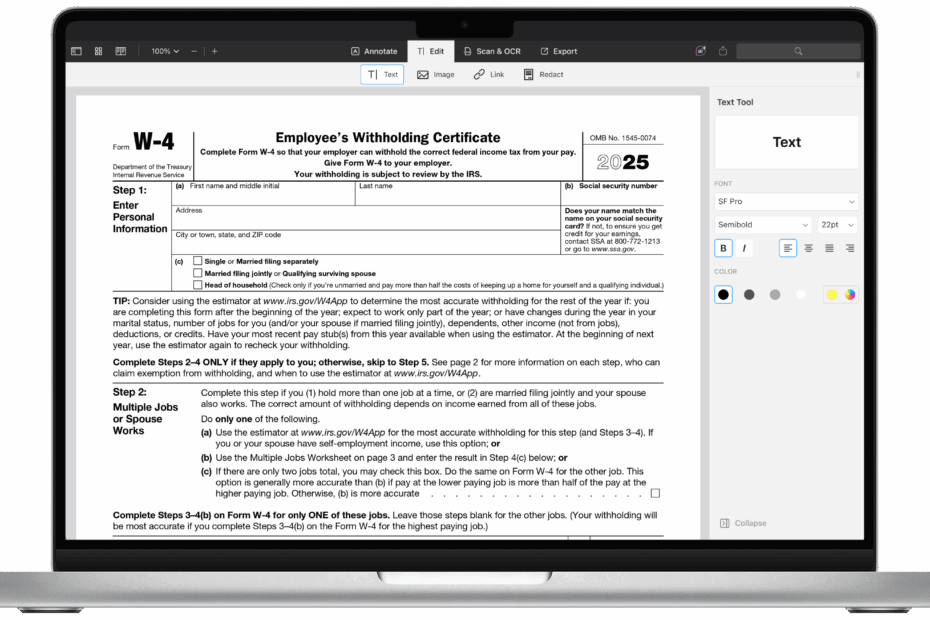

Download and Print W4 Form Printable

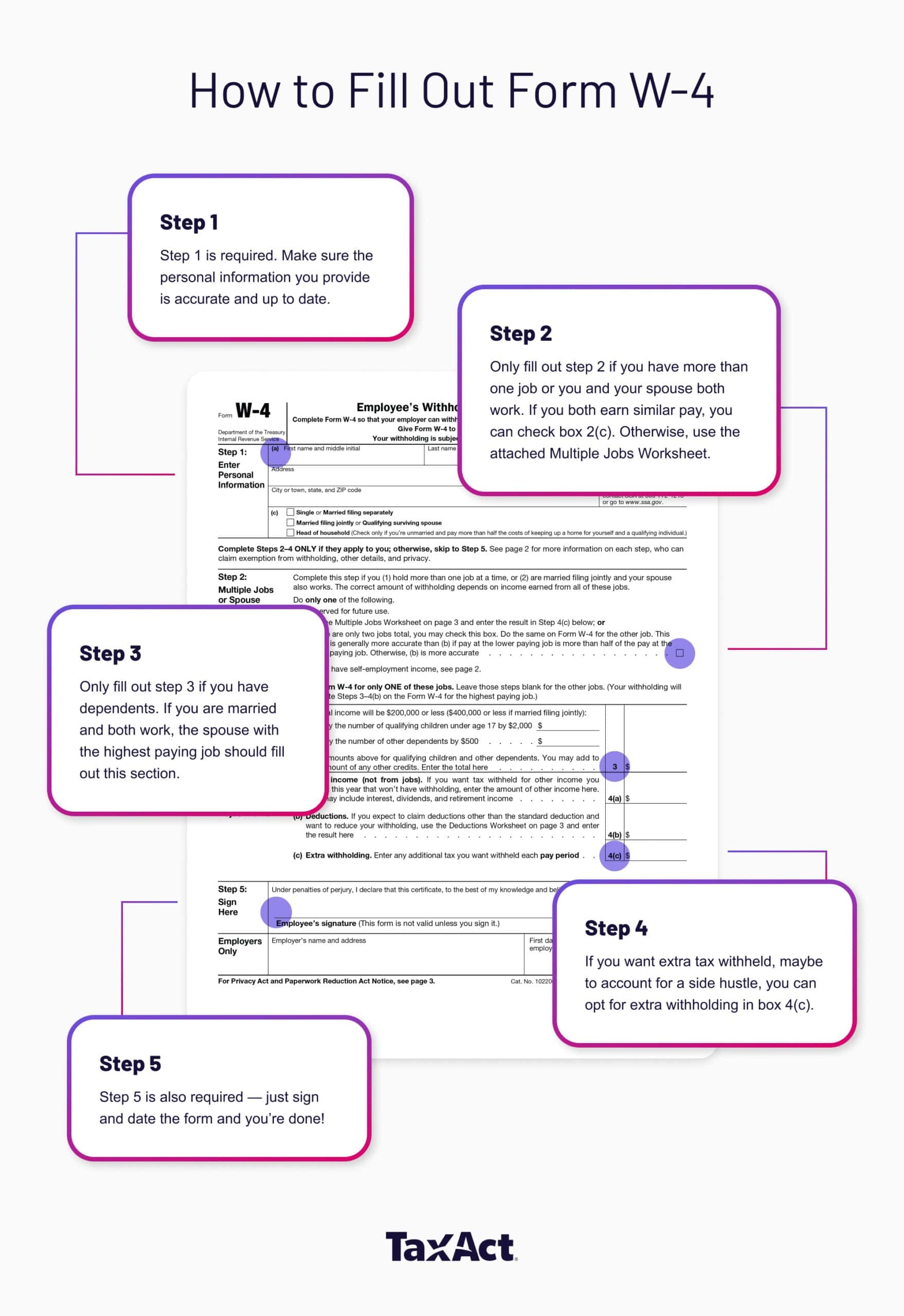

How To Fill Out Form W 4 How To Claim Allowances TaxAct

How To Fill Out Form W 4 How To Claim Allowances TaxAct

W4 Form Printable

When looking for a W4 form printable, it’s important to make sure you are using the most up-to-date version of the form. The IRS updates the form periodically, so using an old version could result in errors in your tax withholding.

Once you have the form in front of you, take your time to read each section carefully and provide accurate information. You will need to provide your personal information, such as your name, address, and Social Security number, as well as details about your filing status and any dependents you may have.

One important section of the W4 form is the withholding allowances. This section helps determine how much tax should be withheld from your paycheck based on your personal situation. The more allowances you claim, the less tax will be withheld from your paycheck, but be careful not to claim too many allowances, as this could result in owing taxes at the end of the year.

Once you have completed the form, make sure to sign and date it before submitting it to your employer. They will use the information provided on the form to calculate how much federal income tax to withhold from your paychecks. If your personal or financial situation changes, you can always fill out a new W4 form to update your withholding allowances.

In conclusion, the W4 form printable is a convenient way to provide your employer with the necessary information to calculate your federal income tax withholding. By taking the time to accurately fill out the form, you can ensure that the right amount of tax is withheld from your paychecks, avoiding any surprises come tax time.