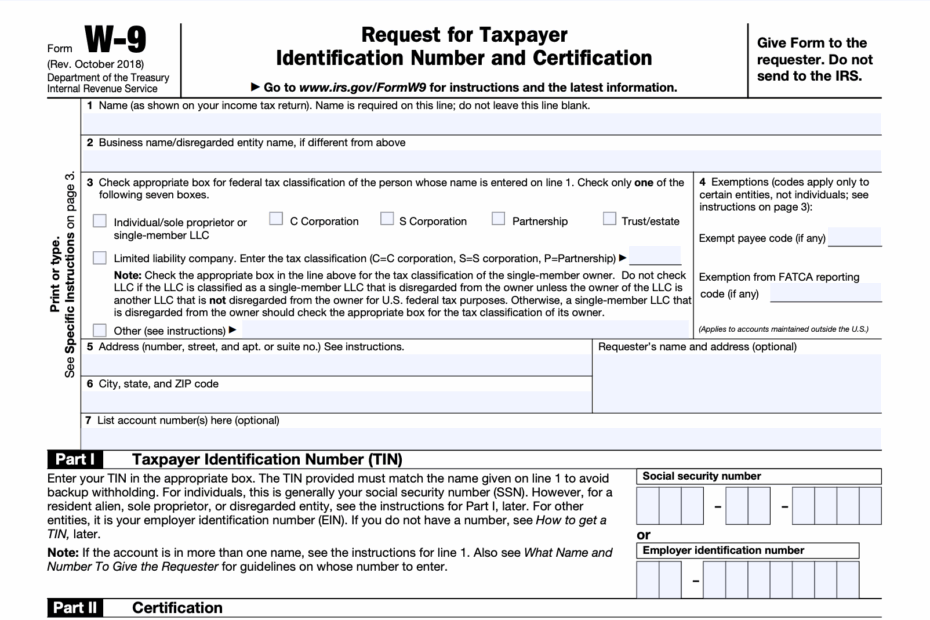

When it comes to tax forms, one of the most common documents that individuals and businesses alike need to be familiar with is Form W-9. This form is used to provide the requester with your correct taxpayer identification number (TIN) to report income paid to you during the year. It is essential for anyone who receives income from various sources to have a completed Form W-9 on file.

Form W-9 is typically requested by employers, banks, clients, or other entities that need to report payments made to you. It is crucial to ensure that the information provided on the form is accurate and up-to-date to avoid any discrepancies in reporting income to the IRS.

Download and Print Printable Form W 9

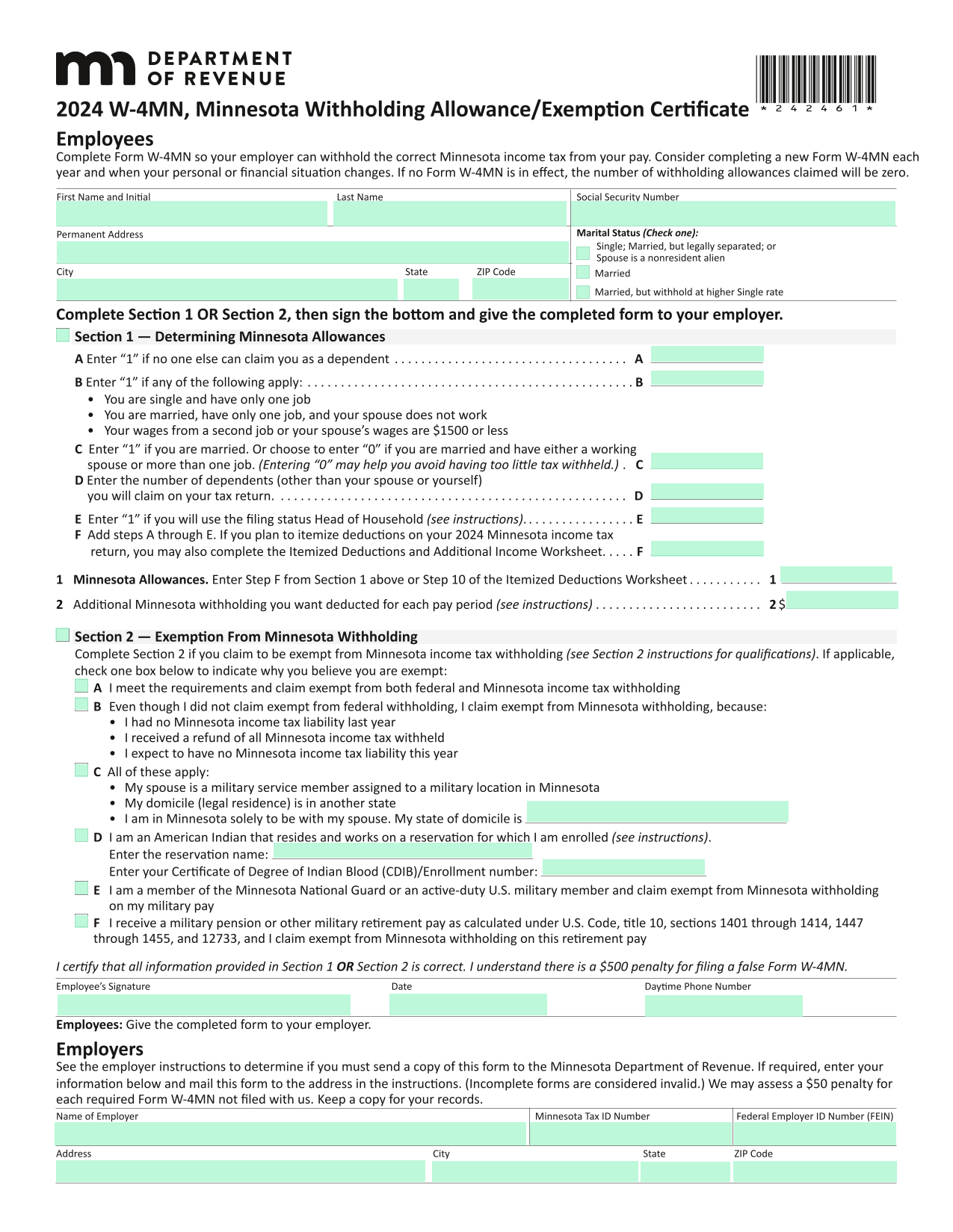

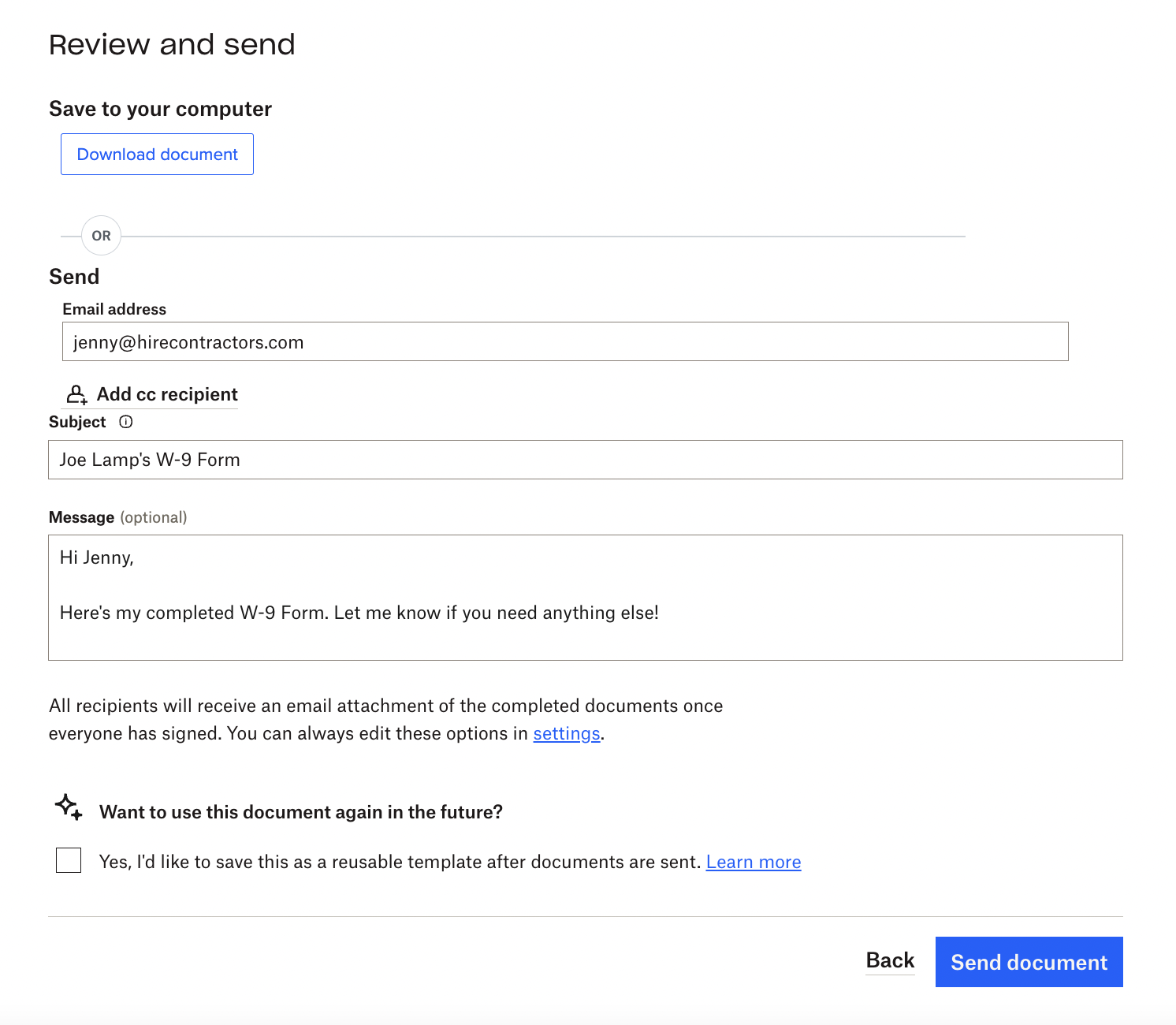

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

Printable Form W 9

Printable Form W-9 is readily available online and can be easily accessed and downloaded for free. Having a printable version of Form W-9 allows individuals and businesses to quickly fill out the necessary information whenever it is required by a requester.

When completing Form W-9, you will need to provide your name, business name (if applicable), TIN, address, and certification. It is important to double-check all information before submitting the form to ensure that there are no errors that could lead to delays or issues with reporting income.

By utilizing the printable version of Form W-9, you can save time and effort in obtaining the necessary documentation for tax purposes. Whether you are a freelancer, independent contractor, or business owner, having a completed Form W-9 on file will help streamline the process of reporting income and receiving payments from various sources.

Remember that Form W-9 is not submitted to the IRS but is kept on file by the requester who needs it for reporting purposes. It is essential to keep a copy of the completed form for your records and provide it to any new requesters as needed.

In conclusion, Printable Form W-9 is a vital document that individuals and businesses should be familiar with when it comes to reporting income and ensuring accurate tax filings. By having a completed Form W-9 on file, you can streamline the process of receiving payments and avoid any discrepancies in reporting income to the IRS. Make sure to keep a copy of the form for your records and provide it to any requesters as needed.