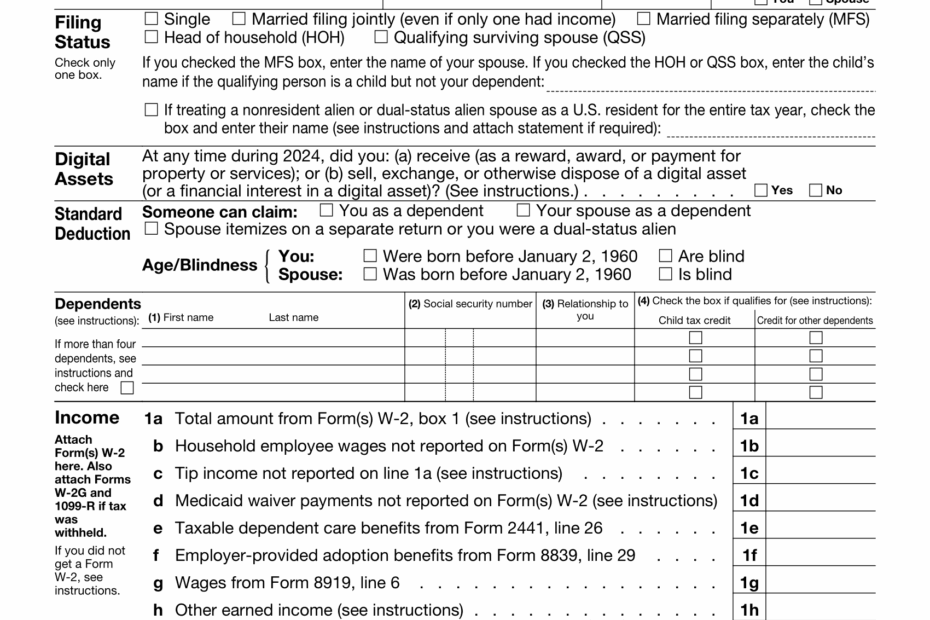

When it comes to filing taxes, the 1040 form is one of the most commonly used forms by individuals to report their income to the Internal Revenue Service (IRS). This form is used to calculate how much tax is owed to the government or how much of a refund is due to the taxpayer. Understanding how to properly fill out and submit the 1040 form is crucial for meeting tax obligations.

For those who prefer to fill out their tax forms manually, printable 1040 forms are available online. These forms can be easily downloaded, printed, and filled out by hand. This option is convenient for those who do not have access to tax software or prefer the traditional pen-and-paper method of filing taxes.

Easily Download and Print 1040 Printable Forms

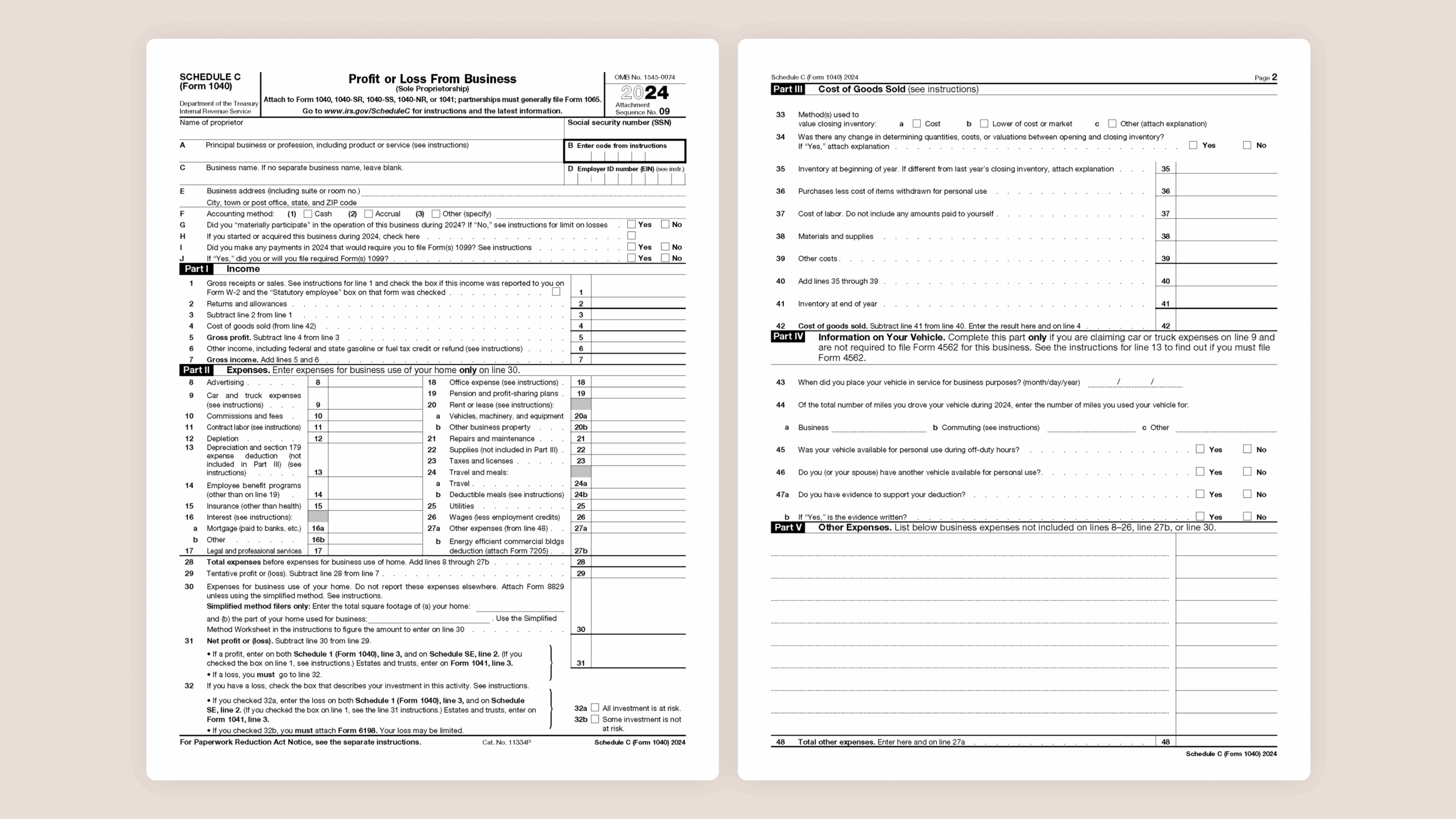

Understanding The Schedule C Tax Form

Understanding The Schedule C Tax Form

1040 Printable Forms

When using printable 1040 forms, it is important to ensure that all information is entered accurately and legibly. Any mistakes or discrepancies could result in delays in processing or even penalties from the IRS. It is recommended to double-check all calculations and verify that all necessary information is provided before submitting the form.

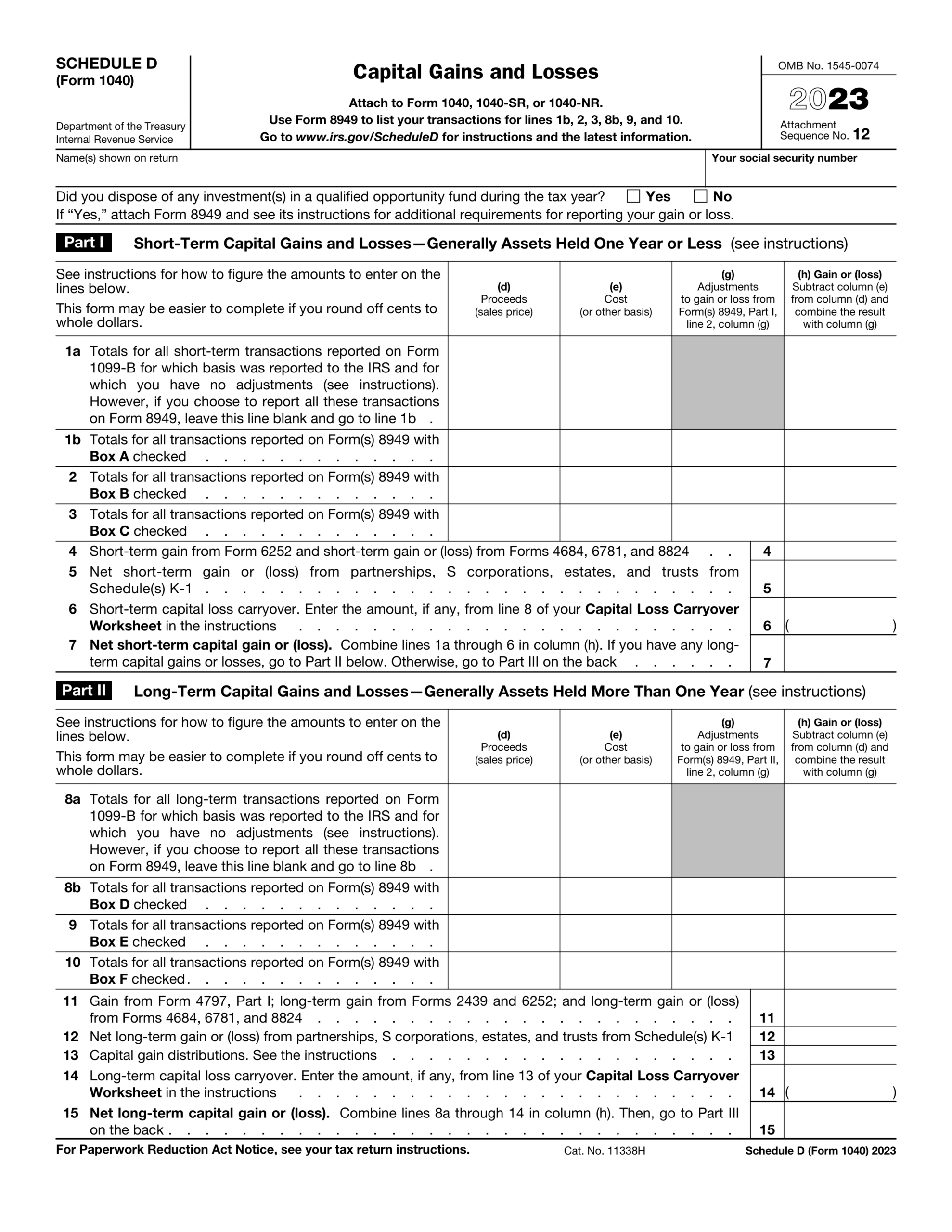

In addition to the basic 1040 form, there are also various schedules and worksheets that may need to be included depending on an individual’s tax situation. These additional forms can also be found online as printable documents. It is important to review the instructions provided with each form to determine which ones are necessary to complete your tax return accurately.

One of the benefits of using printable 1040 forms is the ability to access them at any time and from any location with an internet connection. This flexibility allows taxpayers to work on their taxes at their own pace and convenience. It also provides a cost-effective option for those who prefer to handle their taxes independently without the need for professional assistance.

Overall, printable 1040 forms offer a convenient and accessible way for individuals to file their taxes accurately and on time. By following the instructions provided and ensuring all information is correctly entered, taxpayers can avoid potential issues with their tax return. Whether filing electronically or by mail, using printable forms can help simplify the tax filing process.

In conclusion, printable 1040 forms are a valuable resource for individuals who prefer to file their taxes manually. By utilizing these forms correctly and accurately, taxpayers can fulfill their tax obligations and avoid potential penalties. It is important to take the time to review and complete all necessary forms to ensure a smooth and successful tax filing process.