As we approach tax season, it’s important to stay informed about the latest updates and changes to IRS tax forms. In 2024, the IRS has made some significant changes to the tax forms that taxpayers will need to fill out. It’s crucial to have access to printable versions of these forms to ensure accurate and timely filing.

IRS tax forms are essential documents that individuals and businesses must fill out to report their income, deductions, and tax liability to the government. These forms are updated annually to reflect changes in tax laws and regulations. It’s essential to stay up-to-date with the latest versions of these forms to avoid any penalties or errors in your tax return.

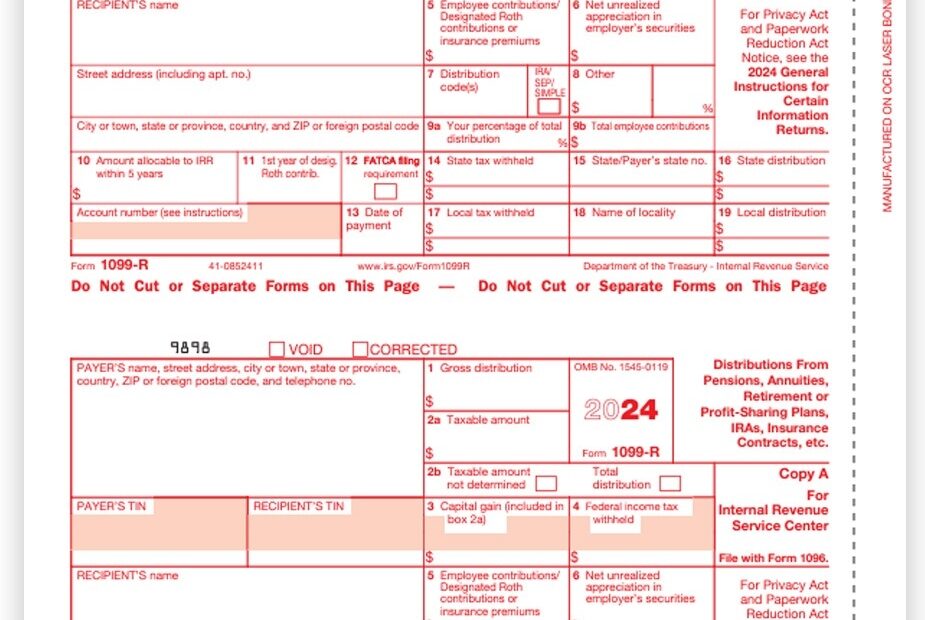

Quickly Access and Print Irs Tax Forms 2024 Printable

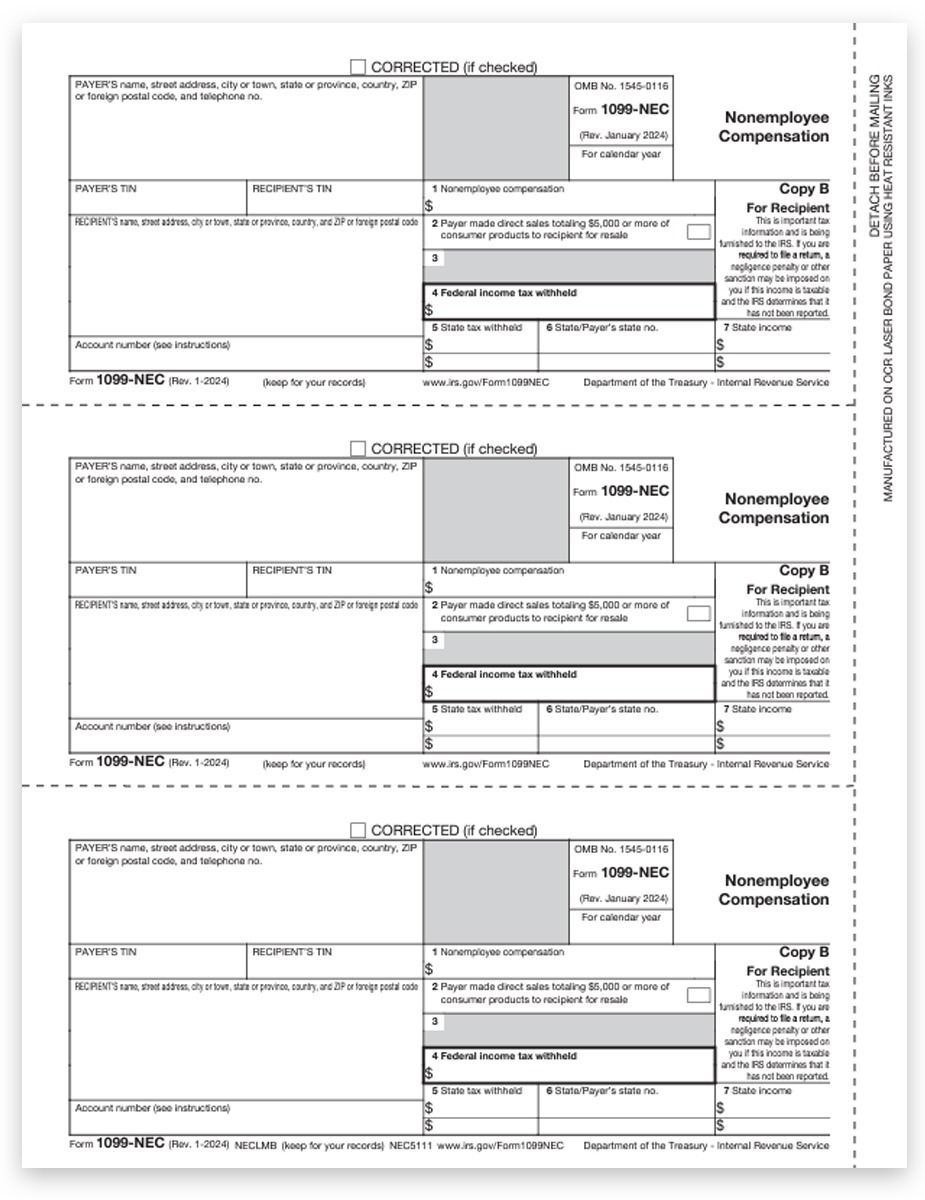

1099 NEC Forms Copy B For Recipient Federal DiscountTaxForms

1099 NEC Forms Copy B For Recipient Federal DiscountTaxForms

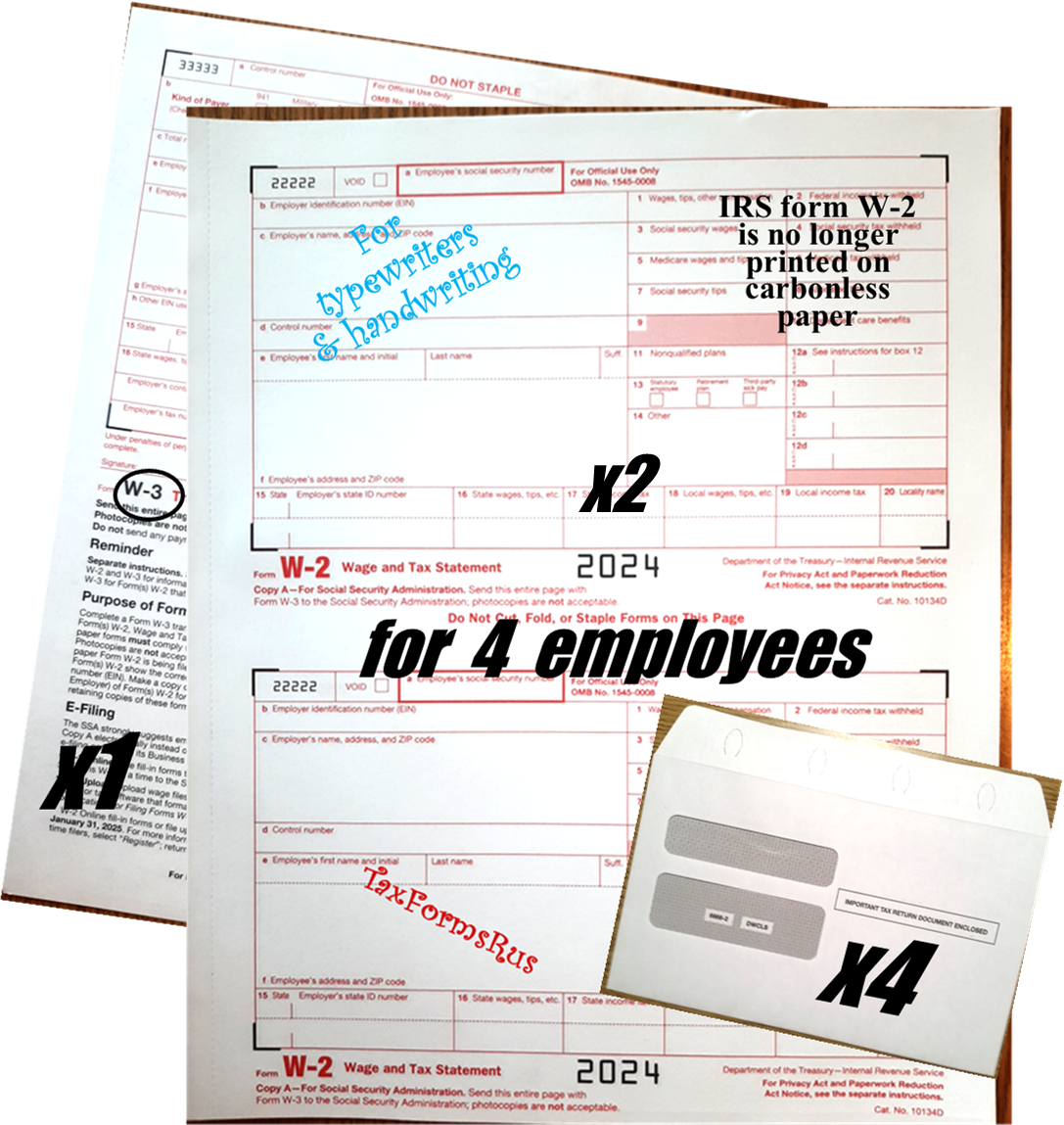

One of the most significant changes to IRS tax forms in 2024 is the introduction of new credits and deductions. Taxpayers will need to be aware of these changes and ensure they are accurately reflected in their tax returns. Having access to printable versions of these forms makes it easier to fill them out correctly and submit them on time.

Another important aspect of IRS tax forms in 2024 is the increased focus on digital filing options. While printable forms are still available for those who prefer to file by mail, the IRS is encouraging more taxpayers to e-file their returns. This can help expedite the processing of your return and reduce the chances of errors or delays.

It’s crucial to start gathering all the necessary documents and information to fill out your tax forms as soon as possible. By having access to printable versions of IRS tax forms for 2024, you can start preparing your return early and ensure that you meet the filing deadline. Remember to double-check all the information before submitting your return to avoid any mistakes that could lead to audits or penalties.

In conclusion, staying informed about the latest updates to IRS tax forms for 2024 is essential for a smooth and accurate tax filing process. By having access to printable versions of these forms, you can ensure that you are filling them out correctly and submitting them on time. Start preparing your tax return early to avoid any last-minute rush or errors. Always consult with a tax professional if you have any questions or concerns about your tax situation.