As tax season approaches, it’s important to have all the necessary documents ready to file your taxes accurately and on time. One essential form that most individuals will need is the W2 form, which provides information about your earnings and taxes withheld by your employer. In 2024, it’s crucial to have access to a printable version of the W2 form for convenience and ease of filing.

Having a printable W2 form for 2024 allows you to easily fill out the required information and submit it to the IRS without any delays. Whether you prefer to file your taxes online or by mail, having a hard copy of your W2 form ensures that you have all the necessary details at your fingertips.

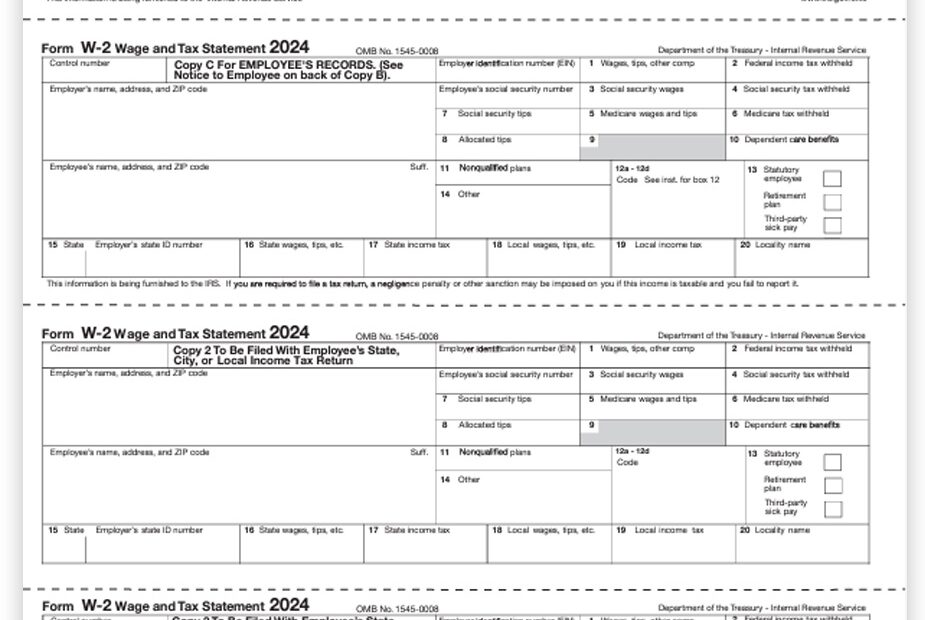

Download and Print 2024 W2 Form Printable

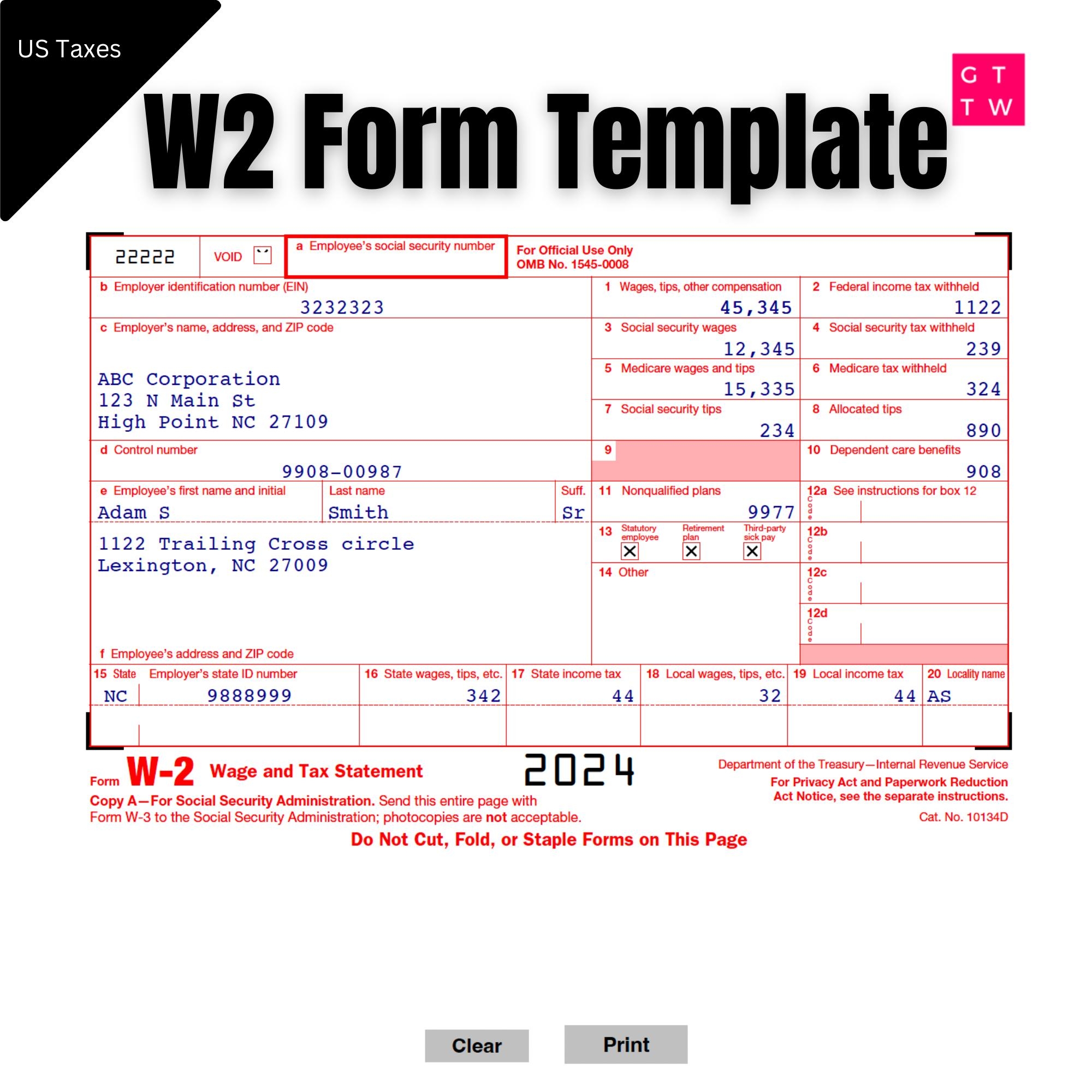

W 2 Form 2024 2025 Fill Edit And Download PDF Guru

W 2 Form 2024 2025 Fill Edit And Download PDF Guru

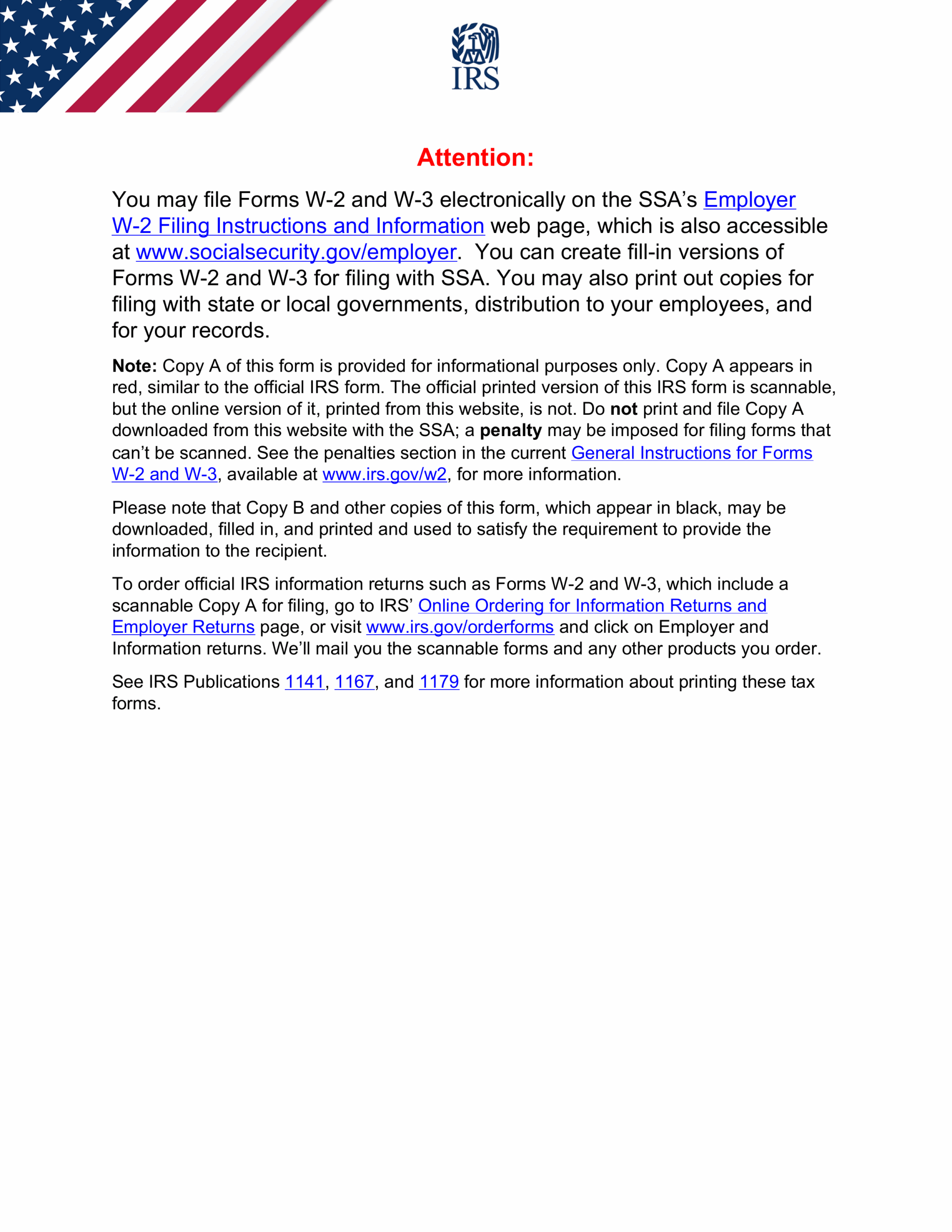

When looking for a printable version of the 2024 W2 form, it’s important to ensure that you are using the most up-to-date and accurate version provided by the IRS. This will help prevent any errors or discrepancies in your tax filing and ensure that you are reporting your income correctly.

Printing out your W2 form for 2024 also allows you to keep a physical copy for your records. This can be helpful in case you need to reference your tax information in the future or if you are ever audited by the IRS. Having a hard copy of your W2 form provides peace of mind and ensures that you have all the necessary documentation in case of any inquiries.

Overall, having access to a printable version of the 2024 W2 form is essential for a smooth and efficient tax filing process. Make sure to download the form from a reliable source, fill it out accurately, and submit it to the IRS on time to avoid any penalties or delays. Having all your tax documents in order will make the process much easier and less stressful for you as a taxpayer.

Get ahead of the game and start preparing your tax documents early, including your printable 2024 W2 form. By staying organized and informed, you can ensure a hassle-free tax filing experience and potentially maximize your tax refund or minimize any tax liability. Don’t wait until the last minute – start gathering your documents and get ready to file your taxes confidently and accurately.