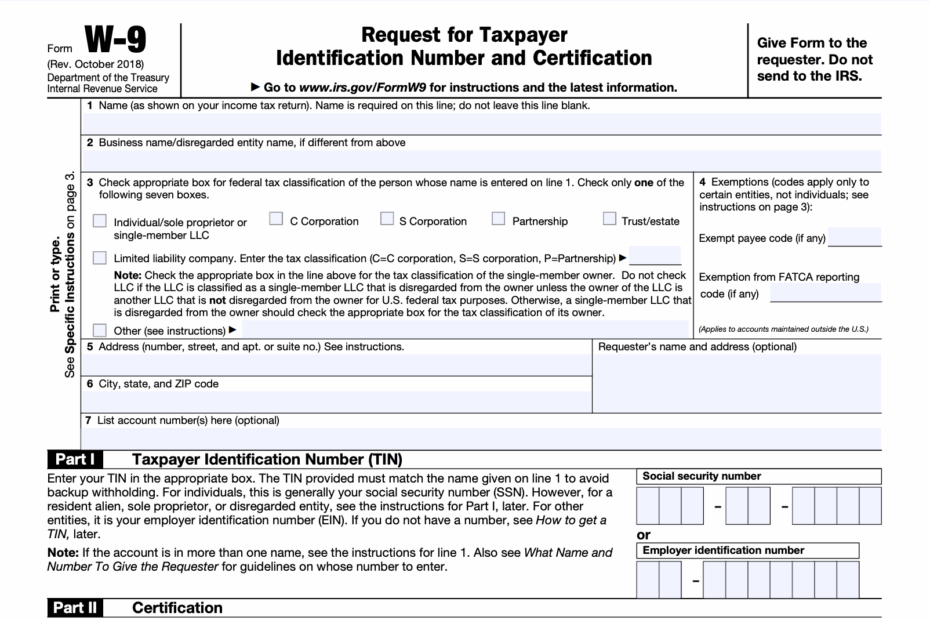

When it comes to tax season, one of the most important forms you may need to fill out is the W9 form. This form is used by businesses to request tax information from independent contractors, freelancers, or vendors they work with. It is crucial for ensuring that the business is complying with IRS regulations and reporting accurate information.

One of the key reasons why the W9 form is so important is that it helps businesses properly report payments made to individuals or businesses for services rendered. By collecting this information, businesses can avoid potential penalties for incorrect reporting and ensure that they are meeting their tax obligations.

Save and Print W9 Form Printable

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

W 9 Form 2024 Fillable PDF For Secure And Legal Tax ID Sharing Worksheets Library

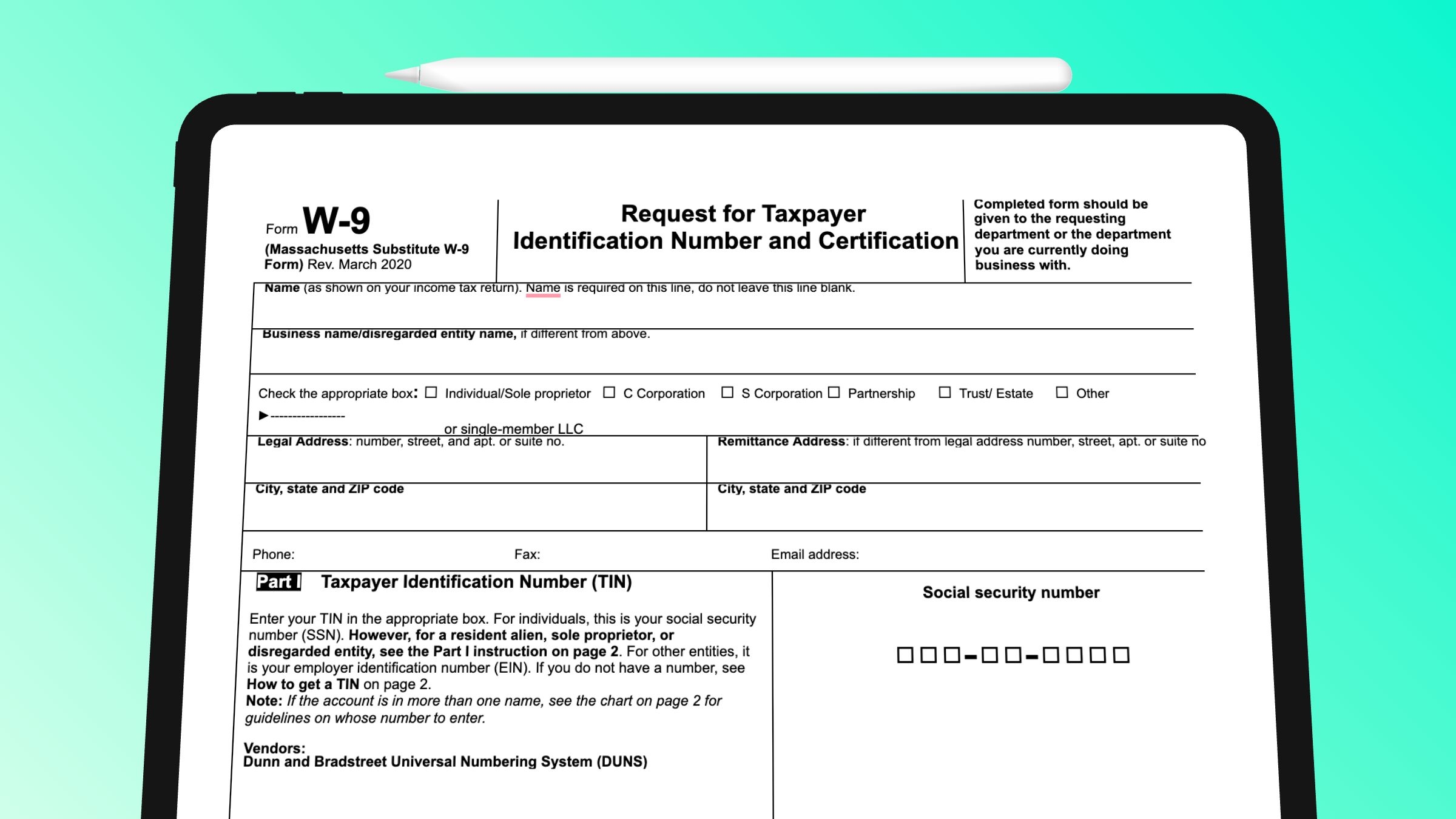

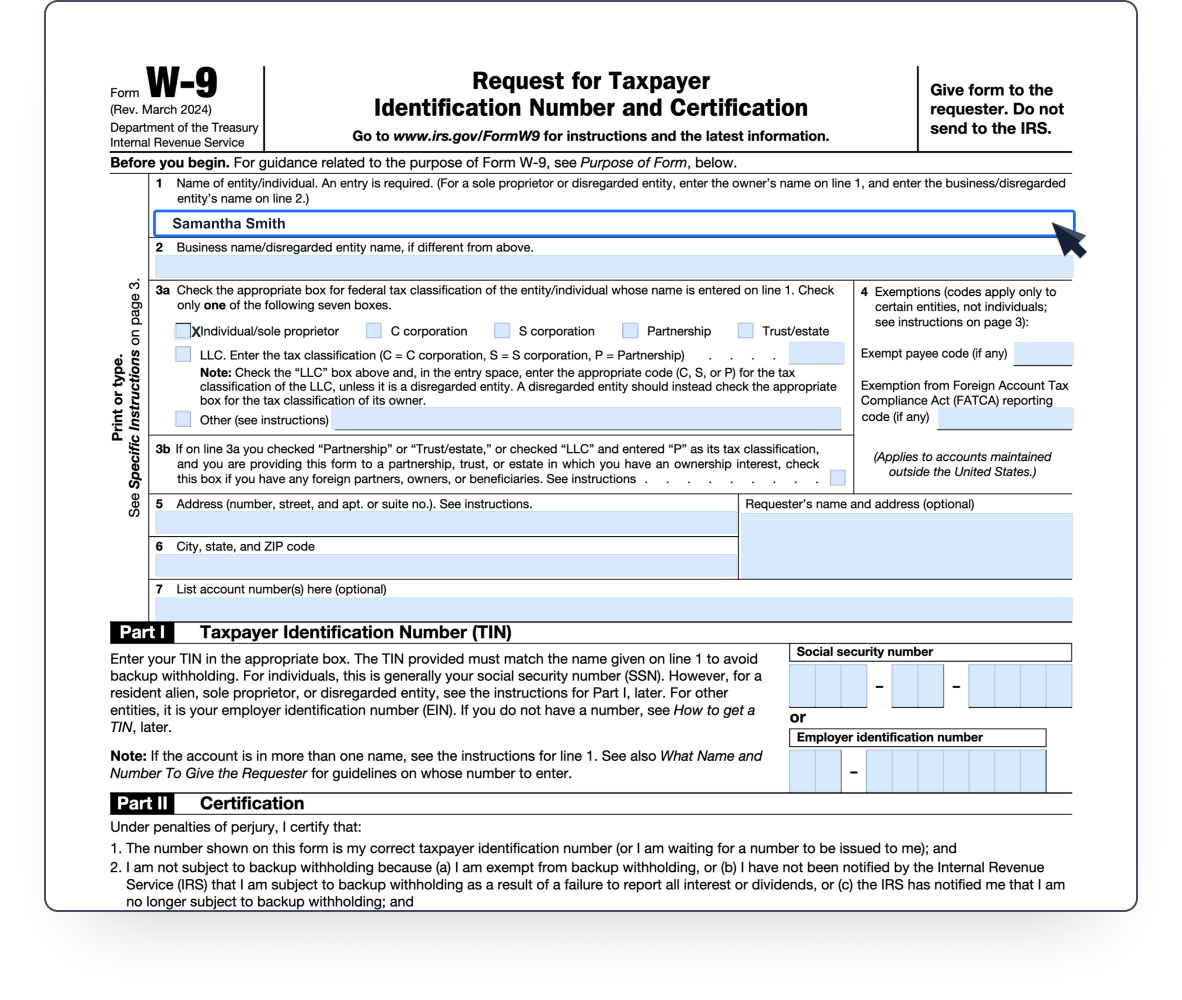

It is essential for individuals or businesses who receive income from various sources to have a W9 form on file for each payer. This form includes important information such as the individual’s name, address, taxpayer identification number, and certification of exemption status. Having this information readily available can streamline the tax reporting process and make it easier to file taxes accurately.

One of the convenient aspects of the W9 form is that it can be easily accessed online and printed out for use. There are many websites that offer a printable version of the W9 form, making it simple for individuals to fill out and submit when needed. It is important to ensure that the form is filled out correctly and completely to avoid any issues with tax reporting.

Overall, the W9 form is an essential document for both businesses and individuals who receive income from various sources. By filling out this form accurately and keeping it on file, you can ensure that your tax reporting is in compliance with IRS regulations. So, make sure to have a W9 form printable on hand whenever you need to provide tax information to a payer.

In conclusion, the W9 form printable is a valuable tool for businesses and individuals to collect and report tax information accurately. By understanding the importance of this form and keeping it on file when needed, you can streamline the tax reporting process and avoid potential penalties for incorrect reporting. Make sure to have a W9 form printable ready to go for tax season!